Owning Tesla shares can feel like riding a rollercoaster through an earthquake. The stock’s wild swings test even the sturdiest investor’s resolve. In 2024, Tesla’s shares initially plunged and, despite a recent spike, they still languish 25% below the year’s starting point.

The question is – does Tesla’s recent surge signify the dawn of a bullish era for the company? Or is it merely an exaggerated reaction in a volatile market?

Challenges in Tesla’s Q1 Performance

Assessing Tesla necessitates a forward-looking perspective. Investors often gauge the company not merely by its present state but also by its future endeavors and product launches.

Examining Tesla’s first-quarter results doesn’t inspire much optimism.

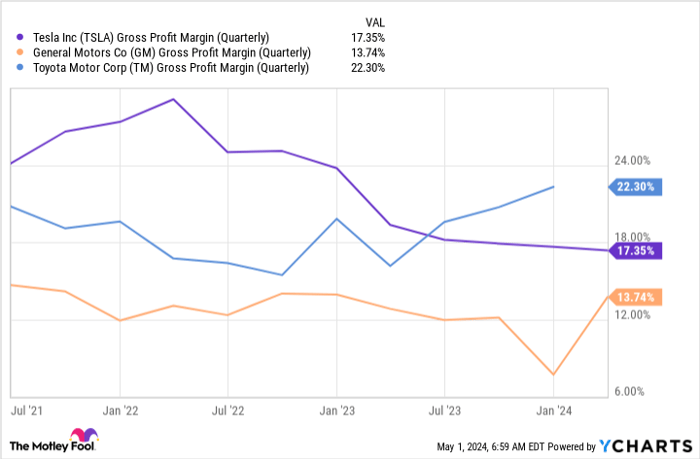

Year-over-year revenue shrunk by 9%, while the gross margin contracted from 19.3% to 17.4%. This decline paints a bleak picture, especially considering Tesla’s historical dominance in gross margins among auto manufacturers. Now, it’s just another player in the arena.

Further exacerbating concerns, Tesla’s earnings per share (EPS) plummeted by 53% to $0.34 due to declining revenue and shrinking margins. The most alarming metric is Tesla’s negative free cash flow, indicating that the company is hemorrhaging cash to sustain its operations. These figures understandably sent shivers down the spines of many investors.

Excitement Sparked by New Ventures

Enthusiastic Tesla investors dream of an all-electric vehicle ecosystem with Tesla reigning supreme. This vision encompasses innovative technologies such as automated taxis and semitrucks, albeit still on the drawing board.

Mark your calendars for August when Tesla unveils the Cybercab, its maiden robotaxi. The success of this launch is crucial, as Tesla’s valuation hinges considerably on its foray into passenger and goods transportation.

Moreover, Tesla teased updates to its product launch roadmap. Initially slated for the second half of 2025, the new vehicle lineup – including a more affordable model – might now hit the markets as early as the first half of 2025 or possibly by year-end. This budget-friendly electric vehicle could attract a broader audience, particularly urban commuters. The narrative of Tesla’s boundless potential is taking shape, but current operational challenges persist.

So, should you seize this opportunity? Consider jumping on board only if you’re a fervent believer in Tesla’s mission. Tesla’s ambitious vision is undeniably captivating, yet its financial underpinnings could crumble if the transition to an all-electric ecosystem faces resistance, even with successful product launches.

Exploring New Investment Avenues

When the seasoned analysts at the Motley Fool voice a stock recommendation, it’s wise to lend an ear. Their newsletter, the Motley Fool Stock Advisor, has consistently outperformed the market for over two decades.*

They recently disclosed their top picks for investors to explore. While Tesla made the cut, there are nine other stocks flying under the radar that merit attention.

*Stock Advisor returns as of May 6, 2024

**Keithen Drury holds positions in Tesla. The Motley Fool holds positions in and recommends Tesla and Uber Technologies. The Motley Fool endorses General Motors and recommends long January 2025 $25 calls on General Motors. For more information, check out the full disclosure policy.