An unexpected slip by semiconductor equipment specialist ASML Holding N.V. penalized the broader technology sector, with the Nasdaq index taking a 1% hit on Tuesday. ASML’s premature release of its third-quarter earnings report sent shockwaves through the computer chip world.

ASML’s revised 2025 net sales guidance range of 30 billion euros to 35 billion euros ($32.7 billion to $38.2 billion), a downgrade from the prior estimate, was a real eye-opener, signaling caution ahead.

Despite a hopeful outlook regarding artificial intelligence, other segments are struggling. ASML’s CEO Christophe Fouquet noted that the recovery is slower than expected, dampening customer enthusiasm.

To compound matters, ASML’s total net sales projection for 2025 shrank to the lower half of its earlier forecast range. This development triggered a flurry of bearish activity in the options market for ASML stock.

Moving beyond the ASML saga, investors are eyeing opportunities in Direxion’s leveraged exchange-traded funds as tech sector turmoil persists. In particular, Direxion’s Daily Semiconductor Bull 3X Shares (SOXL) and Daily Semiconductor Bear 3X Shares (SOXS) have caught the attention of traders seeking high risk and reward.

These funds aim to deliver daily investment results that correspond to 300% (or 300% of the inverse) of the NYSE Semiconductor Index but are designed for short-term holdings given their 3X leverage.

The compounding impact of leverage, especially for the inverse SOXS, is drastic, underlining the need for disciplined trading and timely exits.

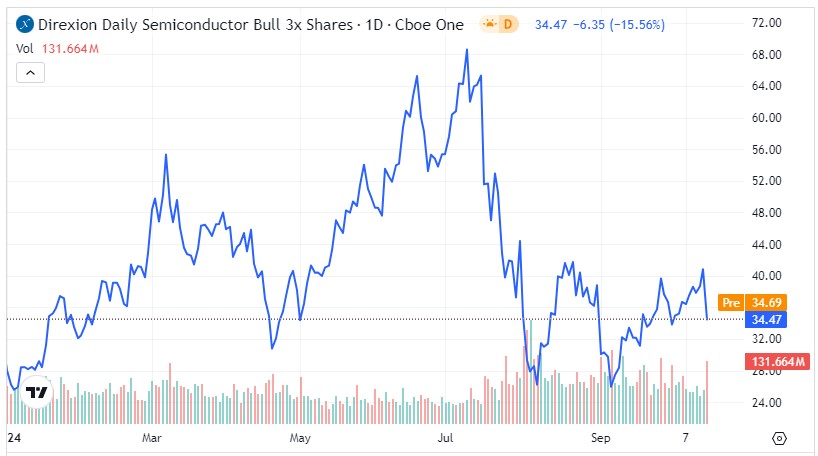

Despite a positive performance earlier this year, SOXL’s extreme leverage resulted in modest gains. The recent ASML-induced dip drove its price below the 50-day moving average, putting it in a precarious position.

- Following a surge in early July, SOXL experienced a sharp decline in early August, followed by a phase of choppy consolidation.

- Currently, SOXL is struggling as the ASML disclosure pushed its unit price under key technical levels.

Conversely, SOXS has been bleeding red ink, losing over 63% year-to-date amid the tech sector’s strength. The fund’s downtrend persists, although Tuesday’s disclosure lifted it nearly 18%, injecting a dose of optimism.

- SOXS continues to face challenges breaking the pattern of lower lows.

- Despite its overall poor performance, the recent disclosure sparked a notable rebound in the 3X bear fund.

Market News and Data brought to you by Benzinga APIs