Financial giants have recently made a bold move, highlighting their optimistic stance on Zeta Global Holdings. An in-depth analysis of options history pertaining to Zeta Global Holdings (ZETA) unveiled a total of 13 unconventional trades executed in the marketplace.

Upon meticulous examination, it was discerned that 61% of the traders projected a bullish outlook, while 38% revealed bearish tendencies. Notably, out of these identified trades, 8 were puts amounting to $376,888, while 5 were calls valued at $327,930.

What Price Range Are the Whales Targeting?

Scrutinizing the Volume and Open Interest associated with these contracts sheds light on the fact that institutional investors have honed in on a price bracket between $25.0 to $30.0 for Zeta Global Holdings over the preceding 3 months.

Insights into Volume & Open Interest

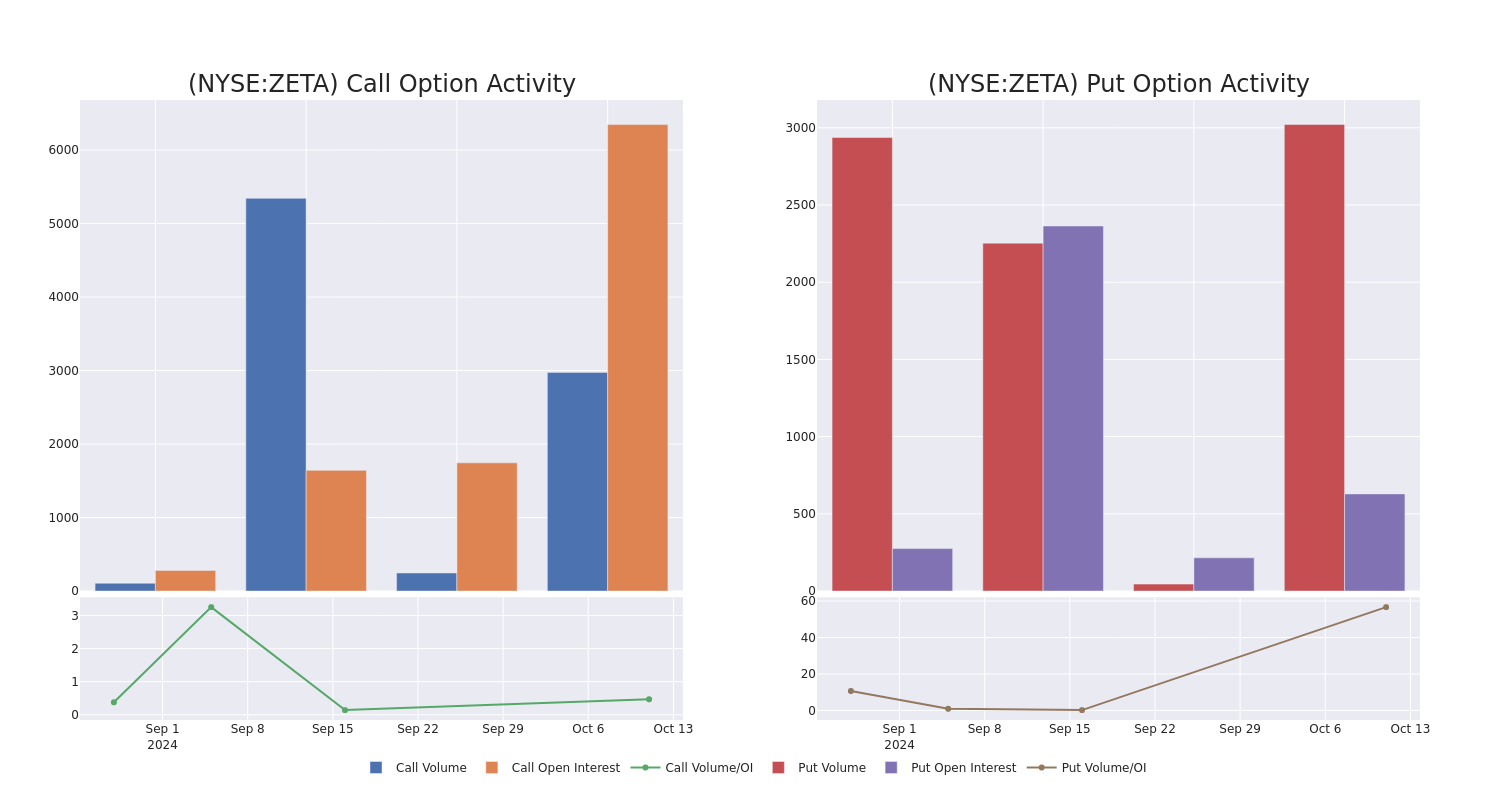

Examining the volume and open interest figures provides a valuable lens through which one can conduct thorough due diligence on a stock.

This data enables investors to monitor the liquidity and interest surrounding Zeta Global Holdings’ options at specific strike prices. Below, we delve deeper into the evolution of the volume and open interest concerning calls and puts in the $25.0 to $30.0 strike price range over the past 30 days.

An Overview of Zeta Global Holdings Call and Put Volume over 30 Days

Significant Options Trades observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ZETA | CALL | SWEEP | BULLISH | 12/20/24 | $3.6 | $3.4 | $3.58 | $30.00 | $106.9K | 3.4K | 348 |

| ZETA | PUT | SWEEP | BULLISH | 10/18/24 | $1.5 | $0.8 | $1.16 | $30.00 | $79.8K | 593 | 1.6K |

| ZETA | CALL | TRADE | BULLISH | 11/15/24 | $2.5 | $1.65 | $2.5 | $30.00 | $62.5K | 547 | 250 |

| ZETA | CALL | SWEEP | BEARISH | 10/18/24 | $1.2 | $1.15 | $1.1 | $30.00 | $62.4K | 2.3K | 1.3K |

| ZETA | CALL | SWEEP | BULLISH | 11/15/24 | $2.9 | $2.75 | $2.9 | $30.00 | $58.0K | 547 | 485 |

About Zeta Global Holdings

Zeta Global Holdings Corp is a cloud-based omnichannel data platform that equips enterprises with consumer insights and marketing automation tools. Catering to various industries like finance, insurance, telecommunication, automotive, travel, and retail, the Zeta Marketing Platform (ZMP) serves as the core omnichannel marketing system. Leveraging advanced machine learning algorithms and an expansive pool of opt-in data, the ZMP can analyze massive amounts of structured and unstructured data to anticipate consumer behavior.

Having delved into the options trading behavior centered around Zeta Global Holdings, our focus now shifts to the company itself, unraveling its current market positioning and performance.

Current Status of Zeta Global Holdings

- With a trading volume of 4,346,791, ZETA’s price has experienced a decline of -4.15%, hovering at $30.0.

- Present Relative Strength Index (RSI) readings hint at a potential overbought scenario for the stock.

- The forthcoming earnings report is slated for release in 31 days.

Analyst Perspectives on Zeta Global Holdings

Recent evaluations from 5 professional analysts over the past month have collectively established an average price target of $38.2 for Zeta Global Holdings.

Amidst these analyses, various analyst viewpoints emerge, guiding investors on potential strategies:

- An analyst at Roth MKM maintains a resolute Buy rating on Zeta Global Holdings, keeping their price target at $44.

- Showcasing consistent confidence, a Craig-Hallum analyst upholds a Buy rating on Zeta Global Holdings with a target price of $37.

- In a guarded stance, a Truist Securities analyst downgrades their rating to Buy, setting a price target of $35.

- Continuing with steadfast optimism, analysts from DA Davidson, Craig-Hallum, and Needham all maintain Buy ratings for Zeta Global Holdings with target prices ranging from $36 to $39.

Trading options presents heightened risks alongside the potential for amplified profits. Seasoned traders navigate these risks through ongoing education, strategic adjustments in trading, utilizations of diverse indicators, and a keen awareness of market dynamics. Stay informed about the latest options activities related to Zeta Global Holdings through reliable real-time alerts provided by Benzinga Pro.

Market News and Data sourced from Benzinga APIs