The Power of Repeat Revenue

When seeking a growth stock to fortify your retirement portfolio, one must go beyond merely selecting a soaring entity. Qualities that provide stability and longevity must also be considered. This brings us to the standout exemplar of Amazon ((NASDAQ: AMZN)).

A company revered for its consistent growth trajectory and steadfast customer base, Amazon boasts 167 million U.S. Prime members and over 200 million worldwide. A substantial 42% of U.S. members make regular purchases each month, underscoring the company’s robust business model. With a trailing-12-month revenue of $604 billion as of June 30, 2024, Amazon’s success is further bolstered by its thriving Prime subscription service and online store, generating $237 billion and $42 billion, respectively, in the past year. The strategic expansion of same-day and grocery delivery services to Prime members demonstrates Amazon’s potential for enhanced purchase frequency and revenue growth.

Moreover, Amazon’s revenue stream receives a significant boost from Amazon Web Services (AWS), the leading global cloud computing provider, serving millions of customers across 190 countries. Despite contributing less than 20% of the company’s total revenue, AWS stands out as the most profitable segment, accounting for approximately two-thirds of Amazon’s operating profit.

Unveiling Vast Growth Horizons

Amazon’s runway for expansion stretches across the expansive online retail and cloud computing realms, promising enduring growth prospects.

The e-commerce sector, predicted to hit $6 trillion in 2024 by eMarketer, is projected to burgeon to $8 trillion by 2028, positioning Amazon favorably amidst an expanding market. On the front of AWS, the potential for shareholder returns appears even more promising. With AWS revenue soaring 19% annually to reach $98 billion in the trailing 12 months, the widespread transition of enterprise data from on-premises servers to cloud platforms offers a lucrative opportunity. AWS is poised to emerge as Amazon’s principal revenue stream, fueled by its high profit margins, which could substantially elevate Amazon’s profitability and propel its stock to new heights.

The Compelling Upside Potential

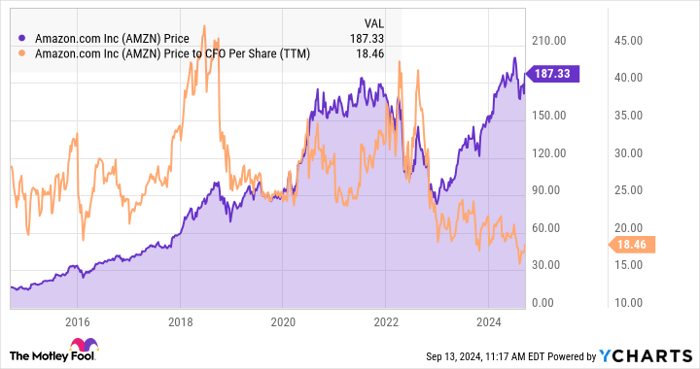

Amazon’s valuation often appears lofty in terms of price-to-earnings ratio due to its focus on maximizing long-term cash flows rather than short-term earnings per share.

Assessing Amazon’s price-to-cash-flow ratio, the stock is currently trading at a multiple of 18.4, reflecting a conservative valuation compared to the last decade. Despite doubling in value over the past five years, Amazon’s current P/CFO ratio is at its lowest in over a decade, underscoring a potential buying opportunity. With Amazon’s cash from operations tripling to $107 billion in the past five years, the stock mirrors this growth trajectory. As Amazon continues to capitalize on e-commerce and cloud services, its cash flows are poised for further expansion, hinting at an optimistic path for its share price.