As Meta Platforms (META) and Alphabet (GOOG) take the plunge into dividend payments, joining the elite ‘Magnificent 7,’ the spotlight now turns to Amazon (AMZN). Long regarded as the trailblazer of e-commerce, should Amazon follow suit and start rewarding shareholders with a dividend? Let’s delve into this conundrum and analyze the potential merits and pitfalls of Amazon initiating a dividend.

The Landscape of Cash Distribution

In the realm of corporate finance, companies can choose to allocate excess cash to shareholders through dividends or share buybacks. While buybacks offer flexibility in adjusting to market conditions, dividends provide stability and serve as a reliable income source for investors. The upheavals of 2020 witnessed several companies suspending dividends due to the pandemic, only to reinstate them as conditions improved.

The Allure of Buybacks in Tech

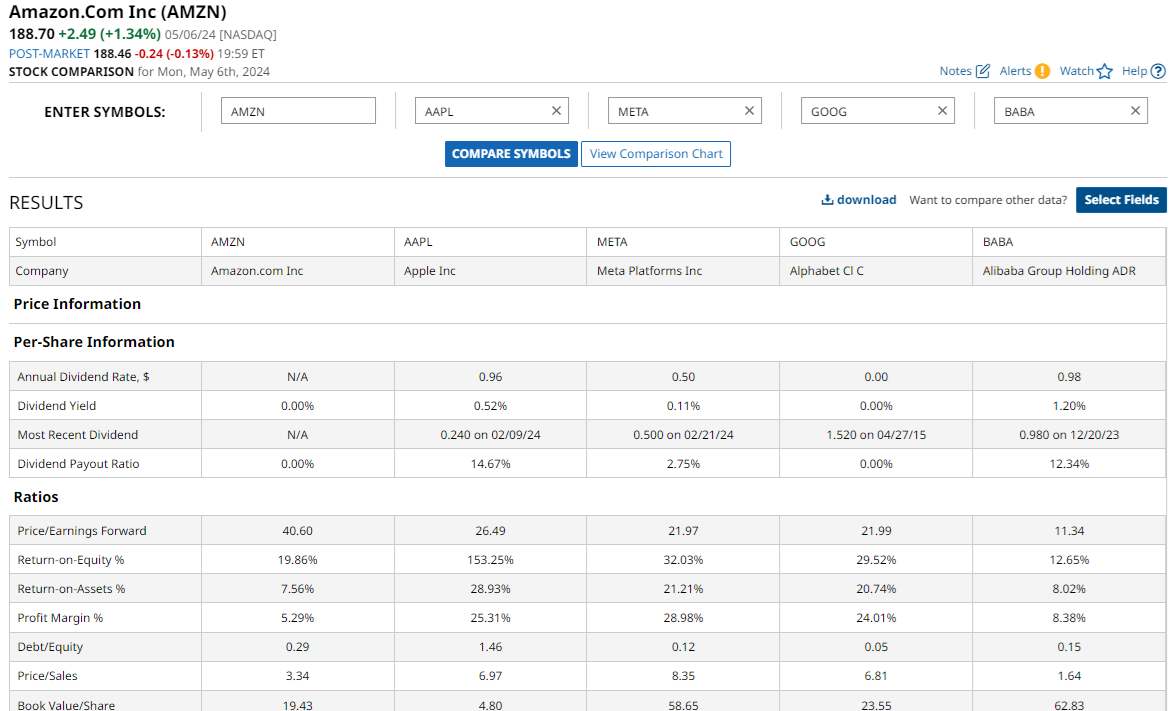

Tech giants typically lean towards share buybacks over dividends, with even dividend-paying companies offering modest yields. For instance, Meta and Alphabet present dividend yields below 0.50%, while Microsoft leads the ‘Magnificent 7’ with a 0.73% yield, eclipsing the broader market’s yield.

Big Tech entities typically prioritize reinvesting free cash flows into business growth or acquisitions. Despite robust overall cash generation, certain ventures within these companies, such as Meta Platforms’ Reality Labs and Alphabet’s Other Bets segment, absorb substantial cash resources.

The Argument for an Amazon Dividend

Three key rationales support the case for Amazon to contemplate a dividend:

- Enhanced Investor Appeal: By instituting a dividend, Amazon can attract investors who prioritize dividend-paying companies, broadening its investor base.

- Steadying Growth Trajectory: With Amazon’s growth moderating and a shift to stable revenue forecasts ahead, a dividend could signal maturity and stability to shareholders.

- Solid Cash Position: Amazon’s robust free cash flows of $36.8 billion in 2023 lay a fertile ground for initiating regular dividend payments.

Although the call for Amazon to heed this dividend trend gains traction, the company’s capital allocation framework hints at a cautious approach.

The company’s CFO, Brian Olsavsky, emphasized Amazon’s commitment to long-term investments, particularly in burgeoning arenas like generative AI, bolstering the company’s future returns. Peers like Microsoft and Alphabet echo a similar sentiment, heralding a wave of capex surge aimed at fortifying AI capabilities.

Countering the Dividend Notion for Amazon

Contrary to the dividend proponents, Amazon’s intricate business dynamics pose challenges to immediate dividend initiation. The company’s substantial cash outlay, especially in expanding its global footprint and bolstering its e-commerce infrastructure, necessitates ongoing massive investments.

Additionally, Amazon’s fluctuating operating margins, susceptibility to economic downturns, and positive net debt status distinguish it from its Big Tech peers, dissuading an immediate dividend plunge.

Given Amazon’s unique financial landscape and strategic imperatives, the likelihood of a dividend declaration remains distant in the horizon. While investors eagerly anticipate Amazon’s next move, those eyeing both AI prowess and dividend yields may find solace in alternative avenues such as HP (HPQ).