The stock of electric vehicle maker Tesla (TSLA) just got a big price target boost from a leading analyst at Jefferies Financial Group (JEF).

Analyst Philippe Houchois has raised his price target on TSLA stock to $300 from $195, an increase of 54%. Yet despite the big increase, Houchois maintained a Hold rating on Tesla stock. Even more unusual, he suggested in a note to clients that Tesla use the current post-election rally to raise equity.

Raising equity would require Tesla to issue more stock, which would dilute existing shareholders and is generally frowned upon by analysts and investors. However, Houchois notes that about half of Tesla’s current net cash position of $26 billion includes capital that was last raised in 2020.

Capitalizing on TSLA Stock Rally

In his note, Houchois said that, “In the current environment, raising equity could probably be done ‘at market’ like in 2020,” and would provide Tesla with an edge “as investment needs and competition step up across multiple business units…”

Tesla’s stock has risen about 25% since Donald Trump won the U.S. presidential election on November 5. The rally has lifted Tesla’s market capitalization to $1 trillion. However, at $313 per share, Tesla’s share price is now above the price targets of most analysts, including Houchois’ upwardly revised target.

While TSLA stock may pullback from its current level, Houchois continues to expect the share price to rise over the long-term, saying in his note that, “Assuming markets remain competitive, deregulation raises the growth path” for Tesla’s stock.

Is TSLA Stock a Buy?

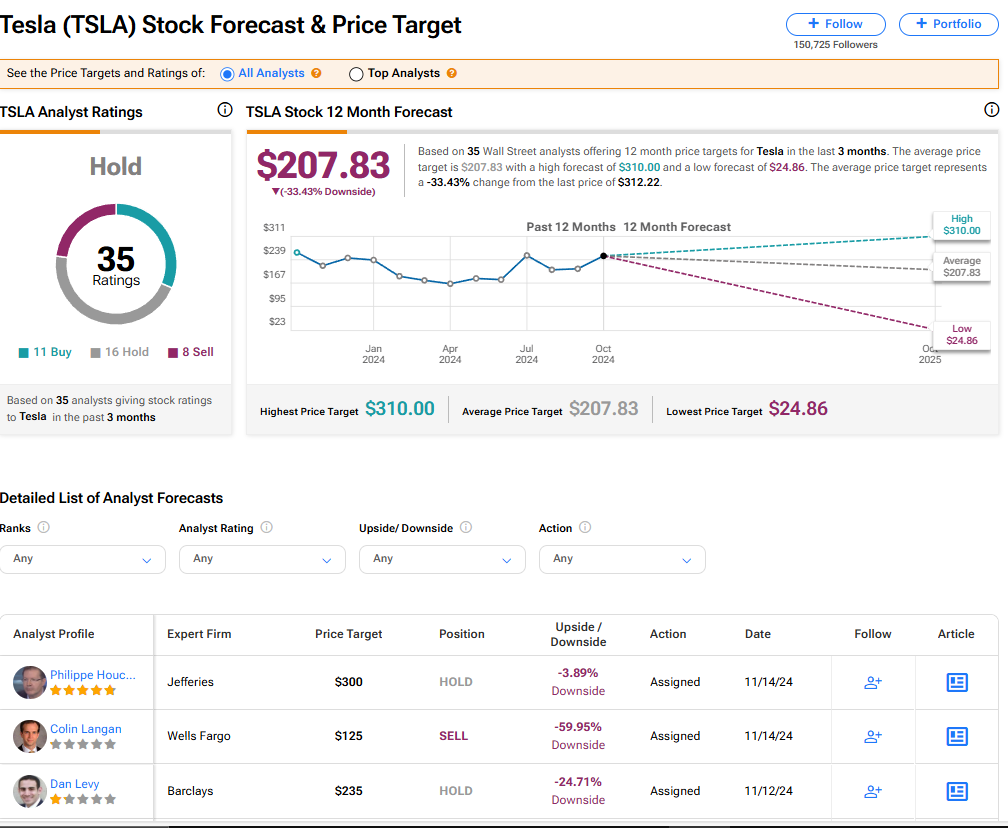

Tesla stock currently has a consensus Hold rating among 35 Wall Street analysts. That rating is based on 11 Buy, 16 Hold, and eight Sell recommendations made in the last three months. The average TSLA price target of $207.83 implies 33.43% downside risk from current levels.