Market movements can be a rollercoaster, as evident from recent shifts.

S&P 500 – A Test of Resilience

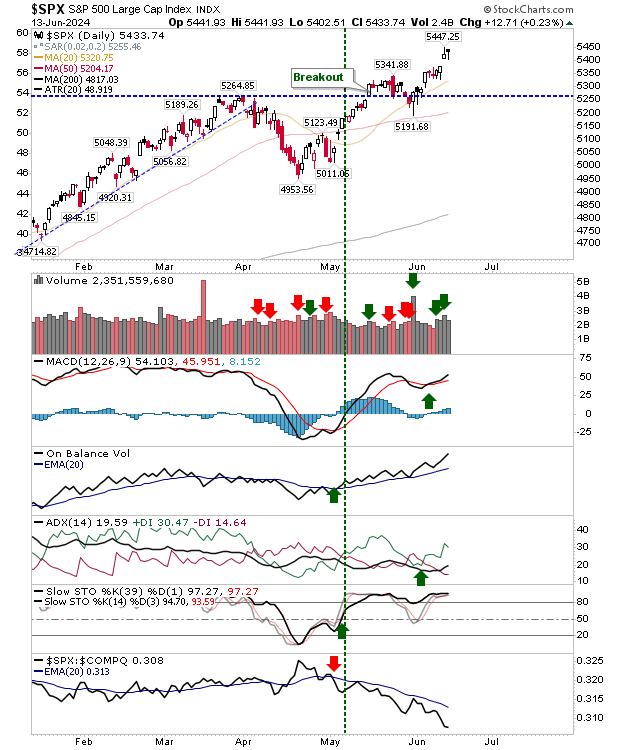

Yesterday’s session for the S&P 500 hinted at a neutral stance. While the closing remained within the previous day’s range, the bearish tone in the candlestick raised some concerns. Investors are closely monitoring the potential closure of the breakout gap, anticipating a move akin to historical trends.

Noteworthy breakout gaps have a tendency to remain open, suggesting a pivotal point for the index. Caution is advised to avoid breaching the lows of the previous day, maintaining a sense of balance in the market.

For day traders, embracing a proactive approach by anticipating an opening near the prior day’s close could be strategic. However, remaining vigilant about the Federal Reserve’s comments is paramount, especially if positions are in the positive territory.

Nasdaq Composite – Wrestling with Sentiment

The Nasdaq Composite finds itself in a similar conundrum as the S&P 500, striving for new highs amidst prevalent selling pressure. A potential gap down in today’s pre-market scenario may lead to a move resembling the Russell 2000 ($IWM) pattern.

Conversely, an opening near the previous day’s close could embolden the bullish camp, eliminating immediate resistance hurdles.

Dow Jones Industrials – Walking the Tightrope

Characterized by a doji at the recent close, the Dow Jones Industrials index isn’t signaling an oversold condition that typically preludes a bullish reversal. Despite its distance from recent peaks, it stands as a cautious long-term prospect with technically bearish indicators.

Insights into Market Dynamics

The recent market dynamics have been intriguing, with the Dow presenting a promising stance for trend followers. In contrast, the Nasdaq faces potential downside risks in case of a subdued opening.