Amazon‘s (NASDAQ: AMZN) took a beating after revealing its second-quarter results, with a downward spiral of nearly 10% in the initial trading session that escalated over subsequent days, perpetuating a significant deviation from its 2024 peak. Amidst this downturn, a window of opportunity has emerged for savvy investors to delve into a discounted share of one of the market’s premier companies.

Analyzing Amazon’s Q2 Performance

Post-earnings release, Amazon’s stumble was predicated on a rather trivial basis, particularly for long-term investors. With revenue landing within the guided range of $144 billion to $149 billion, the actual Q2 figure of $148 billion slightly undershot the lofty $148.6 billion analyst consensus, culminating in investor discontent. Moreover, Q3’s forecast, though marginally below expectations at a midpoint of $156 billion versus the anticipated $158 billion, carries little weight in the grand scheme of Amazon’s resilient core operations.

While the spotlight traditionally shines on Amazon’s online retail arm, which sustained modest 6% year-over-year growth, the focus pivots to its burgeoning advertising domain and the lucrative Amazon Web Services (AWS) cloud computing segment, pivotal drivers of the company’s financial landscape.

Investment Prospects in Amazon

Advertising has emerged as Amazon’s growth engine in recent years, showcasing a 20% revenue uptick in the latest quarter. Despite slightly missing analyst projections, Amazon remains optimistic about the expansion prospects within this domain. Concurrently, AWS, with its robust performance and commendable growth trajectory, signifies a promising avenue for bolstering Amazon’s profit margins, delivering a notable 64% of the company’s operating profit while constituting a mere 18% of total revenue.

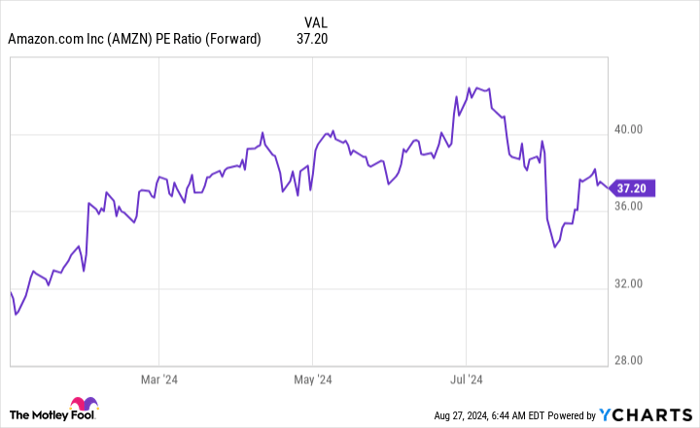

Although Amazon bears a premium valuation, with a forward price-earnings ratio of 37, a tad steep for a 10% revenue growth rate, its earnings are poised to outpace revenue growth substantially in the near future. Hence, while the purchase price may seem elevated presently, the stock is primed to uphold its premium valuation in the foreseeable future.

Assessing Stock Viability

Given the current valuation dynamics, contemplating a $1,000 investment in Amazon beckons careful deliberation. While Amazon may not have featured in the top 10 stock picks endorsed by the Motley Fool Stock Advisor, historical anecdotes such as Nvidia’s meteoric rise post-recommendation underscore the potential for substantial returns through astute investments. The Stock Advisor service’s commendable track record, outperforming the S&P 500 multiple-fold since 2002, lends credence to the narrative of informed investments yielding fruitful outcomes.

As Amazon remains a stalwart in the global economic landscape, trading below its peak levels, prospecting investors could leverage this opportune moment to establish a position in a company poised for robust growth trajectories.