In the vibrant arena of Wall Street, electric vehicle (EV) frontrunner Tesla (TSLA) stands as a striking emblem of the bull/bear standoff, eagerly awaited to announce its earnings post-market closure. The narrative around Tesla’s stock oscillates depending on the observer’s horizon, a rollercoaster charted across time. Since its public debut in 2010, Tesla stock has ignited a blazing ascent of 19,500%, illustrating a vivid tale of long-term gains. Yet, turbulence rattled its trajectory from 2021 onwards, with the current trading price lingering around ~$250, a palpable distance from its split-adjusted pinnacle of $414.50. Cautiously, the stock appears reinvigorated, surging nearly 40% over the last month, piercing through its crucial 200-day moving average – a pivotal barometer of trends.

In recent years, Tesla found itself amid the underachievers within “The Magnificent 7”, a cohort inclusive of tech behemoths like Nvidia (NVDA) and Microsoft (MSFT). Delving into tonight’s earnings release, we dissect the pivotal elements to monitor.

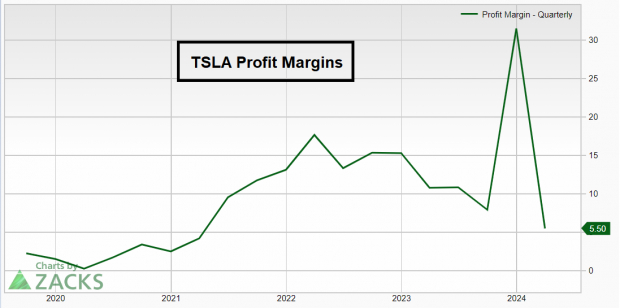

Margins: Stability or Continued Descent?

Skyrocketing interest rates emerged as a formidable obstacle for Tesla. In a bid to cleanse inventory, CEO Elon Musk and the Tesla cohort resorted to hefty price reductions and incentives, fostering higher sales figures.

Image Source: Zacks Investment Research

Attentive investors should keenly await insights regarding the company’s pricing strategy moving forward. The CME FedWatch Tool, a gauge assigning probabilities to monetary policies, hints at a pronounced likelihood of Jerome Powell and the Fed implementing rate cuts come September. In essence, TSLA might soon glimpse the beacon at the end of the interest rate tunnel.

Robotaxi Developments

Musk’s resolute commitment to molding Tesla into the vanguard of the autonomous robotaxi domain is vivid. While TSLA witnessed an 8% dip on July 11th postponing the highly-awaited robotaxi reveal, students of Walter Isaacson’s biographical work recognize that far-fetched deadlines align with the visionary CEO Elon Musk’s playbook.

Market Expectations & Market Response

Three consecutive quarters found Tesla falling short of Zacks Consensus Estimates. However, last quarter bore witness to a share surge, as investors wagered that the worst was already discounted in the stock. An upward shift following unmet expectations, akin to Tesla’s scenario, often telegraphs optimism. Yet, the forthcoming quarter will unfold more evidence.

Image Source: Zacks Investment Research

Cybertruck Prospects

The extravagant Cybertruck SUV journey commenced in late 2023. Will this eccentric marvel captivate the masses or languish in obscurity?

Competitive Landscape in Asia

Musk’s echo on the rise of formidable Chinese EV competitors like Nio (NIO) and BYD Co. (BYDDF) protrudes. Can Tesla navigate this burgeoning competitive milieu brimming with budget-friendly Chinese alternatives? Tesla stakeholders should seek insights on potential rivalry from hybrid vehicle sectors.

Final Analysis

The anticipated plunge in interest rates is poised to catalyze Tesla’s trajectory towards a brighter 2025. Investors, however, are advised to closely monitor Tesla’s EPS performance for firmer confirmation of a stock resurgence.