Understanding the Stock Surge

The ascension of Nvidia stock has been nothing short of spectacular, boasting a remarkable 600% surge since the dawn of 2023. Witnessing the market cap catapult from $360 billion to a whopping $2.5 trillion in such a condensed timeframe marks a monumental feat, one unrivaled in the annals of stock market history.

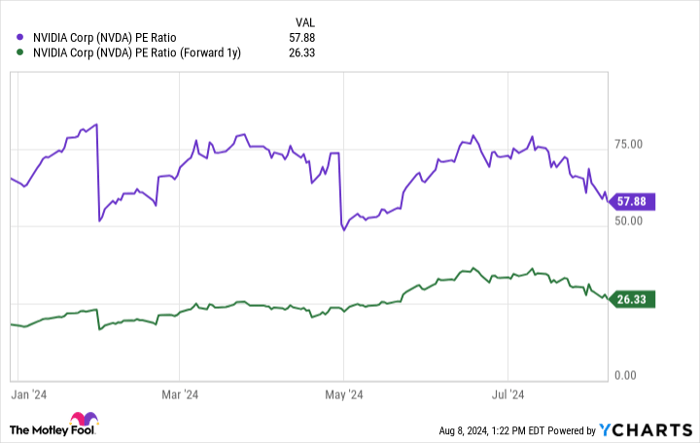

Yet, skepticism looms. Despite this bullish trajectory, murmurs of overvaluation echo on Wall Street, fueled by discerning eyes scrutinizing the stock through the lens of the price-to-earnings (P/E) ratio. This benchmark, derived from dividing a company’s share price by its earnings per share (EPS), is a quintessential metric revered by investors across the board.

Comparing Metrics Against the Nasdaq-100

Painted against the backdrop of the Nasdaq-100 index – home to Nvidia and its big-tech brethren – Nvidia stock gleams conspicuously at a P/E ratio of approximately 58, considerably loftier than the index’s modest 30.7. By conventional standards, Nvidia appears unequivocally dear. Yet, an intriguing narrative unfolds when peering into the future.

Anticipated estimates predict Nvidia’s EPS surging to $3.74 in its fiscal 2026, set to commence on Jan. 30, 2025. Through this forward-looking scope, Nvidia’s stock stands not as an extravagance but as a comparative steal, presenting a paradigm shift in perception akin to a phoenix rising from its proverbial ashes.

The Technological Vanguard

Nvidia’s prowess in the realm of data center chips, serving as a linchpin in the development of artificial intelligence (AI), is a force to be reckoned with. As competitors linger on the periphery, Nvidia stands as an unassailable technological powerhouse, basking in a considerable lead. With data center revenue catapulting by a staggering 427% in the most recent quarter, one can almost taste the unquenchable thirst for Nvidia technology that pervades the market landscape.

For the discerning investor with a periscope set on horizons spanning several years, Nvidia stock becomes not a splurge but a judicious investment grounded in foresight and fortitude.

The Allure of Nvidia Stock: Past and Present

Before taking the plunge into Nvidia stock, a slice of history may shed light on the path ahead. The Motley Fool Stock Advisor analyst team unveils a trove of the top 10 stock picks destined to reap bountiful returns, with Nvidia gracelessly omitted. A reminiscence back to April 15, 2005, beckons a tantalizing “what if” scenario – an investment of $1,000 during that epoch would have burgeoned into a staggering $643,212, should providence smile upon your fortunes.

Guided by the tenets of the Stock Advisor, investors embark on an odyssey marked by lucid strategies, a compendium of analyst updates, and the promise of two novel stock selections each lunar cycle. Mirroring the S&P 500 in its ascension, the Stock Advisor service stands head and shoulders above the fray, encapsulating a story of triumph and tenacity since its inception in 2002.

An opulent tapestry of opportunities awaits, urging investors to navigate through the labyrinth of possibilities, with Nvidia percolating as a beacon of hope in an ever-evolving market ecosystem.

*Stock Advisor returns as of August 6, 2024