August has brought turbulent seas for Amazon shareholders as the e-commerce giant grapples with a market sell-off triggered by global economic events. One such contributing factor has been Japan’s slight interest rate increase and the unraveling of the carry trade, adding weight to the already bearish market sentiment.

Diving deeper into Amazon’s recent financial performance and market response may provide valuable insights for potential investors eyeing this tech behemoth.

Unpacking Second-Quarter Results and Future Projections

Stock reactions post-earnings are often a result of the variance between actual performance and market expectations. Amazon’s Q2 report revealed a robust 10% revenue growth; however, the $148 billion in sales missed analyst predictions marginally. The subsequent projection for Q3 sales growth at 8% to 11% fell short of the anticipated range.

In the tech giant’s portfolio, Amazon Web Services (AWS) shone brightly with a 19% revenue surge. North American sales climbed 10% to $90 billion, with international sales following suit at 7% to $31.7 billion. Notably, advertising services saw a 20% revenue uptick to $12.8 billion, underscoring Amazon’s commitment to expanding revenue streams.

The company remains bullish on its future prospects, vouching for heavy investments to support the growing demand for AI and other workloads. Amazon’s expenditure trajectory is set to rise in the second half, aligning with its strategic technological advancements.

Exploring the Investment Landscape for Amazon

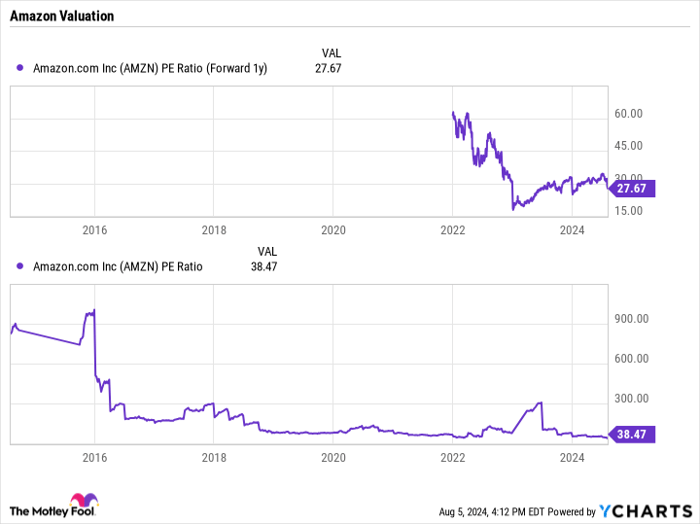

Amazon’s investment allure stems from multiple fronts, notably its expansive foray into AI applications and the burgeoning advertising sector. While recent quarters have shown promising growth trajectories, concerns loom over Amazon’s valuation metrics.

With a forward P/E ratio of close to 28 based on 2025 estimates, Amazon’s valuation appears relatively high, considering the tapering revenue growth rates. A comparative analysis of gross margins against industry peers like Microsoft unveils Amazon’s margin constraints.

Despite these valuation concerns, prospective investors could see this dip as a tentative entry point, awaiting a more favorable valuation amid market fluctuations and Amazon’s promising growth avenues.

Weighing the Prospects of Investing in Amazon

Before delving into Amazon stocks, evaluating the broader investment landscape could offer valuable insights. Identifying potential high-growth stocks should be on every investor’s radar, with Amazon facing scrutiny and appreciation in equal measure.

Reflecting on past investment successes like Nvidia’s monumental growth underscores the potential upsides of strategic stock picks. As market dynamics evolve, considering Amazon’s long-term growth trajectory aligns with prudent investment strategies.

While market volatility persists, gauging Amazon’s resilience and adaptability in the tech domain could pave the way for sound investment decisions amidst the ever-changing financial terrain.

*Stock Advisor returns as of August 6, 2024