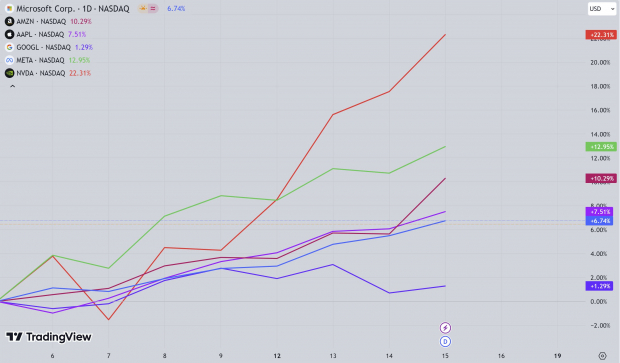

The recent tumult in the market, marked by a sharp correction and intense selling, may have left many investors reeling. However, the subsequent buying spree, resulting in a V-shaped recovery, has been nothing short of awe-inspiring. The rebound has not only been swift but has also unveiled buying opportunities, especially among the elite group known as the Magnificent Seven – comprising some of the largest and best-performing stocks.

Among these titans, Nvidia (NVDA), Meta Platforms (META), and Amazon (AMZN) have emerged as frontrunners in the recent rally. Their rapid gains since the market lows suggest they could lead not only the Magnificent Seven but also the broader market in the foreseeable future.

Image Source: TradingView

Insights into Continued Market Rally

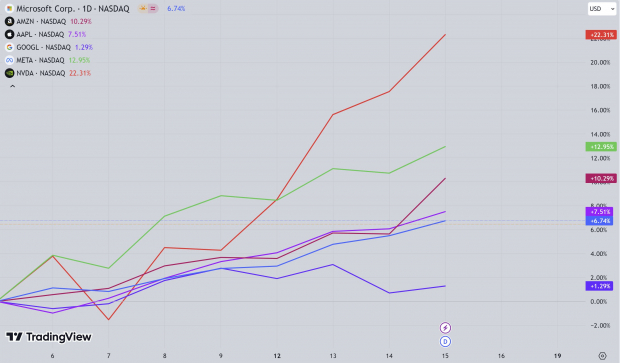

Investing in stocks after a significant run-up may appear daunting, but history often proves that strength attracts further strength. While markets exhibit volatility and intermittent pullbacks, waiting for an opportune moment to enter the market is a prudent strategy. Confidence in buying the dip stems from a favorable economic backdrop, with projections of sustained growth, robust earnings, and anticipated interest rate adjustments favoring market expansion.

Seasonal trends and looming events, such as the upcoming U.S. presidential election, may introduce short-term uncertainty, potentially leading to temporary market dips. However, patient investors can capitalize on such fluctuations, as opportunities for strategic investment decisions are likely to present themselves.

Image Source: EquityClcck

The Growth Story of META, AMZN, and NVDA

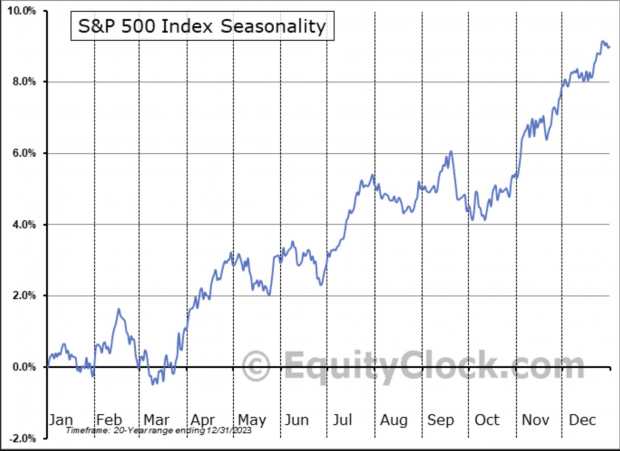

What sets Nvidia, Amazon, and Meta Platforms apart as compelling investment options is their remarkable earnings growth trajectory. Despite carrying a Zacks Rank #3 (Hold) rating, indicative of stable earnings revisions, these companies are forecasted to achieve exceptional annual earnings growth rates: 37.6% for Nvidia, 27.4% for Amazon, and 19% for Meta Platforms over the next few years. In the world of stocks, earnings growth often translates into stock price appreciation, potentially leading to substantial gains for investors.

Firmly positioned at the forefront of pivotal business and technology trends, these companies are driving forces in sectors such as Artificial Intelligence, cloud computing, e-commerce, and digital communities. Their valuations, when compared to historical averages, appear reasonable, signaling potential upside. Meta Platforms, trading at 25.3x, Amazon at 36.7x, and Nvidia at 48.5x are all poised for growth and valuation expansion.

Image Source: Zacks Investment Research

Parting Words

While the recent market dynamics have been exhilarating, the path ahead remains unpredictable. Investors navigating the market’s twists and turns must exercise caution and strategic foresight. Pullbacks, although inevitable, should be viewed as opportunities for astute investors to position themselves in high-caliber stocks like Nvidia, Amazon, and Meta Platforms. By emphasizing risk management and aligning investment decisions with long-term objectives, investors can navigate the market’s capricious nature while striving for optimal returns.