Stock Market Dynamics

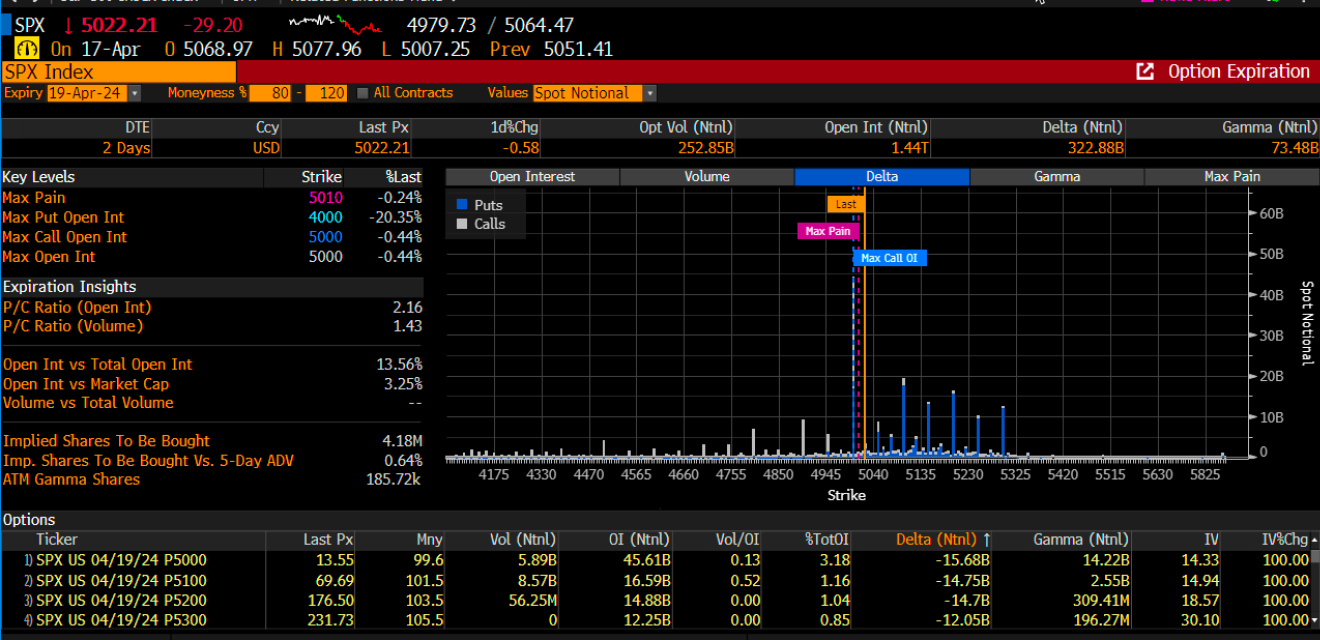

Despite an early rally attempt, stocks closed lower with the S&P 500 finishing down nearly 60 bps at 5,022. The index is now approaching the critical 5,000 level, a key gamma point that may offer support in the short term. However, a breach of this level could alter the market landscape significantly before the Friday options expiration.

Market Maker Strategy

Market makers have established put delta positions at 5,200 and 5,100 in the S&P 500, indicating a bearish sentiment. If the index falls below 5,000, the selling pressure is expected to intensify as these put options become profitable, prompting further selling.

ETF Impact

The ETF covering calls at the 17,900 strike price will lead to a buyback on April 18. While the impact of this buyback is projected to be minimal, the subsequent sale of new calls on Friday may create a significant sell-off imbalance in the market.

Nasdaq 100 Movement

The Nasdaq 100 index has breached the megaphone pattern and filled the February 21 gap. A breakdown below 17,400 could set the stage for a potential decline to around 17,100, signaling further bearish sentiment.

Nvidia’s Crucial Role

Nvidia’s stock price testing and nearing the $850 support level is a critical development as its fate may dictate the direction of the broader market. Given Nvidia’s substantial influence, a significant downturn in its price could trigger a market-wide sell-off.

Market Implications

Nvidia has been a major driver of the S&P 500’s 5.3% gain this year, accounting for approximately 40% of the total points. A substantial decline in Nvidia’s stock, down to $670, would have a cascading effect on the market, potentially leading to significant losses. The interdependency among major tech stocks, including Nvidia, emphasizes the fragility of market gains and the susceptibility to rapid downturns.

(BLOOMBERG)