A Legal Showdown

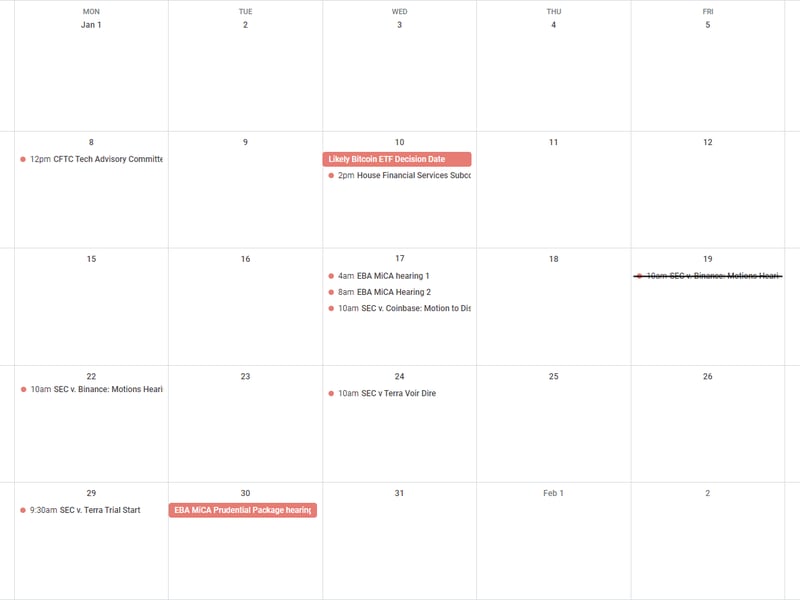

Last summer, the U.S. Securities and Exchange Commission (SEC) brought legal action against major crypto exchanges Coinbase and Binance, arguing that they had facilitated the trading of unregistered securities in the form of various cryptocurrencies. This week, both exchanges found themselves squaring off against the SEC’s legal teams in court as they fought the allegations, contending that the SEC had not presented a compelling case to classify these digital assets as securities.

The Significance

The outcomes of the SEC’s lawsuits against Coinbase, Binance, and Kraken could significantly impact the U.S. crypto industry. Should federal judges affirm the SEC’s stance that certain cryptocurrencies are securities, it would subject issuers and trading platforms to stringent registration and reporting obligations. Conversely, a ruling in favor of the exchanges would provide a substantial green light to a vast segment of the industry, potentially staving off onerous regulatory requirements.

Anatomy of the Dispute

In June 2023, the SEC filed suit against Coinbase and Binance, accusing them of listing digital assets such as solana (SOL), filecoin (FIL), and axie infinity (AXS) without proper registration, deeming them unregistered securities. Despite previous signals from SEC Chair Gary Gensler, the industry reacted with displeasure. Subsequently, various stakeholders, including lawmakers and lobbyists, have submitted amicus briefs in support of the defendants’ motions to dismiss the cases entirely.

Jesse Hamilton previewed Wednesday’s Coinbase hearing, highlighting that a dismissal at this stage is unlikely. Judge Katherine Polk Failla posed tough questions during the hearing, refraining from making a decisive ruling for now. An SEC attorney argued that it was the transactions, rather than the tokens themselves, which constituted securities. Moreover, a hearing in the SEC’s case against Binance was rescheduled due to adverse weather conditions in the Washington, D.C. area.

Simultaneously, the U.S. Supreme Court is deliberating a challenge to the Chevron doctrine, a longstanding precedent affording federal regulatory agencies leeway in interpreting federal laws for rulemaking purposes. Should the doctrine be overturned, regulatory agencies may be less inclined to exploit ambiguous statutes, potentially fueling renewed legislative momentum in Congress to regulate the crypto industry.

These developments have profound implications for the industry, with the potential to shape its trajectory in the coming years.

Other Noteworthy Events

Simultaneously, the European Banking Authority (EBA) held a series of hearings on the Markets in Crypto Assets Regulation (MiCA) and guidelines for preventing illicit crypto activities. Meanwhile, external factors like adverse weather and judicial deliberations have added layers of complexity to an already intricate legal landscape.

The evolving interplay between the SEC, the crypto industry, and the judicial system is set to shape the future of cryptocurrencies and their market regulation.

Looking ahead, the crypto industry is amid a period of uncertainty and transformation. The implications of these legal battles extend far beyond the courtroom, affecting the industry’s long-term regulatory framework.

For inquiries or suggestions on future topics to cover, feel free to reach out via email or on Twitter. Additionally, join the conversation on Telegram to stay updated on the latest developments.

Until next time, keep a close eye on the evolving landscape of cryptocurrency regulation!