The Champion Among Giants: J.P. Morgan’s Standout Pick

Alibaba (NYSE:BABA) stands shoulder-to-shoulder with other heavyweights in the Chinese e-commerce arena such as PDD and JD, all boasting comparable forward PE ratios of roughly 11x.

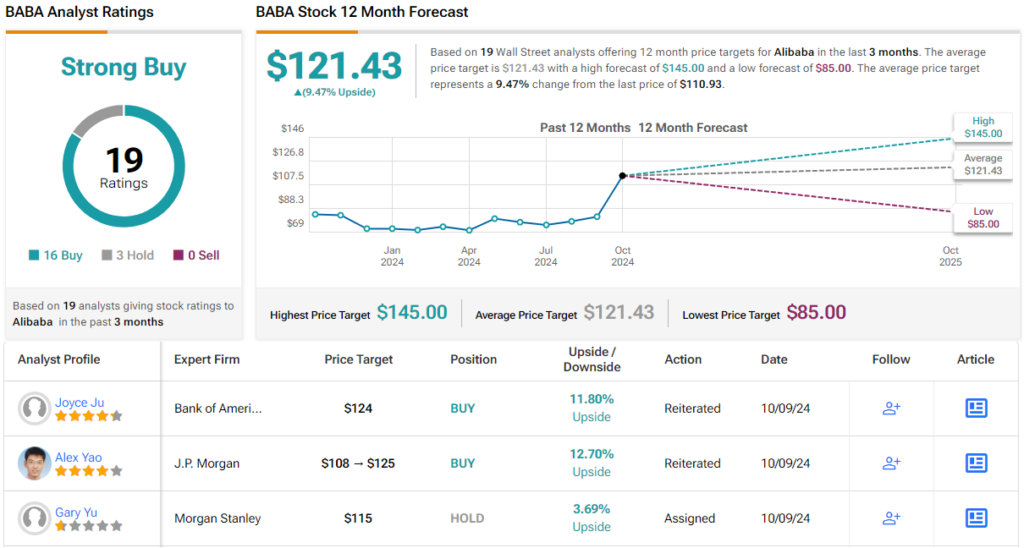

However, J.P. Morgan’s Alex Yao makes a bold assertion – Alibaba shines brightest in the constellation of choices available to investors at the moment.

Yao points out two pivotal factors driving Alibaba’s appeal: the expectation of several high-impact catalysts on the horizon and the potential for a transformative shift in the domestic e-commerce landscape, paving the way for a revaluation that could prove lucrative for shareholders.

Weathering the Storm: Navigating Near-Term Challenges

Despite the sunlit projections, dark clouds loom ahead as Alibaba braces for potential turbulence in its upcoming September quarter results, with a sluggish consumption environment threatening to cast shadows over both its revenue and profits.

Yao acknowledges the testing macroeconomic climate, which is likely to reverberate through China’s GMV, echoing the National Bureau of Statistics’ observations of a downturn in August’s online physical goods sales growth, a marked drop from July’s figures.

Yao foresees a modest 6% uptick in Alibaba’s quarterly revenue compared to the previous year, falling marginally shy of the consensus estimate. Though a 2% dip in non-GAAP EPS is in the cards, Yao’s forecast still triumphs over the Street’s projections by a notable 5%.

Looking Beyond the Storm: Seeking Silver Linings in Future Horizons

Urging investors to peer past the looming clouds, Yao advises a patient stance, awaiting the advent of a series of favorable tailwinds in the following quarters. These include broader improvements in consumer spending, fueled by governmental incentives, and accelerated core-core revenue expansion following the rollout of fresh monetization strategies in September.

Moreover, Yao anticipates a surge in active buyer engagement driven by the integration of Weixin Payment (WeChat Pay) and a sustained influx of Southbound capital post-Alibaba’s recent inclusion in the HK Stock Connect.

Based on this optimistic outlook, Yao endorses BABA shares with an Overweight rating, coupled with a $125 price target signaling a potential upside of approximately 13% from current levels.

Consensus and Beyond: Aligning with Wall Street Optimism

Wall Street resonates with Yao’s buoyant sentiment, with 15 analysts throwing their weight behind a Buy rating for Alibaba, while 3 Hold ratings do little to detract from the resounding Strong Buy consensus. The average price target of $121.43 hints at potential gains of 9.5% in the near term, slightly lagging behind Yao’s more bullish projection.

For those on the lookout for undervalued stocks, TipRanks’ Best Stocks to Buy offers a valuable resource, consolidating a wealth of equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended for informational purposes and should not be construed as investment advice. It is imperative to conduct thorough research before making any financial decisions.