Ups and Downs: Market Reflections

Amidst the trading turmoil, a day of mixed signals unfolded. The market opened with a downward gap that hinted at a looming sell-off; a gamble some attempted to short. Yet, against odds, it was the longs who emerged victorious.

Today poses the pivotal question: Can the recent market dynamics muster the strength to challenge the highs of two days ago and potentially breach previous records?

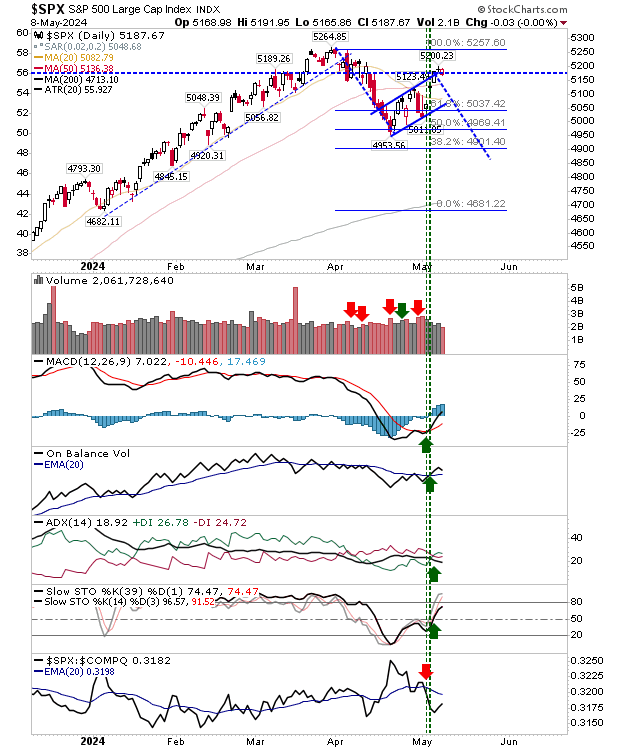

S&P 500: Leading the Charge

Standing tall among the indexes, the S&P 500 closed the day on a neutral note, staying in close proximity to yesterday’s neutral doji pattern. Its resilience positions it favorably to dictate today’s market moving forward.

Dow Jones Industrial Average: Testing Resistance

Among the large-cap indexes, the Dow Jones Industrial Average managed to surpass the previous day’s performance, albeit encountering a new hurdle in the form of a resistance level.

Nasdaq Composite: Evening Star Formation

The Nasdaq Composite follows in line, presenting a potential bearish ‘evening star’ pattern post yesterday’s gains. Despite the upward momentum, a negative ‘sell’ trigger in the On-Balance-Volume indicates caution.

Russell 2000: Awaiting Clarity

The Russell 2000 demonstrates the most defined bearish ‘evening star’ pattern in the current mix, despite deviating from the standard red candlestick sequence typical of the formation.

Noteworthy is the diminishing volume, a common signal for a “bear flag” scenario, hinting at a potential reversal of yesterday’s gains. Although technical indicators lean positive, vigilance is advised in the face of a bearish outlook.

Into the Unknown: Future Prospects

Looking ahead, keep a watchful eye on the Dow Industrial and S&P 500 indices for guidance. A sustained bullish momentum and positive movements in these key indices may pave the way for the Russell 2000 to make significant strides upwards.