Investors often rely on Wall Street analysts’ recommendations when contemplating stock decisions. These analysts, employed by brokerage firms, have the power to sway market sentiment. But do their ratings truly reflect the stocks’ worth?

Before delving into the veracity of brokerage recommendations and their strategic significance, let’s peek into the thoughts of these financial gurus concerning Symbotic Inc. (SYM).

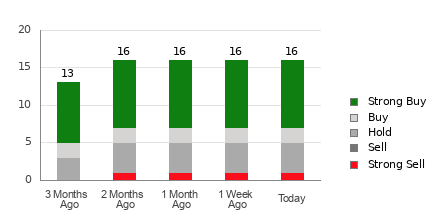

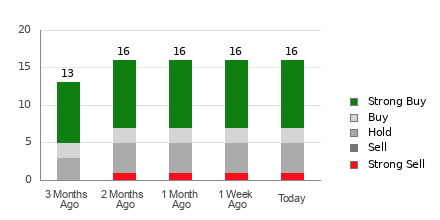

Symbotic Inc. currently holds an Average Brokerage Recommendation (ABR) of 1.88, indicating a consensus between “Strong Buy” and “Buy.” This rating aggregates inputs from 16 brokerage firms, where a majority favor a bullish outlook, with 56.3% Strong Buy and 12.5% Buy recommendations.

Understanding the Flux in Brokerage Recommendations for SYM

While the ABR hints at a buy recommendation for Symbotic Inc., solely banking on such data may not be prudent. Studies reveal that brokerage inputs often fail to pinpoint stocks poised for substantial price surges.

The bias of brokerage analysts towards the stocks they cover is a significant factor. Typically leaning towards positive ratings, these analysts tread cautiously with pessimistic assessments. For every “Strong Sell” recommendation, you’re likely to find a trail of five “Strong Buys.” This indicates a misalignment between analysts’ interests and actual stock trajectory.

Given this scenario, investors are best served when using these recommendations as a cross-reference to their own research or as a signal to validate other reliable indicators. One such indicator is the Zacks Rank, a trusted tool synonymous with success in predicting stock price movements.

Deciphering Zacks Rank Against ABR

Though both ABR and Zacks Rank scale from 1 to 5, they differ fundamentally. Where ABR is molded by brokerage choices, displaying refined ratings like 1.28, Zacks Rank boasts a more analytical bend with integers from 1 to 5.

Brokerage analysts, enveloped in bias, often skew their recommendations, favoring optimistic narratives over objective assessments. Conversely, Zacks Rank revolves around earnings estimate revisions, clutching insights from empirical data linking price movements with earnings trends.

Zacks Rank preserves balance among stock grades by consistently incorporating current-year earnings estimates in its analysis. Freshness distinguishes Zacks Rank from ABR, as the former quickly responds to changing business dynamics reflected in timely stock price predictions.

Should You Trust Investing in SYM?

While scrutiny of SYMBOTIC INC’s earnings estimate revisions exposes a 40.9% dip in the Zacks Consensus Estimate for the current year to -$0.08, a looming shadow of pessimism descends over analysts. Agreement in lowering EPS estimates underscores a Zacks Rank #4 (Sell) for the entity.

Amidst these revelations, the Buy-equivalent ABR for SYMBOTIC INC should be taken with caution as a storm may be brewing in the near horizon.