Analysis of Schwab (SCHW) Performance

Schwab (NYSE:) unveiled its Q1 ’24 results on April 15, 2024. The stock is grappling with challenges posed by the inverted yield curve and the necessity to offer clients a 5.35% money market yield. This dynamic has impacted net interest income. However, the standout feature of the quarter was the exceptional “net new asset” growth of $88 billion, with approximately half of the inflow realized in March ’24.

In Q1 ’24, the net interest margin surged from 1.89% to 2.02%. Morningstar highlighted that SCHW experienced its first sequential revenue increase since Q3 ’22.

At present, Schwab’s valuation appears reasonable, trading at a level where its internal model values the stock at $88, while Morningstar’s fair value estimate stands at $73. The stock hit an all-time high of $96 in early February ’22, trading at 21x expected ’24 EPS and eyeing a 9% EPS growth this year. It seems that expectations for fed funds rate cuts in ’24 are currently modest.

Following the latest earnings report, Schwab’s EPS projections were raised, while revenue estimates largely stayed consistent pre-release.

The primary reason underpinning Schwab’s potential undervaluation lies in the decline of its pre-tax margin from the low 50% range to 37.9% as per Q1 ’24 earnings. Schwab is expected to ultimately revert to a 50% pre-tax margin, but this may necessitate a normal yield curve and a lower fed funds rate than present.

Technicals and Predictions: A Potential Schwab Rebound?

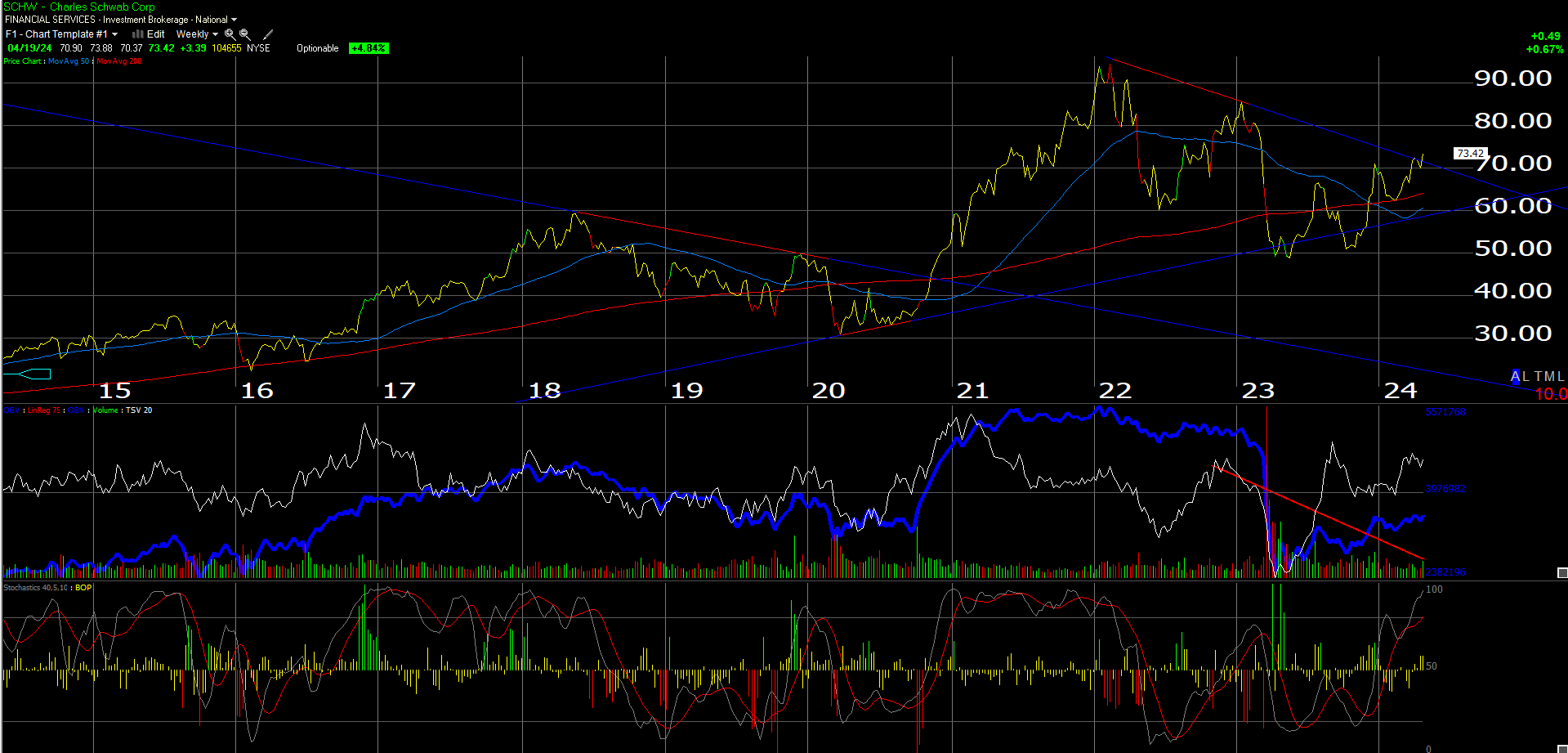

A noteworthy development is the chart showing Schwab edging above its downward-sloping trendline from the $96 peak in February ’22. Observers suggest that SCHW and the regional bank ETF (NYSE:) could indicate shifts in Fed monetary policy. Despite previous struggles around the $73 mark, recent post-Q1 ’24 earnings performance and the chart trend signal positive momentum, with SCHW closing above $73 on above-average volume.

Assessing Schwab’s Future Trajectory

Reflecting on Schwab’s history, notably navigating zero interest rates post-2008 and during the Covid era, the company’s trajectory has been marked by adaptive responses to changing economic landscapes. Schwab’s transition into an asset-gathering entity post-1999, alongside industry initiatives like zero commissions, underpin its strategic evolution.

As we anticipate potential changes to Fed monetary policy, accumulating stock in client accounts indicates growing confidence in Schwab’s trajectory, bolstered by technical improvements.

Netflix (NFLX) Performance Review

Similar to JPMorgan (JPM) in the previous week, Netflix faced a selloff on April 19, 2024, potentially influenced by broader tech sector trends. Analyst upgrades preceding the April ’24 earnings release hinted at high expectations that may have shaped market sentiment.

Concerns arose over Netflix’s decision to halt disclosing net paid adds and memberships. However, the company’s commitment to continue providing data for the next three quarters should temper investor apprehensions about membership dynamics. With US/Canadian markets reaching a 60% household penetration, potential growth areas lie in Southeast Asia and other non-US regions.

While reduced data transparency is typically worrisome, Netflix’s strategic focus on the advertising business and forays into live sports could drive revenue and margin improvements, surpassing traditional subscription models.

As Netflix’s operational landscape evolves, particularly in content development and audience engagement, the company’s adaptability bodes well for its future competitiveness and market relevance.

Unveiling Market Shifts: Netflix’s Strategic Moves

When pondering the bottom-ranked market share streaming services, the rumor mill spins tales of offloading premium content to Netflix. A move seen as a bid to enhance returns and margins, reminiscent of a struggling artist seeking new inspiration. As an enthusiast yearning to consume elusive content like Tom Hanks’ “Greyhound” on AppleTV while on a World War II submarine movie spree, the absence of classics such as “Das Boot” on Netflix is palpably disappointing.

Wishful yearnings aside, Netflix’s EPS and revenue estimates encountered an upswing post its recent report, notwithstanding the market’s tepid reaction.

Fiscal Projections Unveiled

The trajectory of Netflix’s full-year 2024 EPS estimate reveals evolving yoy growth rates:

- 3/24: 51% yoy EPS growth projected ($18.06 estimate)

- 12/23: 40% yoy EPS growth anticipated ($16.03 EPS estimate)

- 9/23: 30% yoy EPS growth expected ($15.81 EPS est)

- 6/23: 29% yoy EPS growth envisaged ($15.15 EPS est)

- 3/23: Predicted 28% yoy growth rate ($14.27 EPS est)

Netflix navigates a post-2022 and 2023 landscape marked by lackluster EPS growth at -11% and +22%, minimal norms for the streaming behemoth.

Trajectory Analysis

A weekly chart for Netflix illuminates a volatile journey, oscillating between the highs near $700 in late ’21 and the troughs. Anticipations suggest a firm grounding near the upward-sloping trendline and the 200-week moving average.

For astute investors, setting stop-limits around the 200-week moving average as the primary support level, followed by the trendline as a secondary cushion, is prudent. These levels currently hover around $400 – $437, subject to fluctuations in daily trading.

Strategic Insights

The evolving landscape hinges on two key emerging spheres: advertising ventures and live sports engagements. The Mike Tyson vs. Jake Paul boxing extravaganza serves as a litmus test to gauge the receptiveness of Netflix’s audience towards such events. Moreover, management’s post-event insights and future development strategies will be telling. Despite improved cash flows and free cash flows, existing valuation metrics reflect a hefty tag, with figures at 33x to 35x cash-flow and FCF, respectively.

Final Verdict

The stalwart Schwab and Netflix models have adapted over time to cater to evolving market demands. Defying economic hurdles post-2008, Schwab’s model faces challenges exacerbated by ZIRP and yield curve inversions.

As Netflix’s advertising endeavors mature and live sports collaborations take center stage, the stock potentially eyes a notable upsurge. Advertising avenues promise lucrative margins, bolstered by live sports synergies. Meanwhile, Netflix’s stock price is likely to dance in a holding pattern for the next 90 days, awaiting Q2 ’24 outcomes.