While the financial world gasped in awe, earlier this year, Microsoft (NASDAQ: MSFT) crossed swords with Apple (NASDAQ: AAPL) to snatch the crown of the world’s most valuable company. With a majestic market capitalization standing at around $3 trillion, Microsoft soars above the competition like a behemoth in a land of giants, perched on the esteemed pedestal of the “Magnificent Seven” stocks.

Microsoft’s Momentous Leap into the Cloud Realm

Following in the footsteps of tech titan Amazon (NASDAQ: AMZN), Microsoft unfurled its own cloud infrastructure empire back in 2008. The Redmond-based colossus birthed its Azure cloud platform in 2010, but it wasn’t until 2013 that Azure donned its armor, ready to challenge Amazon Web Services (AWS) head-on.

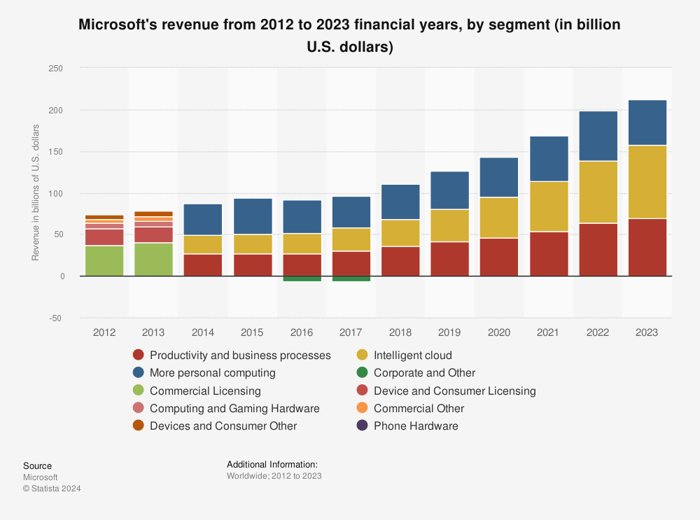

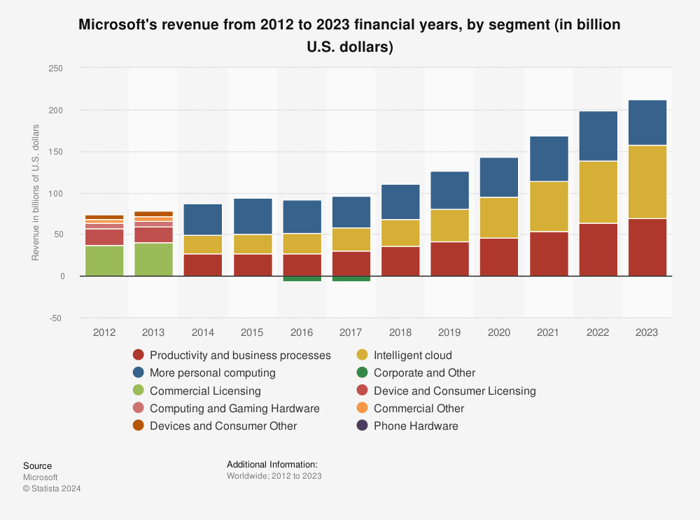

Source: Statista.

Bearing the standard of Satya Nadella as CEO in 2014, Microsoft embarked on a journey of restructuring and realignment of its business segments. The fervor towards cloud and subscription-based ventures became the north star guiding the company’s trajectory. Fueling substantial sales and margin expansion, the productivity-and-business-processes segment witnessed a significant surge, but the intelligent cloud segment, especially Azure, emerged as the true harbinger of success.

As delineated by the chart, the intelligent cloud revenue witnessed meteoric growth, positioning it as Microsoft’s prime revenue generator. For the fiscal year 2023 (concluded on June 30, 2023), this segment bred revenues of $87.9 billion, constituting roughly 41.5% of the company’s overall sales amounting to $211.9 billion. Moreover, it also contributed approximately 43% of the $88.5 billion in operating income for Microsoft in that fiscal cycle.

The Azure unit’s steadfast performance alongside the intelligent cloud segment continued unfurling in the ongoing fiscal year, catapulting Microsoft to the zenith as the world’s most valuable company. While AWS proudly holds the crown as the reigning champion in cloud infrastructure services, Azure’s relentless gain in market share, coupled with a robust surge in demand spurred by the AI era, solidifies its position as a formidable force.

Although Apple sails the high seas of revenue, it is Microsoft’s software-centric business model that enables it to chart a course with lower costs and superior margins. Elevated by the robust growth and substantial profits stemming from the intelligent cloud segment, the software juggernaut ascends the mountaintop as the world’s most valuable company.

Explore New Possibilities

Every whisper of wisdom shared by our team of analysts contains the kernel of success. Dive into the treasure trove of knowledge nurtured over two decades in the Motley Fool Stock Advisor. Witness how they’ve multiplied returns threefold compared to the market.*

Recently unveiled are the 10 best stocks for astute investors like yourself. Among these luminaries, Microsoft takes center stage, yet nine other hidden gems await your discovery.

*Stock Advisor returns as of February 26, 2024