Despite the recent gloom surrounding Tesla’s second-quarter results, there are shining beacons of hope amidst the apparent storm clouds. Let’s delve into the depths of Tesla’s financial seas and uncover the pearls waiting to be discovered.

Looking Beyond the Initial Numbers

While the market may have donned a frown upon Tesla’s Q2 earnings unveiling, a closer inspection unveils a tapestry with more color than initially perceived. The recent quarters might not have dazzled in terms of financial prowess, but the story is not over, nor is the performance as dire as painted.

One of the key highlights was the resilience in gross margins and robust cash flow generation. The threads of Tesla’s pricing strategy are woven skilfully, presenting a canvas yet to be fully appreciated by the discerning eye of the industry.

Unraveling the Financial Threads of Q2

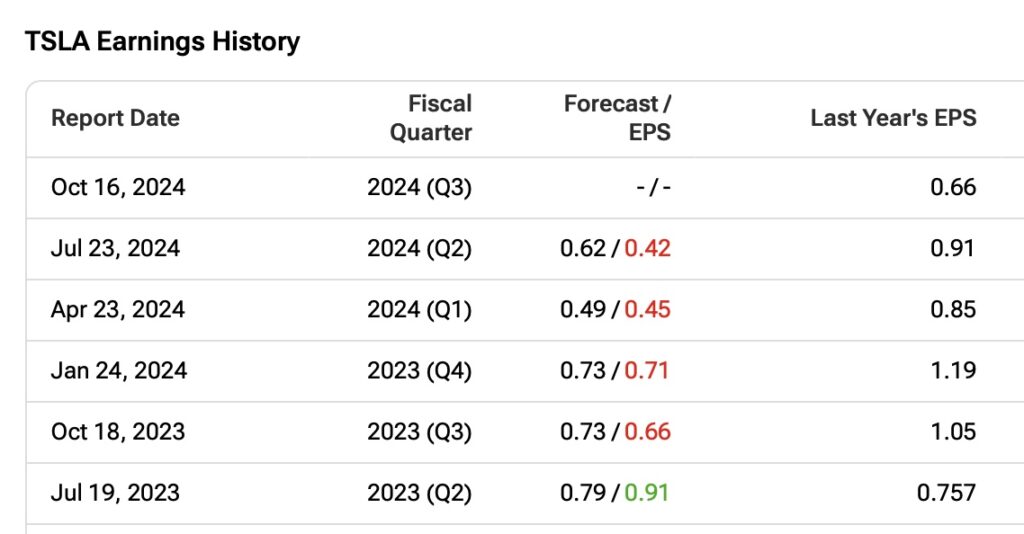

The journey through Tesla’s Q2 financial landscape was marred by the valley of plummeting profitability where net income took a 42% dive from the previous year. Despite this, the slight dip in gross margins to 18% served as a glimmer of hope amidst the darkening skies, taming the downward spiral that threatened to engulf Tesla’s financial foothold.

While Tesla sits atop the profitability hill compared to other electric vehicle contenders, the downward stride in gross margins paints a narrative of caution. Yet, in the tumultuous storm of Q2, the margins managed to weather the tempest, hinting at resilience contrary to all odds.

Revenue reports of $25.5 billion soared above the expectations set by analysts, shining a beacon of light to guide Tesla through the murky waters. However, the undercurrent of automotive revenues flows weak, diverging from the promised surge in vehicle sales and production, resulting instead in a 7% decrease in total automotive revenues year-over-year.

Beneath the surface, Tesla’s pricing maneuvers have orchestrated a symphony of shifting tides, leading to a decline in average selling prices and subsequent revenue woes. The melody of price cuts has sung a somber tune, echoing through the corridors of investor discontent.

Yet, amidst the financial whirlpool, the lighthouse of cash flow generation remains steadfast. While the previous quarter witnessed a descent into the abyss of negative cash flow, Q2 emerged as a phoenix from the flames with a resurrection of solid numbers holding aloft the banner of financial stability.

A Glimpse into Tesla’s Future: A Symphony of Growth

The trajectory of Tesla’s future market dominance may find its melody in a new resonating note as Elon Musk hints at the arrival of a lower-priced model, a silver lining amidst the clouded skies. The symphony of EV demand growth might find its crescendo in this new entrant, harmonizing the discordant echoes of price wars.

As Tesla orchestrates the market dance with lowered prices, the weaker players may stumble from the stage, leaving the floor open for Tesla’s virtuoso performance to shine. The ballet of the EV market may witness a graceful pirouette as Tesla twirls into a position of strength.

A tale as old as time, Tesla’s growth narrative intertwines with the strands of AI, Robotaxi, and robotics, weaving a tapestry rich in potential. Despite skepticism from some quarters, Tesla’s dive into the AI realm stands as an undervalued gem, waiting to be unearthed from the rubble of doubt.

The canvas of Tesla’s AI canvas is a blank slate where the masterpiece of a trillion-dollar entity might find its brush strokes, painting a picture of demand and pricing stability. The past echoes of skepticism may fade as investors champion Tesla’s AI prowess, propelling the company towards the stars.