Beta acts as a yardstick for a stock’s volatility in relation to the broader market. A beta above 1.0 indicates higher volatility, while a beta below 1.0 signals the opposite. Low-beta stocks, like Interactive Brokers IBKR, Elevance Health ELV, and Consolidated Edison ED, offer stability to portfolios and serve as a shield during market turbulence.

Combining low-beta stocks with their high-beta counterparts can strike a harmony, balancing the risk profile effectively. These three low-beta stocks not only promise reduced volatility but also boast a favorable Zacks Rank, pointing to positive sentiment from analysts.

Elevance Health: Earnings Beat Consistently

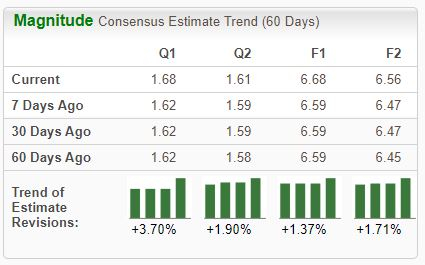

Elevance Health, a Zacks Rank #2 (Buy), supports health benefits for consumers. The company’s earnings trend upwards, often exceeding expectations. Its recent quarterly results pleased investors, showcasing a 1% earnings surprise and consistent revenue growth. Annual earnings expanded by 12.5% and sales saw a modest uptick of 1%.

Image Source: Zacks Investment Research

Interactive Brokers: Outpacing the S&P 500

Interactive Brokers Group, a market maker and broker, sits comfortably at a Zacks Rank #2 (Buy). Analysts have raised their expectations for the company. Over the past two years, the stock has stunningly outperformed the S&P 500, with a remarkable 125% gain compared to the index’s 50% increase. The company reaps benefits from heightened trading activities, propelling its growth.

Image Source: Zacks Investment Research

Consolidated Edison: A Steady Performer

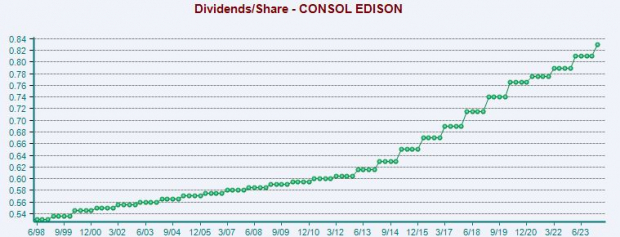

Consolidated Edison, crowned with a Zacks Rank #2 (Buy), operates in regulated and unregulated utility businesses. The company consistently surpasses earnings estimates, with a strong average beat across the last four quarters. With a respectable annual dividend yield of 3.8%, ED is an attractive option for income-focused investors. Moreover, the company maintains a modest 2% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

A Balanced Perspective

Low-beta stocks like IBKR, ELV, and ED offer stability during turbulent market conditions. When paired with high-beta stocks, they create a well-rounded risk profile. For investors seeking a more cautious strategy, these three low-beta stocks are worth considering. In addition to dampening volatility, they hold favorable Zacks Ranks, signifying analyst optimism.