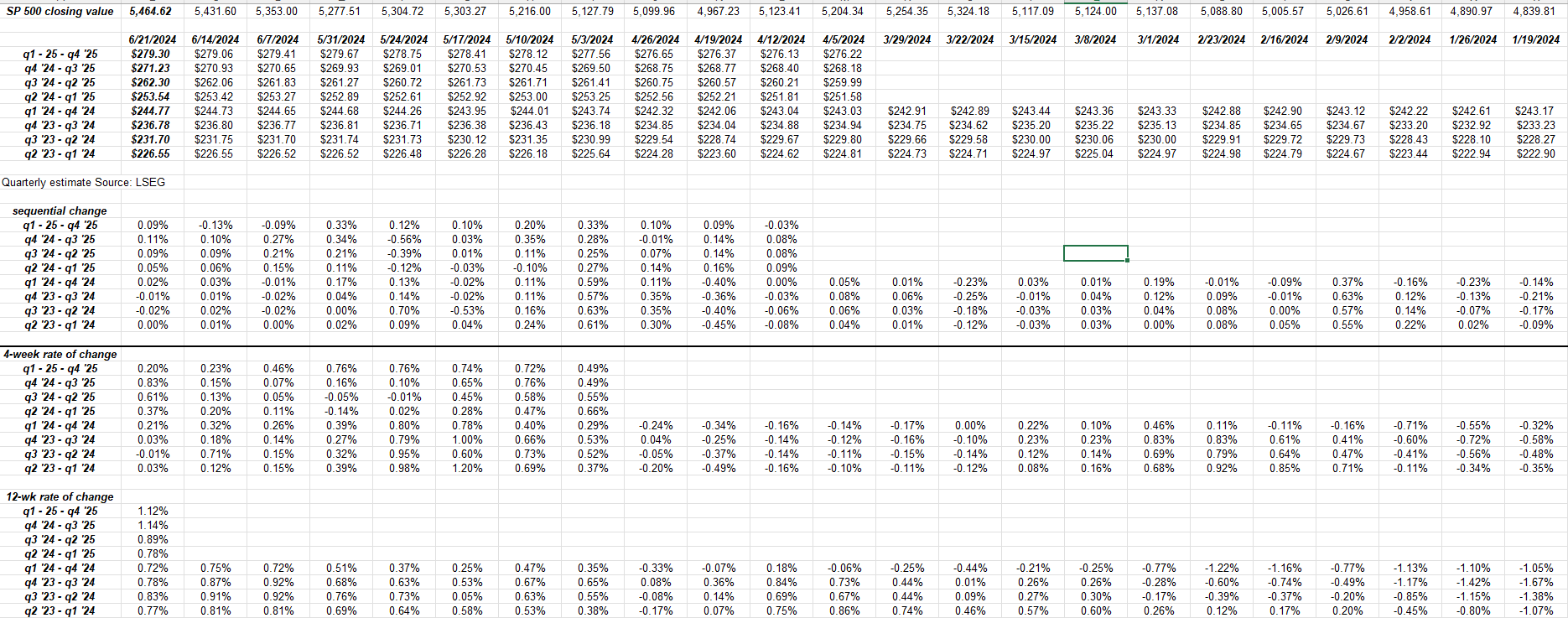

This week let’s delve into what can be likened to the “spot curve” of the forward 4-quarter estimates within the S&P 500. What story does the forward 4-quarter estimate paint for 1, 2, 3, and 4 quarters from today?

The striking pattern emerges as analysts surprisingly revise their estimates upwards, defying the norm of negative revisions during this phase of the quarter. Typically, analysts become more conservative as the 2nd quarter concludes and earnings are on the horizon. But in an unexpected turn, we are witnessing a sustained climb in revisions.

Across the board, positive forward revisions are visible for all time trends – sequential, 4-week rate of change, and with the latest addition, the 12-week rate of change for quarterly estimates reaching 2025. This anomaly prompts speculation and raises S&P 500 targets for year-end 2024.

While skepticism may arise due to the distant horizon of 2025, historical trends suggest otherwise. Anticipating a scenario akin to the “very pro-growth” environment post the 2016 Presidential election, analysts foresee a trajectory conducive to vibrant economic expansion.

Undoubtedly, the S&P 500 earnings estimate revisions play a significant role in this narrative. The data begins to reflect projected 2025 EPS and revenue figures, alluding to a nuanced interplay of political and economic factors.

As we navigate through the forthcoming quarters, particularly post the Q2 ’24 earnings, a diligent watch on the evolving 2025 estimates becomes imperative. The upcoming revisions will provide crucial insights into the unfolding economic landscape.

S&P 500 Insights:

- Current figures present the S&P 500’s forward 4-quarter estimate at $253.54 this week, marking a notable increase from the past weeks and the end of March.

- Peering into the subsequent quarter, the forward estimate for July ’24 through June ’25 stands at $262.30, projecting encouraging growth prospects, contingent upon real Q2 ’24 results.

- The PE ratio vis-a-vis the forward estimate has remained relatively stable, suggesting a nuanced interplay between PE expansion and EPS growth in the market.

Russell 2000: A Comparative Analysis

Examining the past, 2023 was a challenging year for earnings, shaping robust expectations for 2024. With a favorable outlook for the latter half of the year, 2024 appears poised for brighter prospects against the backdrop of 2023 performance.

Intriguingly, the divergence between the Russell 2000 and the S&P 500 warrants a keen observation of this asset class. As dynamics shift, exploring the varied patterns within the asset class can offer unique insights.

Summation

Set against the backdrop of imminent quarterly reports from significant players like FedEx, Micron, and Nike, the upcoming earnings serve as a litmus test for the US economic pulse. Analyzing these reports promises a nuanced understanding of the market landscape.

Entering the realm of predictions, while some foresee a favorable outcome for Nike amidst the Summer Olympics, deeper questions loom regarding the brand’s intrinsic vitality amidst market dynamics.

Fueled by AI demand, FedEx and Micron illustrate contrasting yet compelling narratives within the tech and transport sectors. Their trajectories paint a vivid picture of market evolution and resilience against historical benchmarks.

Disclaimer: These insights are subjective and not prescriptive. Past trends do not guarantee future performance. Investors are urged to exercise caution and adapt in response to market fluctuations.

Thank you for your readership.