- The stock market often catapults higher when companies surpass earnings expectations, igniting a fervent rally.

- As the earnings season looms closer, businesses gear up to unveil stellar financial performances that could send shockwaves through the market.

- Let’s delve into four stocks positioned for potential greatness and examine whether they present a golden opportunity at their current valuation.

Corporate earnings wield immense power, propelling stock markets to new heights, and the upcoming earnings season appears poised to dazzle. Numerous companies are primed to not only meet but exceed analyst projections, setting the stage for significant stock price movements.

The trend of positive earnings surprises often triggers a surge in demand for a company’s shares. Today, we will harness the analytical prowess of InvestingPro to pinpoint stocks brimming with the potential to outshine forecasts this quarter.

By utilizing key data and insights furnished by InvestingPro, we aim to unearth companies on the cusp of impressing investors and possibly catapulting their stock prices to unprecedented heights.

1. Super Micro Computer

Super Micro Computer (NASDAQ:) specializes in servers, network devices, management software, and high-end workstations. Established in 1993, the company calls San Jose, California, home.

Having joined the esteemed S&P 500 cadre in March, superseding Whirlpool (NYSE:), Super Micro Computer now eyes potential entry into the in September, displacing Walgreens (NASDAQ:), which bid adieu to the in February.

Despite holding the smallest market capitalization among Nasdaq 100 constituents, Super Micro Computer falls short of meeting the index’s requirement that each member represents at least 0.1% of the total market value.

Scheduled to unveil its earnings on August 6, the company anticipates a staggering 146.90% revenue surge for the quarter, the highest among all companies.

Further emphasizing its robust performance outlook is an anticipated 158.20% increase in earnings per share.

Super Micro’s recent triumphs and dominant market presence in the AI server domain indicate it is primed to sustain its competitive edge.

With a beta of 1.23, the stock exhibits heightened volatility.

Industry experts have pegged its average price target at $1032.

2. Western Digital

Western Digital Corporation (NASDAQ:) specializes in manufacturing, developing, and vending data storage devices and solutions. Originating in 1970, the organization finds its headquarters in San Jose, California.

The company will publicize its financial reports on July 31, with expectations of a 234.48% surge in earnings per share.

In the ever-evolving data storage landscape, Western Digital emerges as a prominent player, offering a diverse product lineup tailored to different market segments.

Amidst an industry witnessing a cyclical rebound, the company’s exposure to the hard disk drive (HDD) markets positions it to potentially capitalize on the upswing.

Boasting a beta of 1.44, the stock outstrips the S&P 500 in terms of volatility.

Market projections indicate an average price target of approximately $87.67.

3. Hess

Hess (NYSE:) operates within the energy sector, focusing on and production. The organization originated from the amalgamation of Hess Oil and Chemical with Amerada Petroleum in 1968 and is headquartered in New York.

Hess has upheld a steadfast record of dividend payouts for 38 consecutive years, illustrating a dedication to delivering value to its shareholders.

The company is slated to release its earnings report on July 24, with revenue prognosticated to rise by 46%. During the previous report, it exceeded earnings per share expectations by a staggering 83%.

The market’s target price hinges on roughly 8.75 times the estimated debt-adjusted cash flow for the fiscal year.

Notably, Hess shareholders granted approval for a proposed merger with Chevron (NYSE:), a monumental development in the oil sector, valued at $53 billion. A majority of Hess’ 308 million outstanding shares cast their vote in favor of the merger.

The company’s robust performance over the past five years, coupled with a moderate debt level, paints a picture of prudent financial management, spearheading growth while preserving sound financial integrity.

Industry insiders peg the average price target at $174.21.

Nvidia on the Horizon: A Closer Look at the Financial Terrain

The Tech Giant

Nvidia, a stalwart in the technology realm, stands as a shining beacon in the realm of artificial intelligence (AI) software and hardware. Since its inception in 1993, this California-headquartered company has been spearheading the design of graphics processing units (GPUs).

Financial Projections

Come August 15, all eyes will be on Nvidia’s financial accounts. Expectations are high, with forecasts pointing towards a remarkable 159.29% surge in EPS and a substantial 113.70% rise in revenue.

Market Dynamics and Evolution

The demand for Nvidia’s products continues to outpace supply, a situation exacerbated by shortages of the coveted H100 and H200 GPUs. Looking ahead, the company is gearing up to usher in its state-of-the-art Blackwell platform in the upcoming months.

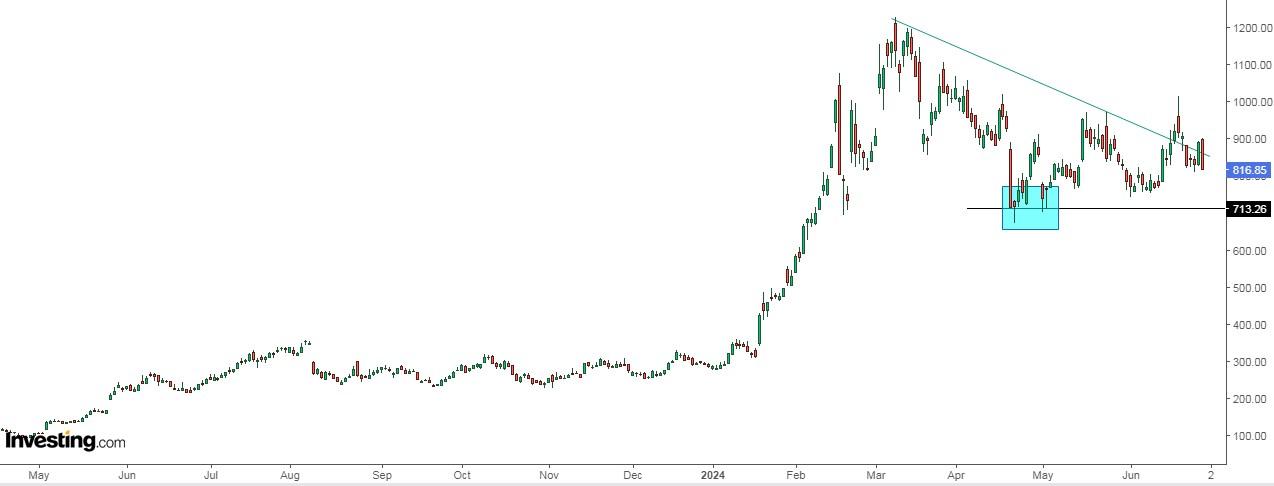

A recent correction of 15% in its stock price is not just a momentary blip but a strategic move to recalibrate valuations to more sustainable levels. This necessary adjustment comes on the heels of a period of impressive revaluation, prompting many investors to secure their gains.

Future Prospects

With a 10-for-1 stock split completed in June, there are whispers in the financial corridors that Nvidia could potentially find a place in the prestigious Dow Jones index in the near future. A similar path was trodden by industry giants like Apple and Amazon following their stock splits, underlining the potential for Nvidia’s ascension to this elite club. Coupled with its robust financial standing, the future looks promising for Nvidia.

Charting Financial Health

A peek into Nvidia’s financial health reveals a robust and thriving entity, painting a picture of stability and promise for discerning investors.