Previewing Tesla’s Q2 Earnings

Tesla’s second-quarter journey is fast approaching, with investors anxiously awaiting the report amidst a tumultuous year for the electric vehicle giant. While a recent uptick in YTD performance provided a glimmer of hope, Tesla’s Q2 revenues are forecasted to dip by 0.9% YoY. This decline comes on the heels of consecutive drops in vehicle deliveries, marking a significant shift for the company.

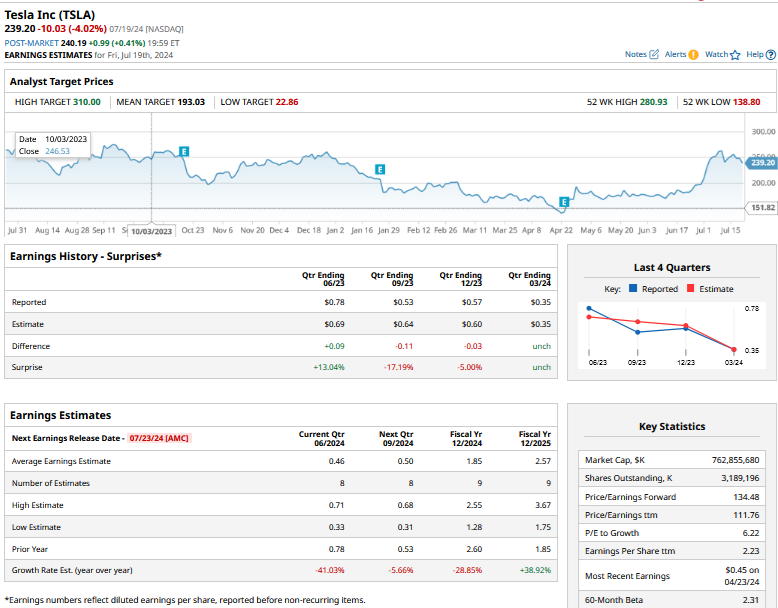

On the earnings front, analysts predict a 41% YoY decrease in Tesla’s earnings per share (EPS) to $0.46. Multiple price cuts on vehicles in recent years have placed pressure on the company’s once stellar margins, reflecting broader challenges within the industry.

Key Factors to Watch

As Tesla gears up to reveal its Q2 performance, investors are keeping a watchful eye on several critical areas:

- Delivery Projections: Market observers are keen to hear Tesla’s outlook on 2024 deliveries following a challenging first half. Optimism from Elon Musk during the Q1 earnings call will be put to the test.

- China Operations: Competition in the Chinese market, particularly from BYD, remains a focal point. Analysts await insights into Tesla’s recovery in China and potential developments with Baidu.

- Product Updates: Expectations surrounding new models and a Model Y refresh are in the spotlight. Tesla’s plans to introduce a more affordable model and enhance the Model Y could shape its future trajectory.

- Robotaxi Timeline: Tesla’s progress towards achieving full autonomy, including the robotaxi initiative, will be under scrutiny. Delays in unveiling key features have raised questions about the company’s execution.

Evaluating Tesla’s Stock Outlook

Analysts’ sentiments on Tesla’s prospects are mixed, reflecting the uncertainties surrounding the company’s trajectory. While some anticipate sustained margin pressures, others foresee positive outcomes, driven by stable pricing and robust revenues.

For investors assessing Tesla’s stock, the company must demonstrate its ability to balance delivery expansion with margin preservation amidst intense market competition. Additionally, Tesla’s advancements in artificial intelligence (AI) will play a pivotal role in shaping its valuation moving forward.

In the realm of AI, figures like Cathie Wood and Dan Ives advocate for Tesla’s potential as a dominant player. However, concerns persist regarding delays in key initiatives, such as full autonomy and robotaxi implementation. As Tesla navigates this evolving landscape, the market eagerly anticipates tangible progress in its technological endeavors.

Despite lingering challenges, Tesla’s resilience and past achievements underline its enduring appeal to investors. While post-earnings fluctuations may not elicit immediate excitement, any significant downturn in stock value could present a compelling entry point for prospective buyers.