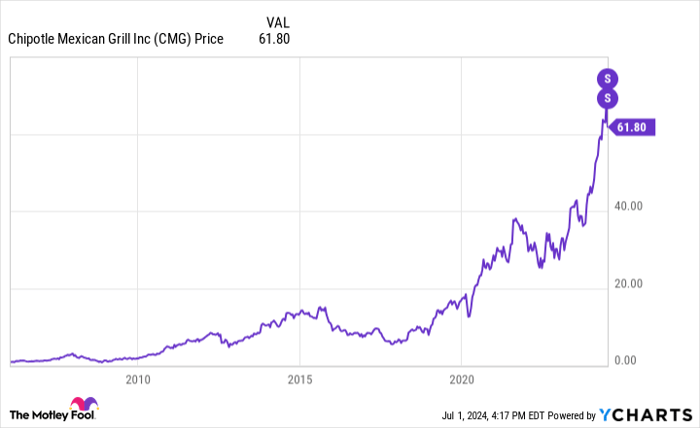

The recent buzz encircling Chipotle Mexican Grill (NYSE: CMG) revolves around its whopping 50-for-1 stock split that came into effect at June 26’s trading onset. Stock splits usually come in milder variants like 2-for-1 or 3-for-1, making Chipotle’s move a compelling anomaly. Investors, however, must zoom out to grasp its implications. While a stock split itself may not carry monumental weight, it could still influence the sentiments of Wall Street.

The Dynamics of Chipotle’s 50-for-1 Stock Split

Stock splits may vary in execution, but the core idea remains constant – a company dispenses a specified number of new shares to existing shareholders based on their current holdings. In Chipotle’s case, it was a ratio of 50 shares for each one held. Consequently, if you owned 10 shares pre-split, you would now possess 500 shares. Though this might appear as a lucrative bargain initially, it essentially amounts to a rearrangement. The stock price normalizes post-split, with Chipotle shares starting trading on June 26 at approximately 2% of the previous closing price.

Each shareholder retained the equivalent stake in the company post-split. Essentially, nothing fundamentally altered, except for a surge in outstanding shares and a reduced stock price. Conversely, reverse stock splits mirror such actions albeit in the reverse trajectory. Following a reverse split, fewer shares circulate alongside a higher stock price. This strategy is often embraced by companies facing stock exchange delisting threats due to dwindling share value.

Exploring the rationale behind a reverse split sets the stage for a critical narrative. Companies typically resort to reverse splits when their stock price decline triggers exchange expulsion signals, marking internal tumult. Typically, in such scenarios, investors divest their holdings, amplifying the selling spree post-reverse splits.

In contrast, conventional stock splits indicate robust investor confidence, reflecting a surge in buying activity that propels stock value to soaring altitudes. Such events commonly unleash sustained bullish momentum as Wall Street interprets splits as signals of an impending strong business performance. Investor sentiment markedly steers stock valuations.

Evaluating Chipotle Post-Split: Wise Investment?

From a business vantage point, Chipotle Mexican Grill stands today as the same entity pre-stock split. The rapid expansion of this exalted Mexican fast-casual chain and the adoration of its fare by consumers are staunch testimonies. While its trajectory has witnessed periodic fluctuations, the management’s commendable execution remains a consistent underpinning.

Prior to the 50-for-1 split, Chipotle’s stock price loomed significantly high, rendering it fairly inaccessible to modest investors. With each share representing a diminished ownership stake post-split, yet becoming more accessible to a broader investor base, the stock’s upward trajectory might persist. In essence, the robust support underpinning the stock could witness a broadened foundation.

Examining Apple’s stock chart (NASDAQ: AAPL) unveils multiple “S” flags indicating stock splits, each heralding a climb in the stock price. Continuous post-split success reaffirms the technology giant’s robust performance, exemplifying the potent influence of stock splits on business performance post-implementation. While outcomes may diverge, investor sentiment’s pivotal role in stock valuations cannot be understated. Investors exhibit a favorable disposition towards stock splits.

Nonetheless, sustained robust business performance shouldn’t be an assumption. In a notable instance, sales surged by a commendable 14% during the first quarter of 2024, with same-store sales marking a respectable 7% uptick. Presently, anxiety seems unwarranted, yet vigilance over Chipotle’s operational prowess remains prudent.

The Essence of Stock Splits: A Reflection of Investor Sentiment

Post the stock split, Chipotle remains unaltered, barring increased outstanding shares and a reduced stock price. The fundamental essence of the company remains intact. Consequently, investment in the stock should primarily hinge on the appeal of the business’ fundamentals. If aligned with the business ethos, the generally positive investor sentiment toward stock splits could furnish a compelling rationale to step into this stock.

Considering a $1,000 Investment in Chipotle

Before delving into Chipotle Mexican Grill stock, contemplate the following:

The Motley Fool Stock Advisor team recently pinpointed what they deem the 10 best stocks for potential investment, with Chipotle Mexican Grill notably missing the cut. The selected 10 stocks boast the potential to yield substantial returns in impending years.

A flashback to Nvidia’s inclusion on this list on April 15, 2005, highlights the extraordinary returns possible. Considering a $1,000 investment upon the recommendation date would have burgeoned into $786,046! The Stock Advisor renders investors a clear roadmap for success, comprising portfolio management insights, regular analyst updates, and bi-monthly stock picks. Since 2002, the service has surpassed S&P 500 returns fourfold.*