Sunrun RUN recently revealed a remarkable second-quarter 2024 performance, surpassing both earnings and revenue expectations by a significant margin. This success was underpinned by robust storage installation rates and soaring customer numbers, demonstrating a noteworthy 13% growth. Investors eyeing this stock for its impressive 11% year-over-year increase in subscriber value must first dive into its recent performance trends, growth potential, and potential risks lurking in the shadows.

Sunrun’s Market Outperformance

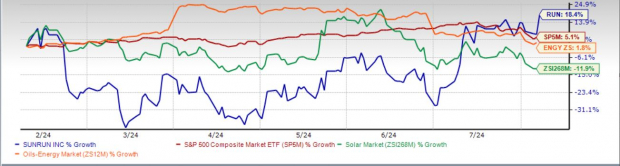

Over the past six months, Sunrun’s shares have soared a remarkable 18.4%, outshining the Zacks solar industry’s 11.9% decline and the broader Zacks Oil-Energy sector’s 1.8% return. The company also outperformed the S&P 500, which posted a 5.1% upsurge in the same period. Another notable player in the solar industry, First Solar FSLR, witnessed an astounding 37.8% surge in its share price during this timeframe.

RUN’s 6-Month Performance

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Driving Forces Behind RUN’s Success

The surge in solar demand across the United States, bolstered by favorable government policies and increasing investments in renewables, has propelled solar installation activities to new heights. This upsurge has significantly increased the demand for Sunrun’s solar and battery storage systems, exemplified by a striking 152% year-over-year growth in storage capacity installed in the second quarter of 2024.

As the leading provider of clean energy subscription services in the U.S., Sunrun offers residential solar and storage solutions with zero upfront costs. With a growing subscriber base, the company’s future revenue prospects are looking brighter.

Notably, Sunrun has partnered with Tesla Electric, a subsidiary of the electric vehicle giant Tesla TSLA, to support Texas’ energy grid. The partnership has already attracted over 150 Sunrun customers to a power program, promising additional recurring revenues for Sunrun with further customer enrollments expected to bolster its revenues.

Assessing RUN’s Growth Potential

Despite the positive trajectory in solar installations and subscriber growth, along with strategic partnerships favoring Sunrun, the company faces challenges due to trade restrictions on Chinese goods. These restrictions could disrupt the global supply chain of solar products, potentially leading to an increase in installation costs and dampening demand for Sunrun’s offerings.

Trading Insights

In terms of valuation, RUN’s forward 12-month price-to-sales (P/S) ratio of 1.66X indicates a premium compared to the industry average of 1.13X. This suggests that investors may be paying a higher price relative to the company’s sales growth potential compared to its peers. RUN also trades at a substantial premium compared to industry peers like Emeren SOL, which holds a forward 12-month P/S of 0.54X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Positive Outlook

Analysts’ estimates for Sunrun reflect an optimistic forecast ahead. The Zacks Consensus Estimate for RUN’s 2024 and 2025 earnings has seen significant improvement over the past quarter, hinting at growing confidence in the stock.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Closing Thoughts

While Sunrun’s recent share surge suggests caution due to its premium valuation, existing investors may find solace in the optimistic estimates, strong quarterly results, and the upward trend in solar installations. With a current Zacks Rank #3 (Hold), staying invested might hold promise for those already onboard.