Dell Technologies Inc DELL is contemplating the sale of cybersecurity company SecureWorks

Corp SCWX,

according to reliable sources as reported by Reuters.

Diving Deep into the Financial Waters

Speculations arose in 2019 when Dell considered selling SecureWorks to alleviate its debt burden.

Initially purchased for $612 million in 2011, the cybersecurity firm may soon witness a change in

ownership.

Market Reactions and Volatility

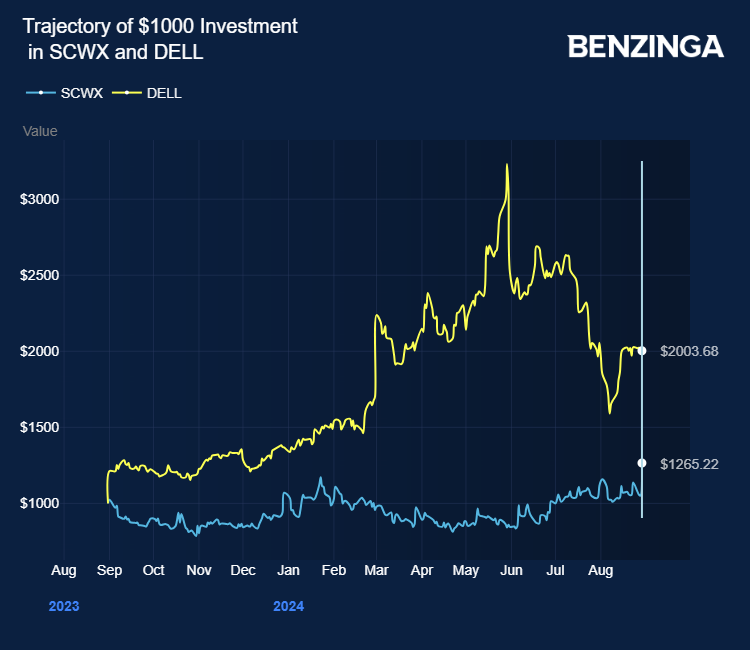

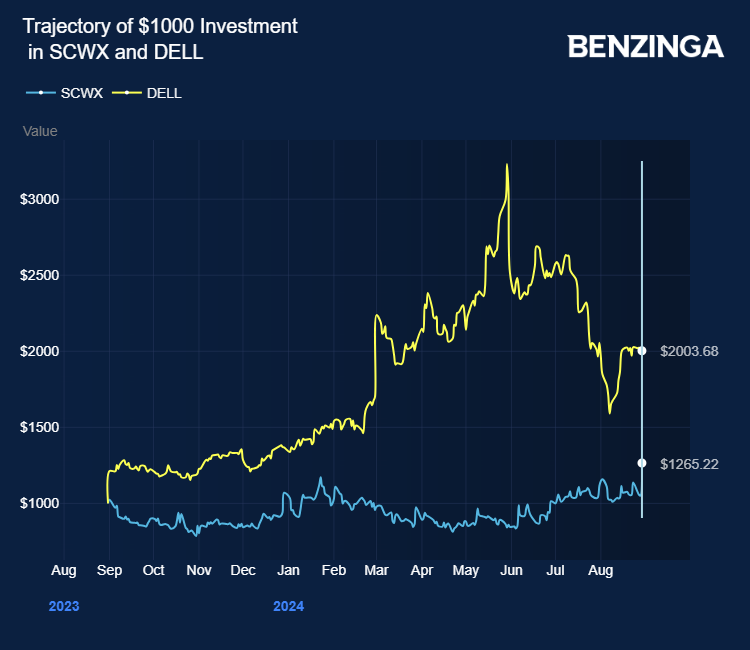

With the news circulating, SecureWorks’ stock experienced a dip of almost 4% on Friday, following a 20%

surge the previous day. Conversely, Dell saw a 6% increase during premarket trading on Friday.

Thursday’s earnings report by Dell indicated an impressive 9% growth in second-quarter revenue, reaching

$25.03 billion, surpassing the analyst consensus of $24.14 billion. However, the company also disclosed a

significant long-term debt standing at $17.8 billion as of August 2, 2024.

Exploring Mergers and Acquisitions

For potential acquirers, Dell has engaged investment banking firms, including Morgan Stanley and Piper

Sandler, to assess interest in a takeover. Private equity entities are among the speculated suitors

eyeing SecureWorks.

Currently valued at $772 million, SecureWorks is predominantly owned by Dell, holding 79.2% of the company

and controlling 97.4% of its voting stock.

Steady Growth Amidst Uncertain Waters

SecureWorks demonstrated resilience in the market as it surpassed first-quarter revenue expectations with

$85.7 million. Taegis, a subsidiary, saw its revenue climb by 10%, reaching $69.1 million. The company

foresees second-quarter revenues between $80 million to $82 million, slightly below the analyst estimate

of $81.2 million. Investors have witnessed a 31% rise in SecureWorks’ stock over the past year.

Current Stock Performance

Price Movements: SCWX shares reported a 3.67% decline, trading at $8.41 during the

premarket check on Friday. Conversely, Dell observed a 6.40% upsurge, reaching $117.83 in early trading

on the same day.

Photo courtesy of Shutterstock