When it comes to the stock market, the recommendations of Wall Street analysts hold considerable sway over investor decisions. These sell-side analysts can impact stock prices with their evolving ratings. But are these views as influential as they appear?

Diving into the realm of Synopsys (SNPS), let’s dissect the perspectives of these Wall Street giants before delving into the reliability of broker recommendations and how investors can leverage them.

Currently, Synopsys boasts an average brokerage recommendation (ABR) of 1.21, aligning on a spectrum from 1 to 5 (ranging from Strong Buy to Strong Sell). This figure is derived from the collective Buy, Hold, or Sell recommendations provided by 14 brokerage firms. An ABR of 1.21 straddles between Strong Buy and Buy territory.

Among the 14 recommendations contributing to the ABR, 12 advocate for Strong Buy, whereas one suggests Buy. These Strong Buy and Buy ratings represent 85.7% and 7.1% of all recommendations, respectively.

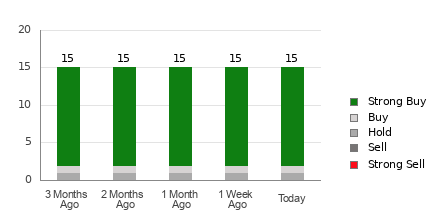

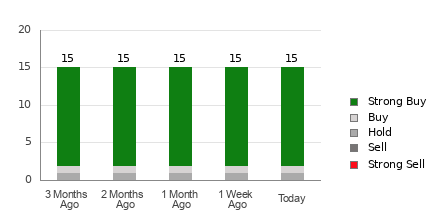

Shifts in Brokerage Recommendations for SNPS

While the ABR favors Synopsys, relying solely on this metric to make investment decisions may not yield optimal results. Studies indicate that brokerage recommendations have limited success in predicting stocks with the highest price increase potential.

Wondering why? Analysts at brokerage firms tend to exhibit a strong positive bias towards stocks they cover due to their vested interests. Our investigations reveal that for every “Strong Sell” recommendation, brokerage firms assign a whopping five “Strong Buy” ratings.

This skewness in their assessments highlights a misalignment between their interests and those of retail investors, failing to provide a clear indication of a stock’s future price trajectory. As such, a more prudent approach would be to complement this information with your own research or a proven predictor of stock price movements.

Backed by a credible externally verified track record, our exclusive stock rating tool, the Zacks Rank, segments stocks into five categories ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), providing a dependable gauge of a stock’s short-term performance. Aligning the Zacks Rank with ABR could significantly aid in making informed investment decisions.

Discerning ABR From Zacks Rank

Amidst superficial similarities, the Zacks Rank and ABR are fundamentally distinct metrics intrinsically.

Broker recommendations are the primary inputs for calculating the ABR, typically presented in decimal form (such as 1.28). Conversely, the Zacks Rank operates as a quantitative model leveraging the power of earnings estimate revisions, reflected in whole numbers from 1 to 5.

Brokerage analysts, due to the vested interests of their employers, tend to exude undue optimism in their recommendations, often surpassing the backing of their research. This disparity frequently misleads investors rather than guiding them.

Conversely, the Zacks Rank hinges on earnings estimate revisions, with empirical research suggesting a strong correlation between near-term stock price movements and these trends.

Moreover, the Zacks Rank delineates its varying grades proportionately across all stocks with earnings forecasts from brokerage analysts for the current fiscal year. This equilibrium ensures consistent classification across all stocks at any given time.

Another crucial distinction between ABR and Zacks Rank lies in their timeliness. While the ABR might lack real-time updates, earnings estimate revisions by brokerage analysts, promptly integrated into the Zacks Rank, ensure timely signals of future price fluctuations.

Is SNPS a Lucrative Investment?

Assessing the earnings estimate revisions for Synopsys, the Zacks Consensus Estimate for the ongoing year has remained stable at $13.12 over the past month.

The unwavering consensus on the company’s earnings potential, reflected in a static estimate, could rationalize the stock’s parity with the broader market in the near future.

Based on the recent consensus estimate stability and three other factors tied to earnings forecasts, Synopsys acquires a Zacks Rank #3 (Hold). For an overview of today’s Zacks Rank #1 (Strong Buy) stocks, refer to the complete list here >>>>

Given the Buy-equivalent ABR for Synopsys, exercising caution might be the prudent course of action.

Revolutionizing American Infrastructure Stocks

A monumental drive to revamp the deteriorating U.S. infrastructure looms on the horizon, a bipartisan, pressing, and inevitable initiative. Trillions are set to be expended, paving the way for immense fortunes.

The pivotal question remains: “Are you positioned in the right stocks early on, when their growth potential is at its zenith?”

Zacks has rolled out a Special Report tailored to aid in this pursuit, and it’s available at zero cost today. Uncover 5 select companies poised to reap the greatest benefits from the extensive revamp and refurbishment of roads, bridges, construction, as well as energy transformation and cargo transport on an unprecedented scale.

Access FREE Guide: Capitalize on Trillions in Infrastructure Spending >>

Synopsys, Inc. (SNPS) : Free Stock Analysis Report