Amidst the financial markets, a rosy financial guidance glittered with opulent promises often sparks euphoria – inundating the streets with investors in an ardent quest to capitalize on the upswing. When corporations fervently bestow optimistic financial roadmaps, it’s akin to basking in the golden sunshine of success which bolsters shareholders’ confidence.

During the ongoing earnings season, three leading entities – Ford F, Uber Technologies UBER, and Cigna CI – have tantalizingly revealed buoyant financial forecasts. Subsequently, the stock prices ascended magnificently in the wake of these propitious disclosures.

Ford Motor Company

Supremo in the automotive realm, Ford veered past the Zacks Consensus EPS estimate by a whopping 140%, and its sales galloped 14% above the anticipated figures. Although the profits faltered in comparison to the previous year, the revenue surged victoriously. For FY24, Ford envisages full-year adjusted EBIT within the $10 – $12 billion stratum, coupled with $6 – $7 billion in adjusted free cash flow. The resplendent results and a sanguine outlook illuminated the shares, inculcating glee amidst the investors.

Image Source: Zacks Investment Research

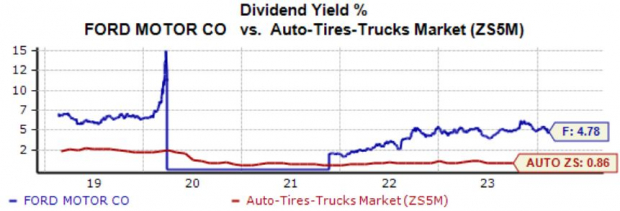

Income-centric denizens might find Ford shares enchanting, as they presently bear a substantial annual yield of 4.8%, complemented by a sustainable payout ratio of 30% from its earnings. As vividly depicted below, the current yield substantially eclipses the Zacks Autos sector average of a meager 0.9%.

Image Source: Zacks Investment Research

Uber Technologies, Inc.

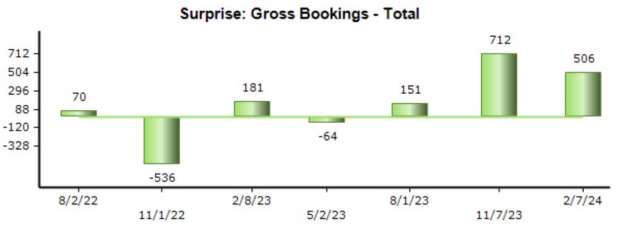

Exceeding the Zacks Consensus EPS estimate by over 300% and outstripping sales by 2% in comparison to estimates, Uber flaunts a Zacks Rank #2 (Buy), while earnings estimates hover loftily. Following the divulgence, Uber anticipates Gross Bookings for Q1 2024 to hover around $37 – $38.5 billion, accompanied by an adjusted EBITDA of $1.26 – $1.34 million. The chronicles show Uber perennially surpassing our consensus estimations concerning Gross Bookings, with the latest triumph amounting to a handsome $500 million.

Image Source: Zacks Investment Research

The stock remains an enticing prospect for growth enthusiasts, with both earnings and revenue for the current fiscal year (FY24) poised to leap by 28% and 15%, respectively. Glancing into the future, the prospects for FY25 wink at an additional 65% surge in earnings alongside a 16% upswing in sales.

Uber flaunts a Style Score of ‘A’ for Growth.

Cigna Group

Cigna radiated unparalleled brilliance in its quarter, surpassing our consensus EPS estimate by 4% and registering a 5% titanic achievement in revenue. The corporation subsequently bolstered its FY24 adjusted EPS forecast, and augmented its quarterly payout by a staggering 14%, emblematic of its wieldy operations.

The shares could allure value aficionados, with the prevailing 11.9X forward earnings multiple (F1) perched comfortably below the five-year apogees of 14.7X and marginally surpassing the five-year median. The stock is bedecked with a Style Score of ‘A’ for Value.

Image Source: Zacks Investment Research

Bottom Line

Positive guidance emerges as one of the most reassuring pronouncements that a shareholder could possibly revel in, bestowing confidence in the overarching long-term panorama.

Evidently, the recent positive outlooks from the triumvirate of companies – Ford F, Uber Technologies UBER, and Cigna CI – have ignited a symphony of optimism.