As the financial world braces for the impending earnings announcements from tech behemoths Amazon and Apple, investors are on edge, anxious to dissect the performance figures once unveiled. After a lukewarm start to the earnings season with Microsoft’s results failing to dazzle, the tech sector has displayed resilience, epitomized by Meta Platforms’ stellar Q2 showing.

Previewing Apple’s Earnings

In this quarter, Apple is projected to record revenues of $84.4 billion, marking a modest 3.2% year-over-year upturn. While Apple ceased issuing specific revenue guidance in 2020, in the previous earnings call, management hinted at “low single-digit” growth for the quarter.

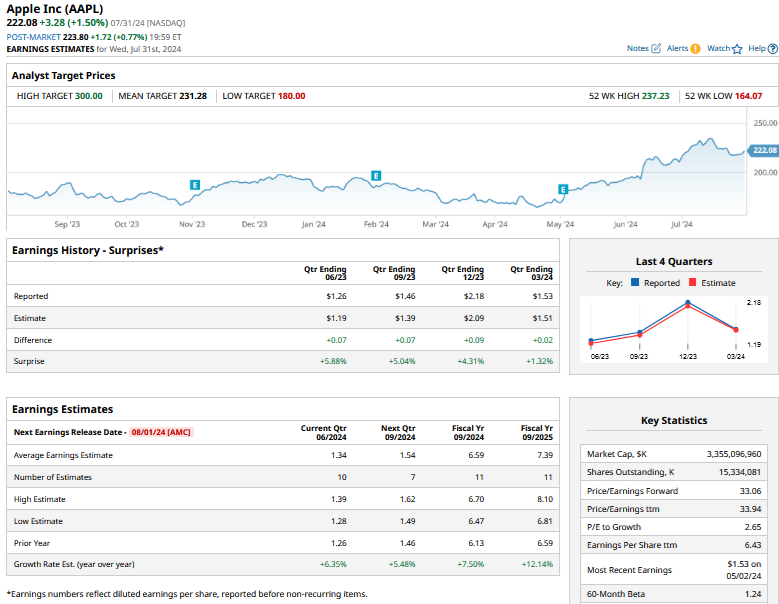

Analysts are anticipating a 6.4% boost in Apple’s earnings per share for the same quarter. Apple has been grappling with stagnant top and bottom-line expansion, and its sales have experienced a year-on-year decline in the previous fiscal period.

Key Focus Areas for Apple’s Earnings Call

Beyond the headline figures, observers should pay special attention to the following key aspects during the imminent earnings call:

- Guidance for the Upcoming Quarter: Apple is poised to unveil its next iPhone in September, a highly anticipated event. Market pundits view the iPhone 16, rumored to incorporate revolutionary “Apple Intelligence” features, as instrumental in driving Apple’s growth trajectory. The guidance provided for the September quarter will offer insights into the expected demand for the upcoming model.

- Insights on the Chinese Market: Recent reports indicate a concerning 6.7% drop in iPhone shipments in China while the overall market surged by 10%. With Huawei gaining ground at Apple’s expense, Apple’s rank in the Chinese smartphone market has slipped. Apple’s strategy to bolster its market share in China will be a focal point during the earnings call.

- Geopolitical Challenges: Amid escalating tensions between the U.S. and China, Apple faces significant risks due to its heavy exposure to the Chinese market, serving both as a lucrative sales domain and major manufacturing hub. Questions surrounding Apple’s contingency plans in the face of potential tariff hikes will likely arise during the earnings call.

Evaluating AAPL Stock Outlook

Apple’s trajectory with sell-side analysts has been tumultuous this year, with a notable string of downgrades in early January offset by a recent wave of optimism following the company’s AI-focused announcements at the Worldwide Developer Conference in June. Leading brokerages such as TD Cowen, Raymond James, Baird, and JPMorgan Chase have revised their price targets upward, reflecting renewed confidence in Apple.

Currently, approximately 77% of analysts covering Apple rate the stock as a “Strong Buy” or “Moderate Buy,” indicative of a growing positive sentiment. With a mean target price of $231.28, representing a 4.1% upside from the last closing price, market sentiment continues to trend favorably.

Strategic Considerations for Buying Apple Stock

Despite the inherent unpredictability of stock price movements post-earnings disclosure, Apple appears to be a compelling investment opportunity at this juncture. The recent stabilization in the tech sector and renewed investor interest in tech stocks bode well for Apple’s future outlook.

While Apple’s valuation may seem stretched, trading at a next 12-month price-to-earnings ratio of nearly 32x, surpassing historical averages, the premium valuation is not without merit. Apple’s evolving identity as an AI-centric player potentially signals a phase of rerating, reminiscent of past transformations where Apple successfully positioned itself as a software innovator rather than just a hardware manufacturer.

As markets eagerly anticipate Apple’s performance and strategic articulation in the upcoming earnings call, stakeholders remain poised to gauge the company’s ability to leverage its “Apple Intelligence” framework into substantial financial gains.