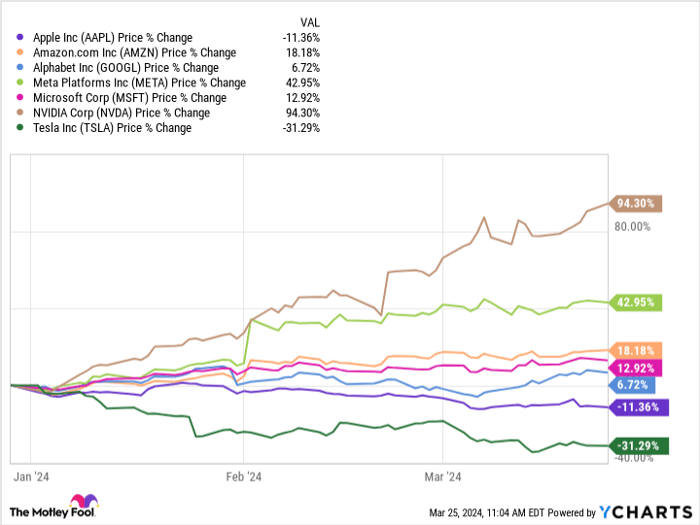

The “Magnificent Seven,” a group of highly acclaimed tech companies, have experienced varied fortunes this year. Apple (NASDAQ: AAPL) finds itself amidst unfavorable company, only surpassed in underperformance by Tesla within the group.

Investor sentiment towards Apple has been subdued due to recent financial results, compounded by significant regulatory challenges. Let’s delve into whether investors should remain invested in Apple stock despite these obstacles.

Antitrust Concerns Resurface

Apple, along with other members of the Magnificent Seven, has been subject to ongoing scrutiny for alleged antitrust practices. Critics claim that these tech giants have achieved success by improperly limiting competition, ultimately detracting from consumer welfare. On March 21, the U.S. Department of Justice, supported by 16 states, filed an antitrust lawsuit against Apple, alleging the company’s maintenance of an illegal monopoly in the smartphone market.

The lawsuit accuses Apple of various anticompetitive practices, such as impeding smooth communication between iPhones and other smartphone brands and enforcing unjust fees for app developers on the App Store. Additionally, the tech giant is charged with hindering innovation on its platform. These are just a few of the claims lodged by the DOJ against Apple, with the lawsuit focusing on Apple’s flagship product, the iPhone.

Remaining Composed in the Storm

While the outcome of the lawsuit remains uncertain and could potentially extend over a prolonged period, Apple stands in a financially resilient position to navigate such legal challenges. With its substantial free cash flow generation, the tech giant has faced its fair share of legal battles over the years, though this particular case stands as one of the most pivotal in its extensive history.

As for investors, a cautious approach may be prudent. Assigning Apple stock a “hold” rating at present seems sensible, advising against selling existing shares while exercising caution in expanding one’s position post-downturn. Beyond legal concerns, Apple appears to lag behind several peers in the burgeoning artificial intelligence (AI) sector.

Rumors suggest that Apple is contemplating strategic moves in the AI space, leveraging its reputation for transforming existing technology into refined versions that drive immense success. Apple’s historic innovation prowess is undeniable, but its trajectory in the AI market remains ambiguous for now.

While the iPhone remains a key revenue driver for Apple, its significance as a growth catalyst has significantly waned over time. Despite a growing services segment with impressive margins, it contributes a modest portion to Apple’s overall revenue. The outcome of the antitrust lawsuit could substantially alter Apple’s capacity to monetize its vast ecosystem, further complicating its growth trajectory.

The convergence of these challenges underscores why Apple presently does not qualify as a compelling buy opportunity amidst its recent struggles.

Before contemplating an investment in Apple, it is crucial to consider the broader market landscape and the evolving dynamics within the tech industry. Conducting thorough research and evaluating the long-term prospects of Apple against industry trends is essential for any potential investor. In the dynamic realm of technology stocks, informed decisions are paramount for optimizing investment outcomes.

Remember, making sound investment choices often requires careful consideration and analysis, particularly in the face of market uncertainties and regulatory complexities.