Symbotic SYM is an American robotics warehouse automation company based in Wilmington, Massachusetts. Founded in 2014, the company develops and deploys AI-powered robotic systems that automate warehouse operations, aiming to improve efficiency, accuracy, and safety.

With tailwinds from AI, automation, e-commerce, and other bleeding edge tech, Symbotic is a company that is positioned for huge gains over the next few years.

Leading Innovations

Symbotic has been developing one of the most innovative and well-positioned new products in the market, combining a litany of new technologies.

Symbotic’s core product is its Symbotic System, which consists of:

- Autonomous mobile robots (AMRs): These robots navigate the warehouse using cameras and sensors, retrieving, and storing goods from shelves.

- Software platform: This software controls the robots, optimizes warehouse layout and inventory management, and integrates with existing warehouse systems.

The Symbotic System is designed to be modular and scalable, so it can be adapted to a wide range of warehouses and needs.

The benefits of using Symbotic’s system include:

- Increased efficiency: The robots can work 24/7, which can significantly increase the throughput of a warehouse.

- Improved accuracy: The robots use computer vision to ensure that they pick and store the correct items.

- Reduced labor costs: Symbotic’s system can reduce the need for human labor in the warehouse.

- Enhanced safety: The robots are designed to operate safely alongside humans.

Symbotic has partnered with several major retailers and logistics companies, including Walmart WMT, FedEx FDX and Target TGT. The company has also raised over $1 billion in funding from investors such as SoftBank Vision Fund and Temasek Holdings.

Considering the massive scale of operations at companies like Walmart and Target, as well as the exploding e-commerce industry born from companies like Shopify SHOP and Amazon AMZN, the sky is the limit at SYM.

In June 2022, Symbotic went public through a special purpose acquisition company (SPAC).

Overall, Symbotic is a leading player in the growing market for warehouse automation. The company’s technology has the potential to revolutionize the way warehouses operate and create significant value for its customers.

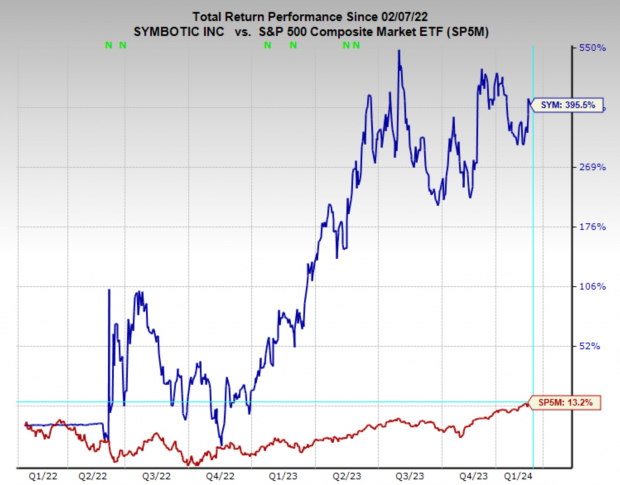

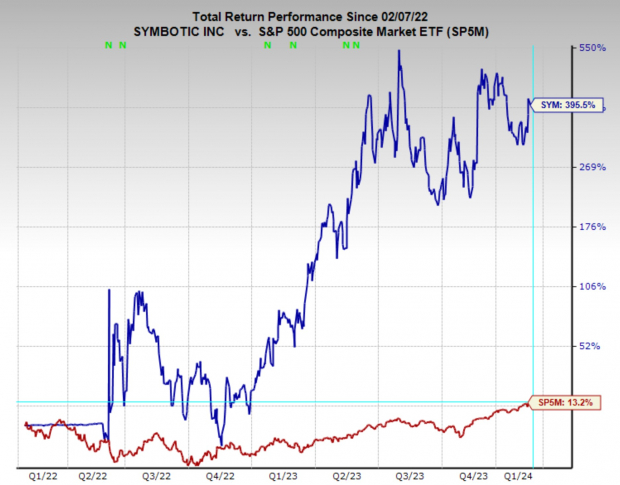

SYM stock has made some impressive gains since it went public in 2022 but has stalled out over the last six months or so.

Image Source: Zacks Investment Research

Earnings Estimates

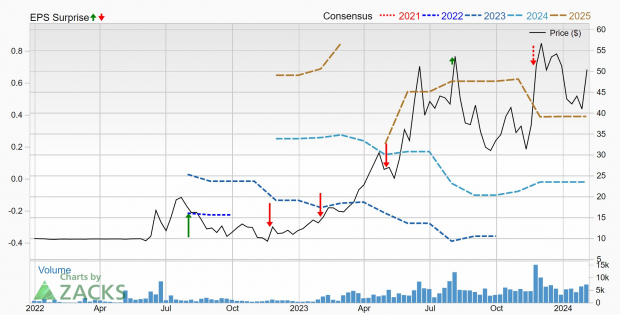

Symbotic is one of these startup companies with exponential growth, putting everything toward building the business as fast as possible. Because of this even though it has 50% YoY sales growth projections, EPS are still net negative. However, EPS are expected to flip positively by FY25.

Currently, Symbotic has a Zacks Rank #3 (Hold) rating, reflecting a mixed earnings revisions trend. As I mentioned near-term expectations for the stock mean it could be a rocky road, but the long-term outlook is quite exciting.

At today’s earnings meeting, analysts are projecting sales to grow 79.5% YoY to $370 million for the quarter, and earnings to climb 58%, from -$0.12 to -$0.05.

Image Source: Zacks Investment Research

Bottom Line

Admittedly, Symbotic trades at a sky-high valuation of 15.8x one year forward sales, but its potential is truly

Symbotic Inc: The Rising Star in Supply Chain Automation

Symbotic Inc., a rising star in the supply chain automation arena, has been garnering increasing attention from investors and industry analysts. The company’s cutting-edge technology and strategic positioning have fueled speculation about its potential to revolutionize the industry. As the operational demands of e-commerce continue to soar, Symbotic Inc. stands at the forefront of the automation revolution, poised to seize a substantial market share and potentially reshape the landscape of supply chain management.

The Promise of Automation

Amid the rapidly evolving e-commerce landscape, the significance of supply chain management and warehouse automation cannot be overstated. Symbotic Inc. has emerged as a key player in this space, leveraging innovative technology to address operational challenges and enhance efficiency. The company’s automated solutions are seen as a potential game-changer, offering the promise of streamlining operations, reducing costs, and optimizing logistical processes.

Strategic Partnerships and Growth Potential

Symbotic Inc.’s strategic partnerships with industry giants Walmart and Target have been pivotal in propelling the company’s growth trajectory. Although still a minority of operations for these retail behemoths, Symbotic Inc.’s association with them has served as a testament to the company’s technological prowess and potential for expansion. Analysts have touted the possibility of Symbotic Inc. significantly bolstering its market presence by assuming operations for these industry leaders.

The convergence of supply chain management and warehouse automation represents a substantial market opportunity, one that Symbotic Inc. appears well-positioned to capitalize on in the years ahead. With the relentless growth of e-commerce and the increasing emphasis on operational efficiency, the prospects for Symbotic Inc. seem promising as it vies for a larger share of the burgeoning industry.