Earnings season is a riveting adventure for investors, a time when the curtain is lifted on companies’ clandestine workings.

The big banks have kickstarted the momentum, setting the stage for a flurry of upcoming releases.

Unveiling Looming Surprises

Among the contenders for positive revelations are NVIDIA NVDA, Coinbase COIN, and Applied Materials AMAT, each flaunting a gleaming Earnings ESP Score.

But what does the landscape of expectations look like as we approach the imminent disclosures? Let’s delve deeper.

NVIDIA: A Data Center Dynamo

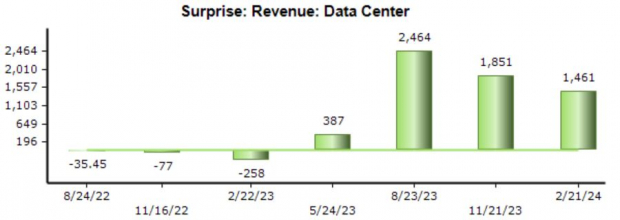

NVIDIA’s Data Center segment has consistently shone bright in its quarterly unveilings, propelled by robust sales of AI chips. The latest period saw NVIDIA’s Data Center amass a staggering $18.4 billion – yet another quarterly pinnacle, marking a meteoric 410% surge year-over-year.

The company has been routinely surpassing consensus forecasts, with the most recent feat surpassing expectations by a substantial $1.4 billion.

Expectations Soar

Growth continues to loom large for NVIDIA, with a Zacks Consensus EPS estimate of $5.48 hinting at a monumental 400% year-over-year leap in sales climbing nearly 240%. The company’s revenue trajectory reflects a pronounced acceleration, as depicted in the quarterly chart.

Coinbase: Riding the Crypto Wave

As the largest U.S. cryptocurrency exchange, Coinbase’s earnings outlook has brightened amid the crypto resurgence. Analysts are notably bullish on the company’s prospects, with earnings forecasts scaling new heights.

Analysts predict significant growth for Coinbase, with a Zacks Consensus EPS estimate of $0.89 pointing towards an almost 500% surge from the previous year. The consensus revenue estimate stands tall at $1.2 billion, marking a 55% upswing from the comparable period.

Upbeat Projections for Applied Materials

Applied Materials, the provider of equipment and services to the semiconductor industry, has garnered bullish sentiments from analysts, earning a coveted Zacks Rank #1 (Strong Buy).

The company has consistently outperformed expectations, exceeding the Zacks Consensus EPS estimate by an average of 9.4% in its last four disclosures. Share prices have enjoyed a post-earnings glow, as illustrated below.

In Conclusion

As earnings season unfolds, a myriad of companies are poised to reveal their quarterly performances in the days to come.

And in the realm of positive revelations, the trio of NVIDIA NVDA, Coinbase COIN, and Applied Materials AMAT stand tall as potential bearers of good news.

With a positive Earnings ESP Score and a promising Zacks Rank, optimism among analysts sets a buoyant backdrop.

Infrastructure Stock Boom to Sweep America

A monumental effort to revamp the ailing U.S. infrastructure is on the horizon – a bipartisan, imperative, and inexorable initiative. Trillions will be injected, paving the path for extraordinary fortunes.

The burning question remains – will you spot the right stocks early on, when their growth potential is at its zenith?

Zacks has unveiled a Special Report to aid in this pursuit, now available for free. Explore five standout companies poised to reap the rewards of the colossal infrastructure renovation and transformation.