Challenging the Status Quo in the AI Data Center Race:

While Nvidia enjoys a commanding position in the AI data center market, AMD is not content with being relegated to the shadows. Despite Nvidia’s dominance, AMD is gearing up to make its mark in the rapidly evolving AI landscape.

Investor Confidence in AMD’s Potential:

Renowned investor Victor Dergunov is optimistic about AMD’s future prospects, foreseeing a significant upturn with promising growth opportunities ahead. Dergunov’s confidence stems from AMD’s strategic initiatives, including the annual release of new AI chips and the competitive positioning of the MI350 chip against Nvidia’s Blackwell series.

Unveiling AMD’s Value and Growth Potential:

Dergunov points out that AMD remains attractively valued, trading at a modest multiple compared to next year’s earnings estimates. With the stock trading below its 52-week high, there is a strong possibility of positive surprises in the upcoming earnings report.

Wall Street’s Favorable Outlook:

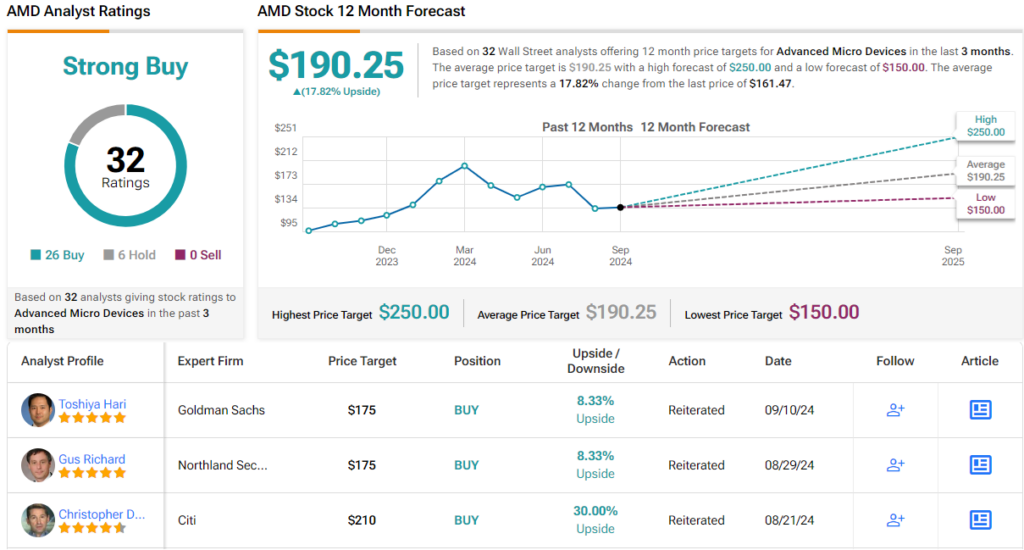

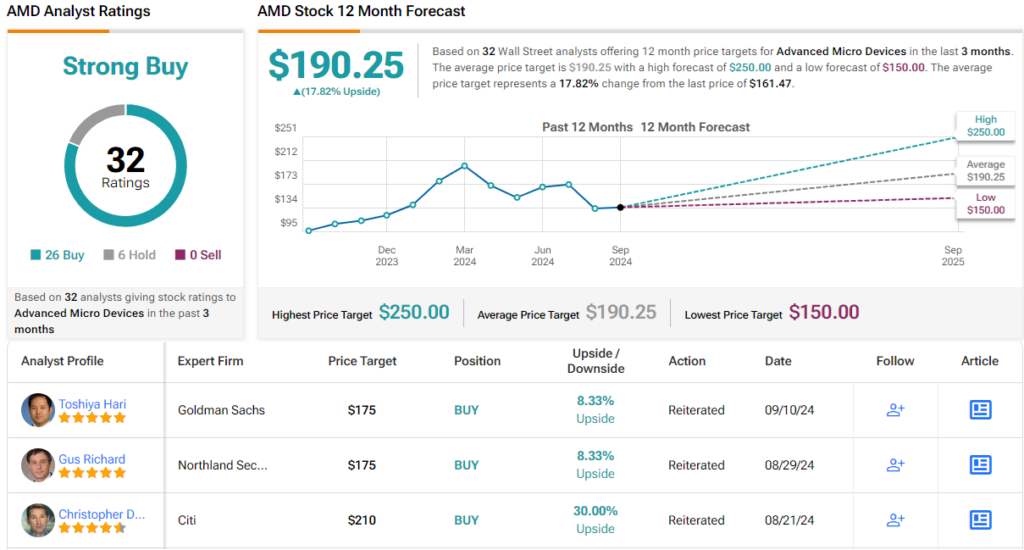

Backing Dergunov’s optimism, Wall Street analysts have demonstrated a bullish sentiment towards AMD, with a majority recommending a Buy rating. The consensus Strong Buy rating is reinforced by a 12-month average price target that suggests a substantial upside potential for investors.

Seizing the Investment Opportunity:

With AMD’s significant potential in the enterprise AI sector gaining recognition, investors are advised to consider the promising outlook of AMD stock as it navigates the competitive landscape and charts a course for growth.