Investors approached the week cautiously, but sentiment shifted after an upbeat announcement by US Federal Reserve Chair Jerome Powell on Friday (August 23).

In a speech at Jackson Hole, Powell hinted at potential interest rate cuts by the Fed.

Crypto markets witnessed a surge, breaking free from a prolonged stalemate in pricing. On the corporate front, Waymo unveiled a new iteration of its self-driving technology, showcasing another victory in a streak of recent successes.

Stay engaged with the latest tech sector developments through the Investing News Network’s comprehensive overview.

1. Positive Market Response to Potential Rate Cuts

At the week’s start, stock markets displayed instability, as the S&P 500 (INDEXSP: .INX) and Nasdaq Composite (INDEXNASDAQ: .IXIC) opened below the previous week’s close on Monday (August 19). However, they rebounded to achieve an eighth consecutive day of gains, mirroring the performance of the S&P/TSX Composite Index (INDEXTSI: OSPTX).

The Russell 2000 Index (INDEXRUSSELL: RUT) surged by 1.1 percent during the day.

The major indexes remained relatively stagnant on Tuesday (August 20) as market participants anticipated fresh inflation data. On Wednesday (August 21), the release of US non-farm payroll benchmark revisions and minutes from July’s Fed meeting occurred. Data from the Bureau of Labor Statistics revealed lower-than-expected job growth between March 2023 and March 2024, despite an expanding labor market.

The Fed meeting minutes unveiled considerations for a rate cut in July due to diminished inflation and heightened unemployment, bolstering expectations for a rate reduction in September. This news propelled market indexes upwards, with the Russell 2000 leading the charge, concluding at 2,170.32 after gaining over 1 percentage point.

Market positivity persisted on Thursday (August 22), with all indexes excluding the S&P/TSX Composite opening above the previous day’s close. Economic data indicated a decline in US manufacturing PMI to 48 in August from 49.6 in July, falling short of projections. In contrast, initial jobless claims increased by 4,000 to 232,000 in the week ending on August 17 compared to the prior week.

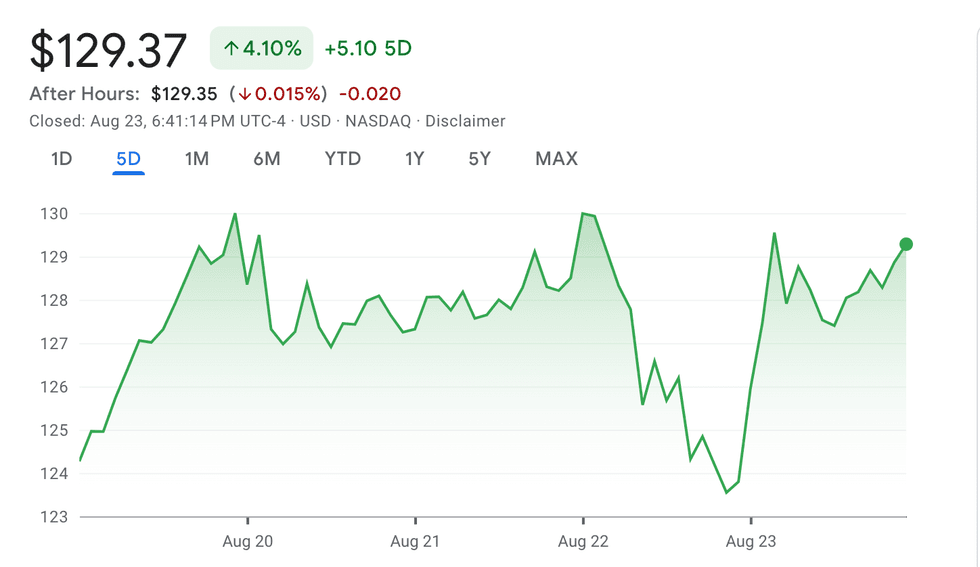

Chart via Google Finance.

NVIDIA performance, August 19 to August 23, 2024.

Stocks experienced a midday retreat on Thursday, with NVIDIA taking the spotlight in the midst of the market flux.

Market Volatility and Political Signaling Impact Tech Sector

Stock Market Reacts to Powell’s Remarks

Amidst a tempestuous week for the tech sector, NVIDIA (NASDAQ:NVDA) witnessed a 4.77 percent decline in its share price, sending waves of concern through the market. However, optimism found its way back on Friday following Federal Reserve Chair, Jerome Powell’s address at the Kansas City Fed’s annual economic conference in Jackson Hole, Wyoming.

Powell’s endorsement of an impending rate cut, although veiled in ambiguity regarding the exact figures, resonated positively with investors. The subsequent surge in all major stock indexes, particularly the Russell 2000’s impressive 3 percent climb, mirrored the renewed optimism. This rally further fueled the ongoing trend of burgeoning interest in mid-cap stocks as a response to the Fed’s upbeat data in recent months. The week concluded on a robust note, with all four major indexes boasting over 1 percent gains, highlighted by the Russell 2000’s remarkable surge of over 3 percent.

Bitcoin Rollercoaster: Peaks and Dips

The realm of cryptocurrencies saw Bitcoin experiencing a rollercoaster ride as its price dipped below US$58,000 in early trading, only to rebound above US$61,000 later in the week. Amidst swift market movements, concerns of increased short bets and potential squeeze arose, reflecting the volatile nature of the crypto landscape.

Although recent data hinted at a slight dip in Bitcoin demand, the continuous accumulation by long-term holders and a notable 14 percent growth in institutional investors holding Bitcoin ETFs showcased a contrasting narrative. Despite warnings of an imminent downturn based on technical indicators, Bitcoin defied the odds towards the end of the week, soaring above US$64,000 post Powell’s address in Jackson Hole, Wyoming.

Political Omissions and Crypto Speculations

As Democrats revealed their 2024 Platform ahead of the National Convention, an unexpected silence on Vice President Kamala Harris’s stance on cryptocurrency and web3 infrastructure raised eyebrows in the crypto community. Amidst speculations of Harris potentially championing the industry compared to the current administration, her ambiguity on decentralized finance regulations and taxation remained a point of interest.

The platform’s mention of “Biden’s second term” added a layer of intrigue, hinting at potential shifts in cryptocurrency policies in the future. With uncertainties looming, the tech market braced for possible shifts in the political winds that could alter the landscape for blockchain technologies and digital assets.

The Financial Frontier Unveiled: A Dive into Emerging Trends

Democratic National Convention Steers Towards Crypto Realm

In the electric atmosphere preceding President Joe Biden’s swift exit from the 2024 presidential race, the spotlight has shifted to Vice President Kamala Harris and her burgeoning stance on cryptocurrency and web3 infrastructure. Brian Nelson, the campaign’s senior policy adviser, hinted at Harris championing measures to foster the growth of emerging technologies.

The political pendulum swung post-Harris’ takeover, with Republican nominee Donald Trump embracing Bitcoin, and the GOP gaining favor with crypto-centric voters. The dynamics of the crypto horse race have seen Harris and Trump vying for supremacy on the crypto-betting platform Polymarket. Recent fluctuations in the odds saw Trump surge ahead, dethroning Harris.

Crypto analysis by Decrypt points to the Democratic Party’s ambiguous platform on cryptocurrencies being a contributing factor to Trump’s ascendancy over Harris, setting the stage for a riveting battle for crypto enthusiasts’ votes.

Waymo’s Triumph with 6th Generation Self-Driving Technology

Waymo, under Alphabet’s wing, unveiled its revolutionary 6th Generation Waymo Driver technology, promising enhanced capabilities and cost efficiency. This cutting-edge system boasts a remarkable sight range of 500 meters, enabling navigation through challenging weather conditions with finesse.

Celebrating a milestone, Waymo’s CEO Tekedra Mawakana revealed a surge in Waymo One’s robotaxi service, doubling the weekly rides to 100,000. The fleet’s backbone comprises Geely Zeekr electric vehicles, powered by the innovative Waymo Driver, signaling a new era in self-driving technology.

Waymo’s journey from a nascent self-driving project in 2009 to a commercial behemoth across Texas, Arizona, and California, culminating in a pivotal partnership with Uber in May 2023, highlights the tech giant’s meteoric rise in the autonomous driving sphere.

AMD’s Strategic Leap into Artificial Intelligence Territory

Advanced Micro Devices (AMD) made waves with its acquisition announcement of ZT Systems, a stalwart in server and network equipment development, aiming to bolster its AI capabilities in the data center domain. AMD’s visionary Chair and CEO Dr. Lisa Su underscored the acquisition’s pivotal role in fortifying the company’s AI leadership, essential for deploying scalable solutions across cloud and enterprise segments.

The acquisition, valued at a substantial US$4.9 billion, underscores AMD’s commitment to carving a niche in the burgeoning AI landscape. The stock market’s resounding approval was evident in AMD’s shares soaring by 4.66 percent following the announcement, reaching a peak valuation of US$161.57 during Tuesday’s trading session.