-

Investors are keenly watching how Trump’s second term could impact market sectors and stock performance.

-

Historical trends from Trump’s first term reveal key insights for navigating today’s market shifts.

-

With caution flags like high valuations and tight bond spreads, balancing optimism and risk is essential.

As Trump reclaims the U.S. presidency, investors are buzzing about what stocks might rally and which sectors could stand out.

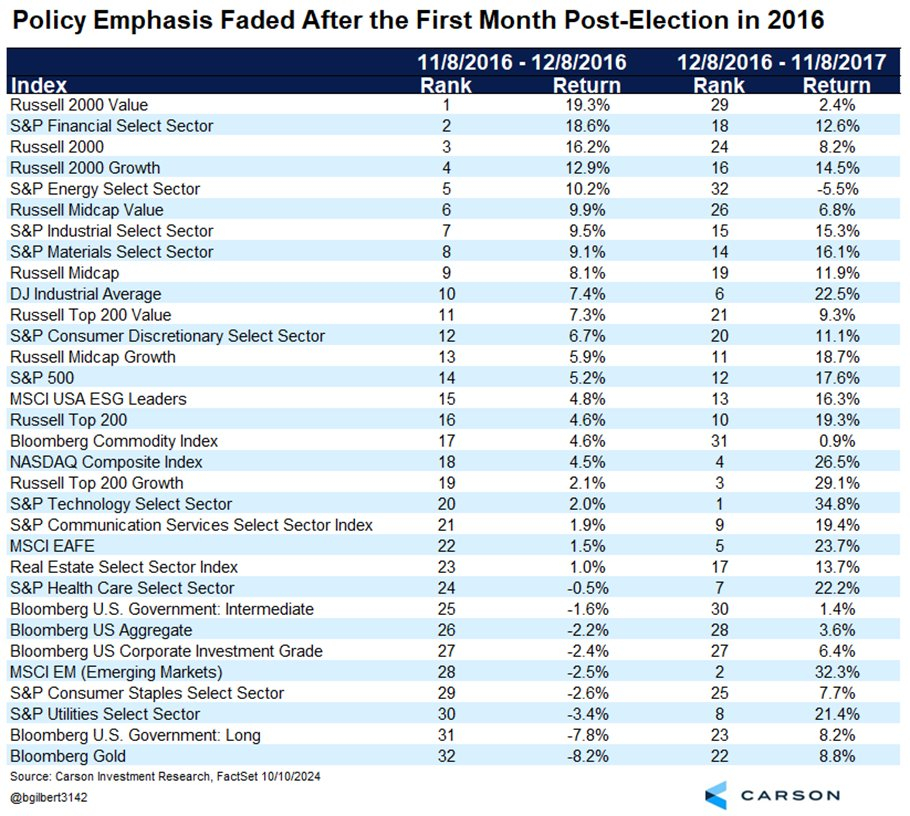

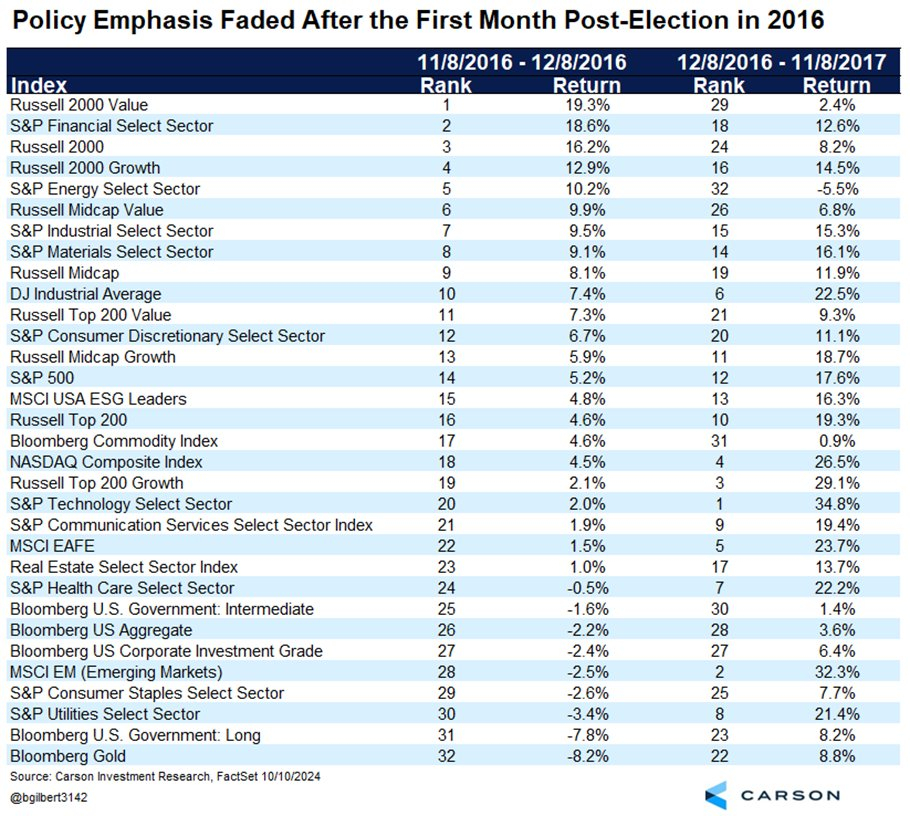

But to understand the market’s next moves, it’s worth looking back at how it performed during his first term, especially in the months and year following his 2016 election.

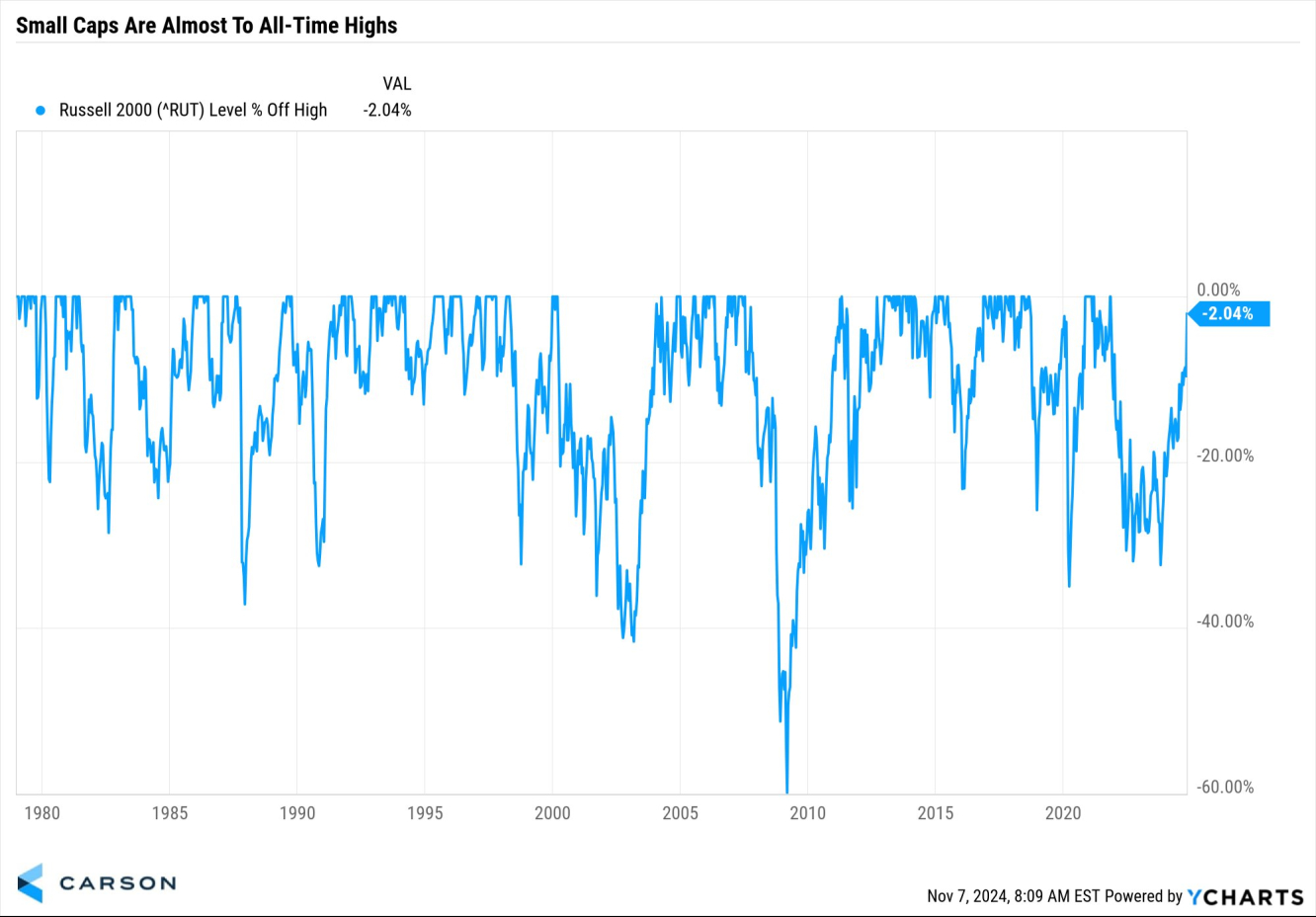

Take small-cap stocks, for example. Right after Trump’s initial victory, small caps soared. The index, a key measure for small caps, spiked impressively, riding the wave of optimism amid monetary easing expectations.

But that initial rush didn’t last forever—larger indices eventually overtook small caps in performance. Last year, I was positive on the prospects of Russell 2000 which was eventually up around 28% over the year.

However, the Russell has lagged behind other indices in setting new all-time highs, though it’s edging closer.

Can History Repeat?

Today’s market, however, is different. After over two years of a steady bull run, sentiment remains positive, and the secular bull market that began in 2009 is holding firm.

Yet several cautionary signals are emerging. Bond spreads are unusually tight, valuations sit at historical highs, and investor sentiment is undeniably upbeat—although not quite euphoric. For investors, the challenge now is balancing optimism with a healthy sense of caution.

Successful investing in this environment requires a dual approach: continue capturing the market’s returns while staying prepared for any downside risks.

It’s a delicate dance, especially when markets feel unstoppable. In 2022, I was among the few who saw buying opportunities amid low valuations and manageable risks. But today’s landscape has shifted, making a more cautious, balanced approach essential.

Bottom Line

Major players like Warren Buffett are taking note, favoring short-term government bonds over riskier plays.

It’s a signal worth heeding. The difference between wise investors and mere speculators today lies in maintaining this balance—taking gains where they can but ready with a plan should the tides turn.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.