Financial Giants Make Bullish Move on First Solar

A distinct bullish sentiment has been observed from financial giants regarding First Solar. An analysis of options history for First Solar (FSLR) uncovered 14 unusual trades.

Delving deeper, it was revealed that 42% of traders displayed bullish tendencies, while an equal 42% showed bearish inclinations. Among the trades identified, 9 were puts amounting to $1,215,907, whereas 5 were calls totaling $167,234.

Exploring Projected Price Targets

Consideration of Volume and Open Interest on these contracts indicates that significant players have been eyeing a price range between $190.0 to $270.0 for First Solar over the past 3 months.

Insights into Volume & Open Interest

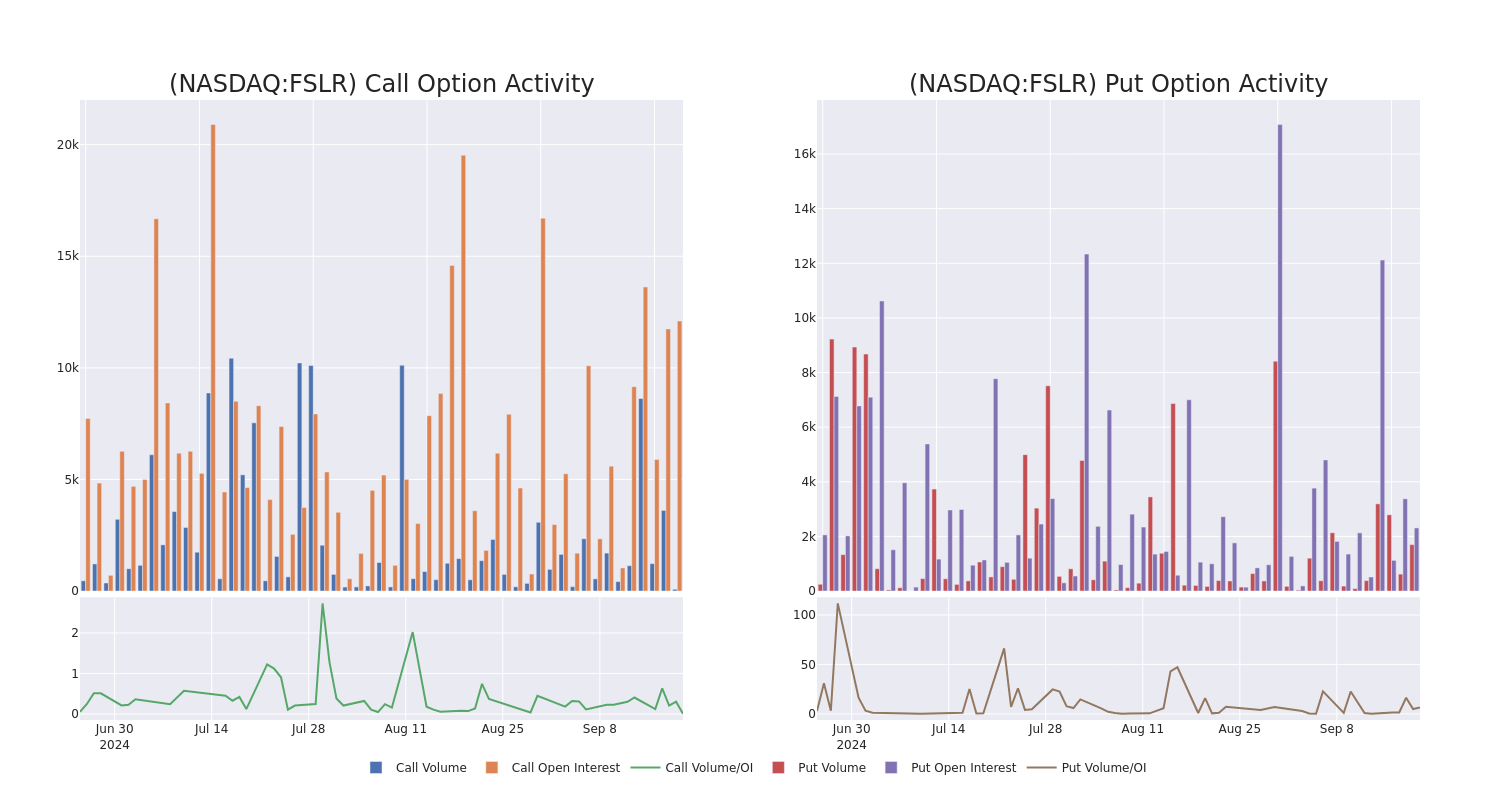

Analysis of volume and open interest serves as a valuable due diligence method for a stock.

This data aids in tracking the liquidity and interest for First Solar’s options at a given strike price.

Below, the evolution of volume and open interest of calls and puts respectively for all of First Solar’s notable activity within a strike price range of $190.0 to $270.0 in the last 30 days is depicted.

Snapshot of First Solar’s 30-Day Option Volume & Interest

Highlighted Key Options

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FSLR | PUT | TRADE | BULLISH | 12/20/24 | $23.3 | $22.8 | $22.8 | $230.00 | $228.0K | 227 | 556 |

| FSLR | PUT | TRADE | BULLISH | 12/20/24 | $23.2 | $22.45 | $22.45 | $230.00 | $224.5K | 227 | 101 |

| FSLR | PUT | TRADE | BEARISH | 12/20/24 | $22.65 | $21.4 | $22.6 | $230.00 | $212.4K | 227 | 207 |

| FSLR | PUT | TRADE | BULLISH | 12/20/24 | $23.0 | $22.8 | $22.8 | $230.00 | $200.6K | 227 | 268 |

| FSLR | PUT | TRADE | BULLISH | 12/20/24 | $22.75 | $22.6 | $22.6 | $230.00 | $113.0K | 227 | 216 |

About First Solar

First Solar is known for designing and manufacturing solar photovoltaic panels, modules, and systems used in utility-scale development projects. Utilizing cadmium telluride in their solar modules for converting sunlight into electricity, First Solar is a leading player in thin-film technology globally. The company operates production lines in Vietnam, Malaysia, the United States, and India.

Following a comprehensive analysis of options trading involving First Solar, we delve into a detailed examination of the company, exploring its current market position and performance.

Current Status of First Solar

- Presently trading at a volume of 943,307, First Solar’s price has dipped by -1.93%, resting at $235.8.

- RSI readings hint that the stock may be edging towards an overbought territory.

- The anticipated earnings release is slated for 39 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Spotting potential market movers before they make their impact is the forte of Benzinga Edge’s Unusual Options board. Discover the positions big money is taking on your preferred stocks. Dive in here.

While options present a riskier investment avenue compared to traditional stock trading, they offer increased profit potential. Seasoned options traders mitigate these risks by engaging in continual education, judiciously scaling in and out of trades, leveraging multiple indicators, and keeping a keen eye on market movements.

To stay abreast of the latest options trades surrounding First Solar, real-time options trade alerts are available from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs