The rise of nuclear stocks is shaking up the market, leaving AI stocks in its wake.

As tech giants like Nvidia drive the demand for AI chip components in data centers supporting advanced AI applications like ChatGPT, attention is turning towards the companies fueling these technological powerhouses.

Utility stocks have seen a dramatic 28% increase this year, with unregulated power company Vistra leading the charge with a remarkable 227% gain on the S&P 500.

Recent deals involving major tech players, such as Microsoft, Alphabet, and Amazon, embracing nuclear power for clean energy in the AI domain, have brought nuclear stocks into the spotlight.

One standout performer amidst this nuclear resurgence is Oklo (NYSE: OKLO), a player in fission-power plant development and nuclear fuel recycling, backed by OpenAI CEO Sam Altman.

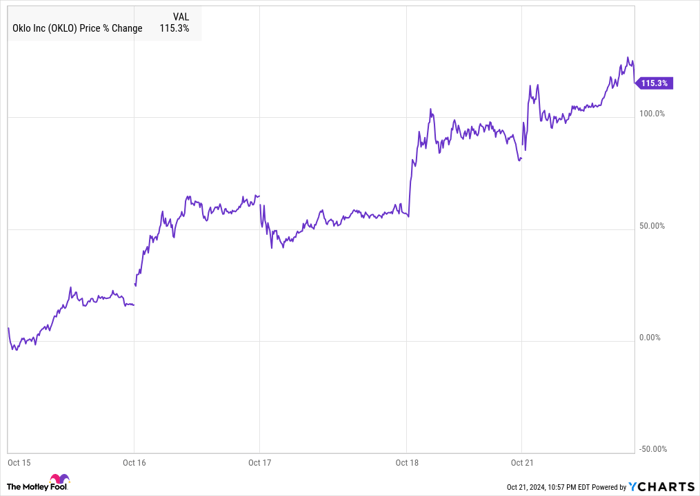

Oklo shares experienced a meteoric 115% surge over five days, doubling in value by October 21, even after a slight pullback.

But why the sudden boom for Oklo? Let’s dig into the reasons behind the uptrend in this scorching-hot nuclear stock before contemplating an investment.

Image source: Getty Images.

Uncovering the Momentum Behind Oklo

While there hasn’t been any significant news specific to Oklo, an approval from the Department of Energy for a fuel-fabrication facility in Idaho contributed to the recent excitement.

The broader sector buzz generated by tech giants like Amazon and Alphabet venturing into nuclear energy, despite no direct dealings with Oklo, fueled the positive sentiment. Peers like Nuscale Power and Nano Nuclear Energy also enjoyed stock price hikes during this period.

Part of the spike in Oklo shares can be attributed to Sam Altman’s notable 6% ownership stake in the company. Oklo’s lackluster performance since its SPAC debut in May received a substantial boost from Altman’s involvement.

Is Oklo Stock a Wise Investment?

With over a decade in the industry and a $2.2 billion market cap, Oklo remains a developmental-stage company with no revenue stream and reported a $17.7 million operating loss in the latest quarter.

The company’s valuation remains speculative due to the absence of revenue, and its recent surge is largely fueled by hype. Oklo anticipates its first plant to be operational by 2026 or 2027, signaling uncertainties ahead.

Given the industry’s unpredictability, Oklo’s lack of revenue, and the uncertainties concerning its plant rollout, investors are advised to exercise caution before diving into the stock.

While a better entry point may arise post the current nuclear energy hype, a competitor could emerge as a more promising bet in this niche sector. At present, Oklo appears to carry more risks than rewards.

Seizing a Second Chance with Lucrative Opportunities

Missed out on lucrative investments before? A timely alert might just change your luck.

Occasionally, our expert analysts issue “Double Down” stock recommendations for impending breakthroughs. Seize the opportunity to invest before it’s too late, as illustrated by historical returns:

- Amazon: $1,000 investment in 2010 would yield $20,803!

- Apple: $1,000 investment in 2008 would yield $43,654!

- Netflix: $1,000 investment in 2004 would yield $404,086!

Watch out for our “Double Down” alerts on three game-changing companies, offering a unique potential for growth.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024