Taiwan Semiconductor (TSM) reported quarterly earnings this morning and pleasantly surprised shareholders. The earnings surpassed analysts’ expectations by 8.9% and displayed a remarkable 54.2% year-over-year (YoY) increase. Moreover, revenue exceeded estimates by 1.3% with a substantial 39% YoY growth.

Management’s optimistic outlook further fueled investor confidence, with Wendell Huang, Senior VP, and CFO stating, “Our business in the third quarter was supported by strong smartphone and AI-related demand for our industry-leading 3nm and 5nm technologies.” He added, “Moving into the fourth quarter of 2024, we expect our business to continue to be bolstered by robust demand for our leading-edge process technologies.”

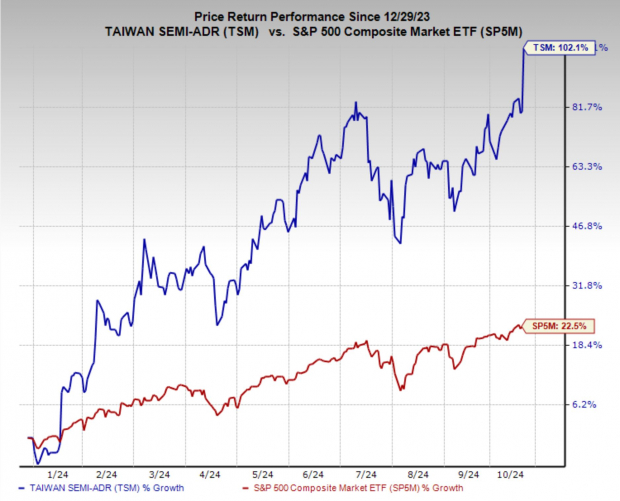

Taiwan Semiconductor stock has been a standout performer, doubling in value over the past 10 months. Its major clients, Nvidia (NVDA) and Apple (AAPL), have contributed to its success, riding the waves of smartphone growth over the last decade and the recent surge in Artificial Intelligence. The company also holds a Zacks Rank #1 (Strong Buy) and sits in the top 1% of the Zacks Industry Rank, which bodes well for its future prospects.

Reviving the AI Trade with TSM Earnings

Artificial intelligence has been a driving force in the stock market’s bull run in recent years, and skeptics have been waiting for a sign of its end. The recent earnings miss by ASML Holdings (ASML) earlier in the week had a negative impact on semiconductor stocks like Nvidia and Broadcom, casting doubts on the sustainability of the AI trend.

However, Taiwan Semiconductor’s latest earnings report seems to have reignited the AI boom. Despite challenges faced by the company and Nvidia during the summer, both stocks have surged to new all-time highs. This resurgence may indicate that the AI sector is picking up momentum once again.

TSM and NVDA: Valuation and Growth Prospects

A notable aspect is that Taiwan Semiconductor and Nvidia continue to trade at reasonable valuations while maintaining strong earnings growth forecasts.

TSM is currently valued at 29.1x forward earnings, slightly above its five-year median of 21.3x. Despite this, when considering its forecasted annual earnings growth rate of 26.5% over the next three to five years, the valuation appears justified for a company of its size.

Nvidia is trading at a one-year forward earnings multiple of 51.2x, lower than its five-year median of 55.7x. With an expected earnings growth rate of 41.7% annually in the next three to five years, the seemingly high earnings multiple is put into perspective.

Anticipating Taiwan Semiconductor’s Stock

Taiwan Semiconductor’s robust earnings performance and positive guidance signal continuous growth as it rides the wave of AI and smartphone demand. The recent results have revitalized confidence in the broader AI sector, especially following concerns triggered by ASML Holdings’ earnings miss.

In conclusion, TSM remains an enticing investment for those who believe in the potential of AI and the sustained demand for semiconductors. With the recent earnings beat and the AI trade showing signs of revival, there may still be more upside potential to be explored.