Understanding Brokerage Recommendations for CVLT

When it comes to making investment decisions, the opinions of Wall Street analysts play a pivotal role. These recommendations can sway market perceptions and impact stock prices. Let’s delve into how analysts view Commvault Systems (CVLT) and explore the significance of brokerage recommendations.

Analyzing Brokerage Recommendation Trends for CVLT

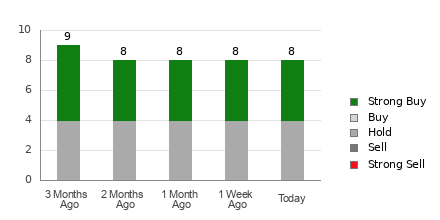

Commvault currently holds an average brokerage recommendation (ABR) of 2.00, suggesting a Buy sentiment. This rating is based on inputs from eight brokerage firms, with half of them strongly advocating for a purchase.

However, relying solely on ABRs to guide financial decisions may not be the most prudent strategy. Academic studies have highlighted the limitations of such recommendations in predicting stock price movements accurately.

Why the skepticism? Brokerage analysts often exhibit a biased inclination towards positive ratings due to their vested interests. It’s common for firms to provide more “Strong Buy” than “Strong Sell” recommendations, shedding doubt on the objectivity of their assessments.

Navigating the Terrain: Zacks Rank vs. ABR

While both ABR and Zacks Rank utilize a 1-5 scale, they serve distinct purposes. ABR reflects brokerage endorsements, often swayed by inherent biases, while Zacks Rank leverages earnings estimate revisions to gauge stock performance.

Brokers may not always act in investors’ best interests, leading to misleading recommendations. In contrast, Zacks Rank’s objectivity in analyzing earnings trends offers a more reliable indicator for predicting stock movements.

The Zacks Rank’s timeliness and holistic approach to all stocks with earnings estimates make it a preferable tool over ABR in making informed investment decisions.

Should You Consider Investing in CVLT?

Examining Commvault’s earnings estimate revisions reveals a stable Zacks Consensus Estimate of $3.32 for the current year. This consistency in analysts’ projections could indicate a market performance in line with broader trends in the short term.

Based on recent changes in estimates and other factors, Commvault holds a Zacks Rank #3 (Hold). This suggests a cautious approach, despite the Buy-equivalent ABR, emphasizing the importance of thorough research before making investment choices.