Amazon.com, Inc. AMZN sprung to life during a lackluster Wall Street session, edging over 1% higher in late afternoon trades. The e-commerce behemoth’s upsurge was fueled by news of a strategic partnership with chipmaker Intel Corp. INTC, announced at the week’s commencement.

Recent reports by Benzinga’s Erica Kollmann reveal Amazon’s unveiling, post-market close, of a collaboration with Intel to craft an artificial-intelligence fabric chip for Amazon Web Services (AWS). This initiative marks an extension of a longstanding partnership between AWS and Intel, spanning over 18 years.

Adding to the buzz around AMZN stock, Amazon declared the return of its pre-holiday sale bonanza, Prime Big Deal Days, slated for October 8 and 9. Amid ripples of concern over the economy’s stability post a lackluster U.S. jobs report, the sale event aims to shore up confidence in Amazon and the broader consumer discretionary sector.

However, Amazon waded into tumultuous waters as its stocks wobbled following an announcement that remote work privileges will cease next year, mandating a full-time office return for all employees under CEO Andy Jassy’s directive from January. Additionally, a restructuring in management ranks was disclosed.

Yet, inflationary pressures loom as a significant concern. Post the pandemic surge in online shopping for safety and convenience, the pinch of soaring prices appears to dampen discretionary spending, casting shadows over key financial indicators such as the Prime Big Deal Days extravaganza.

The Direxion ETFs: Seizing Contrasting Market Tides

Within this turbulent market landscape, Direxion offers ripe trading avenues through its exchange-traded funds. Investors upbeat on Amazon’s resilience amidst challenges may eye the Direxion Daily AMZN Bull 2X Shares AMZU. Conversely, those anticipating a downtrend may explore opportunities with the Direxion Daily AMZN Bear 1X Shares AMZD.

It’s worth noting that both ETFs are ideally suited for short-term plays, not intended for prolonged holdings. The dynamics of leveraged funds or an inverse ETF like AMZD can evoke performance divergences due to daily compounding of risks, akin to a mechanical wristwatch presenting subtle time drift over extended wear.

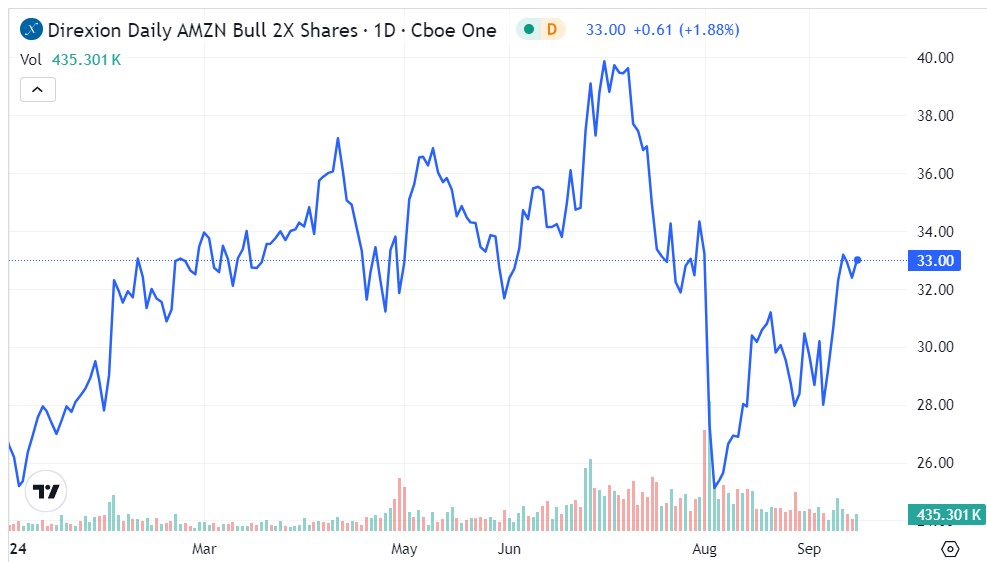

The AMZU ETF: A Bright Performer

Direxion’s 2X-leverage Amazon fund has gleamed as a standout performer this year, steering a remarkable 24% uptick since January’s outset.

- From a closing nadir of $25.12 on August 5, AMZU staged an impressive rebound, notching over 7% uplift in the last five trading sessions.

- Nevertheless, the fund seems to grapple at the $33 threshold, echoing a former support level. Bulls must power past this milestone with tenacity given its pivotal significance.

The AMZD ETF: Navigating Troubled Waters

In a contrasting trajectory, as AMZN stock sails steadily amid broader headwinds, AMZD faced a somber 21% decline since 2021 debut.

- Despite a robust August commencement, AMZD dipped below its 200-day moving average, subsequently sliding beneath the 50 DMA amidst escalating volatility.

- Anchoring around a support frontier near $14, AMZD’s resilience under unfavorable news could propel the inverse fund higher, warranting close monitoring.

Featured photo by Preis_King from Pixabay.