An Overview of AMD

While the recent stumble in stock price paints a different story, Advanced Micro Devices’ (NASDAQ: AMD) shares have soared by approximately 85% in the past year. The surge is partially attributed to the buzz surrounding its AI chips, notably the Instinct MI300 Series Accelerators. Despite Nvidia’s dominance with an 80% share of the market, MarketDigits predicts a robust 38% compound annual growth rate in the AI chip sector until at least 2030. This forecast spells positive prospects for AMD, even with its modest market share.

The company’s financial reports echo this narrative. In the fourth quarter of 2023, AMD witnessed a 10% year-on-year revenue uptick to $6.2 billion. Notably, the data center segment, inclusive of AI chips and representing $2.3 billion in revenue, saw a stellar 38% annual growth.

Amid these triumphs, investors shouldn’t overlook AMD’s other facets. Its client-side division provided the fastest growth, with a 62% surge in fourth-quarter revenue to $1.5 billion. Despite declines in gaming and embedded segments, AMD’s recovery remained on track.

AMD’s Ongoing Challenges

However, not all financial metrics paint a rosy picture for AMD. The full-year 2023 results indicated a 4% revenue dip to $23 billion, reflective of the broader industry’s cyclical downturn. For AMD, only the data center and embedded segments witnessed growth during this period.

Consequently, the waning revenue led to a substantial reduction in operating income, with net income settling at $4.3 million—a 22% decline in adjusted net income compared to the previous year.

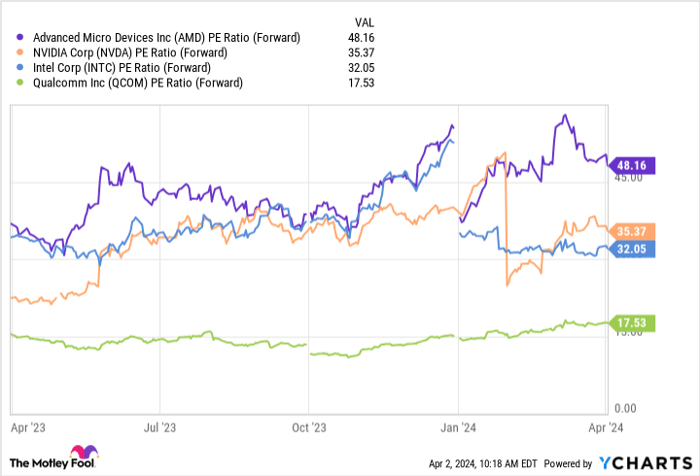

Further scrutiny of AMD’s earnings multiple raises red flags for potential investors. With a price-to-earnings (P/E) ratio hovering around 350, the figure appears more indicative of profit drops rather than a true reflection of AMD’s valuation. In contrast, the forward P/E ratio stands at 48, potentially signaling an overpriced stock.

Comparing these valuations with industry peers like Intel (NASDAQ: INTC) and Qualcomm (NASDAQ: QCOM), who’ve also ventured into AI chip development, AMD’s forward P/E overshadows even Nvidia’s. Such discrepancies could exert downward pressure on gains or potentially trigger reversals.

AMD PE ratio (forward) data by YCharts.

Decision Time: Invest in AMD Correction?

Despite the lofty price tag, AMD presents a compelling case for investment, particularly within the burgeoning AI chip market. As the demand for such chips surges, AMD stands to amass substantial revenue and income in the long run—a scenario validated by its fourth-quarter performance.

It’s true that AMD’s stock appears pricey, especially in comparison to Nvidia and emerging AI chip competitors. Nevertheless, the anticipated explosive growth in the AI chip sector could augur well for all players involved. With this optimistic outlook in mind, coupled with AMD’s diversified revenue streams, the recent stock slump could indeed signal a buying opportunity rather than a warning sign to steer clear of this semiconductor stock.

The Wisest Choice for Investors

Pondering an investment in Advanced Micro Devices ($AMD)? Here’s a nugget for thought:

The analysts at Motley Fool Stock Advisor have pinpointed the 10 best stocks poised for stellar returns, yet AMD doesn’t make the cut. These 10 elite stocks hold the promise of substantial profits in the near future.

Stock Advisor offers a clear roadmap to success, providing invaluable insights on portfolio construction, regular analyst updates, and bi-monthly stock recommendations. Since 2002, the Stock Advisor service has outperformed the S&P 500 threefold*.

Explore the 10 recommended stocks

*Stock Advisor returns as of April 4, 2024

Will Healy has investments in Advanced Micro Devices, Intel, and Qualcomm. Motley Fool holds positions in and endorses Advanced Micro Devices, Nvidia, and Qualcomm. While recommending Intel, the Motley Fool has disclosed positions in long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short May 2024 $47 calls on Intel, as per its disclosure policy.