As the stock market rebounds from the recent pullback on August 5th, investors are once again feeling bullish and ready to take on more risks!

Although surging markets are a welcome sight, they come with inherent perils. One such danger is the temptation for some to veer off the path of sound long-term investing and delve into riskier strategies like day trading.

Before delving further into the debate on the feasibility of consistently profiting from day trading, it’s crucial to acknowledge that to thrive as a day trader, one must aim to outperform the market. While conventional wisdom suggests that beating the market is a near-impossible feat for active managers and individual investors alike, this notion is misleading. In reality, there are numerous portfolio managers and individual investors who consistently outperform their benchmarks.

Consider closed-end funds (CEFs), for instance. These funds boast an average yield of over 7%, with many of them demonstrating a track record of surpassing their respective benchmarks. This is particularly evident in funds that focus on assets beyond equities, such as REITs, corporate bonds, municipal bonds, and preferred stocks.

There’s no reason why you can’t achieve similar success. A good starting point is leveraging your expertise in a specific field. For instance, if you have a background as an HVAC engineer, your in-depth knowledge of HVAC systems could potentially enable you to identify promising HVAC companies more effectively than a Wall Street investment banker.

The rationale is simple. Investment banks frequently enlist specialized firms to tap into the expertise of individuals skilled in niche sectors. As a day trader, you might have the advantage of cutting out the intermediary—namely, the banks consolidating this expertise—giving you an edge in beating the market.

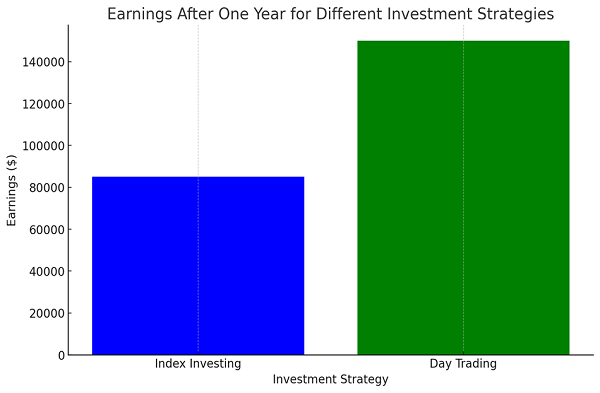

However, the data indicates that the odds are stacked against day trading. Consider a scenario where you have a million-dollar account and invest in an index fund with an average annualized return of 8.5%—representative of the historical long-term return of the stock market over various periods.

Now, envision a best-case day trading scenario with an exceptionally generous 15% average annualized return. The math works out to a $65,000 difference in favor of day trading—undoubtedly a substantial sum.

Yet, when we factor in time, the narrative changes. American stock markets operate for six-and-a-half hours per day, five days a week, nearly year-round. This translates to around 1,631.5 hours annually, equating to an earning potential of under $40 per hour.

While this hourly rate might surpass your current income and assuming you are impeccably poised to avoid irreversible errors, it’s crucial to recognize that achieving financial independence through day trading remains elusive. Essentially, you’re essentially stepping into the role of a small business owner—as an asset manager—with a full-time commitment.

Even for dedicated day traders who clock in additional hours outside market hours, the effective hourly rate dwindles further. To counterbalance this, one would need to target a more substantial return. For instance, a day trader confident in delivering a 150% annual return on average could potentially earn $867 per hour on a million-dollar investment.

While this appears impressive on the surface, there exist individuals in the financial realm who rake in higher earnings with significantly lower stress levels. Regardless of one’s proficiency or potential earnings, day trading fundamentally represents a job, laden with considerable risks when personal capital is at stake.

Thus, our stance at CEF Insider remains unwavering: advocating for the purchase of quality CEFs, adopting a long-term holding strategy, and reaping the benefits of their substantial—often monthly—dividend payouts presents a superior investment approach.

An Alternative Route to Passive Income

With average dividend yields surpassing 7%, CEFs offer a compelling avenue to transform long-term capital gains from equities and other assets into a predictable income stream.

The reported 7% yield serves as a conservative estimate, influenced by several municipal-bond CEFs that yield comparatively lower rates. However, given the tax-exempt status of municipal bond income for most Americans, these lower yields effectively translate to an equivalent of around 8% for median earners in the US.

Equity CEFs, on the other hand, boast an average yield of 8.1% over the extended horizon, underscoring the significant income potential inherent in CEFs that often surpasses the reported figures.

This aspect holds critical significance as it implies that investors can amass the 8.5% annualized profits typically associated with the stock market through dividends, with certain funds exceeding this threshold.

Take, for instance, the Adams Diversified Equity Fund (NYSE:), a holding of CEF Insider that features prominent holdings such as Microsoft, Apple, JPMorgan Chase, and Visa among its top assets.

Over the past decade, the fund has delivered a total return of 280.4%, outperforming the broader market’s returns.

ADX Outperforms the Market

ADX has distributed $16.58 per share in dividends over a 15-year span, showcasing consistent dividend payouts. Investors who entered early and reaped these dividends have enjoyed a handsome 13.53% yield on their initial investment.

While this figure may fall short of the hypothetical day trader’s potential $150,000 earnings on a million-dollar investment, it surpasses the market average and importantly, demands zero input of hours annually to garner these dividend returns.

It’s worth noting that ADX recently revamped its dividend policy, eschewing the prior practice of a single year-end special payout in favor of distributing no less than 2% of its net asset value (NAV) per quarter—a move geared towards offering a consistent 8% yield on NAV to cater to income-oriented investors.

Moreover, the allure of ADX lies in its relatively reduced risk profile. While day trading holds the peril of total capital erosion following a single misstep, ADX has remained a profitable entity since 1854 and a profitable CEF since 1929, weathering economic cycles for over a century without faltering.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who seek undervalued stocks/funds in the US markets. Learn more about profiting from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”