The stock market is on a wild ride in 2024, with the S&P 500 and Nasdaq Composite hitting new highs like a seasoned surfer catching a wave. At the forefront of this bull run sit the tech titans, especially the “Magnificent Seven” stocks driving the artificial intelligence (AI) revolution.

Among these tech behemoths, Nvidia (NASDAQ: NVDA) shines like a 24-karat diamond. Since its IPO in 1999, Nvidia has delivered a jaw-dropping total return of 138,700%. A mere $1,000 invested back then would have ballooned to a mind-boggling $1.4 million today.

But hold onto your hats because Wall Street sage C.J. Muse of Cantor Fitzgerald has prophetically raised Nvidia’s price target to $1,400, hinting at a tantalizing 34% potential upside from current levels. It’s like watching a SpaceX rocket preparing for another breathtaking launch!

Nvidia’s Unstoppable Growth Engine

Nvidia is the wizard behind the curtain, conjuring up an impressive lineup of GPUs that power everything from colossal language models to cutting-edge machine learning applications. With coveted gems like the A100, H100, and Blackwell chips in its treasure trove, Nvidia secures its throne as the king of GPUs.

Peek under the hood, and you’ll find that Nvidia owns a staggering 80% of the market share for AI-powered chips. That’s not just a piece of the pie; that’s practically the whole bakery!

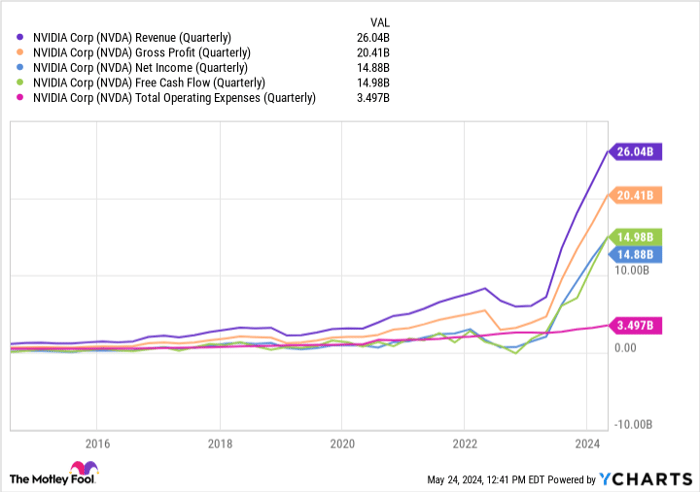

Thanks to this dominance, Nvidia wields potent pricing power, a superpower that fuels the entire Nvidia ecosystem. Like a skilled conductor, Nvidia orchestrates its business to a symphony of soaring revenues.

The road to riches isn’t without bumps, though. As Nvidia ramps up production and pours resources into R&D, expenses naturally spiral. Yet, unlike many in its shoes, Nvidia defies the odds. Demand for its services is off the charts, enabling Nvidia to hike prices without breaking a sweat. It’s the kind of poker game where Nvidia holds all the aces!

Notably, Nvidia’s expanding gross profit margins are the icing on the cake, translating into bottom-line growth that makes the stock market quiver in excitement.

The Trajectory of Nvidia Stock

You might wonder if Nvidia can sustain this meteoric rise. With rivals like Advanced Micro Devices and Intel nipping at its heels, and tech giants like Amazon and Meta Platforms brewing their chip concoctions, Nvidia could face stiff headwinds in the future.

However, competition isn’t necessarily a dark cloud on the horizon. Nvidia’s metamorphosis from a gaming graphics pioneer two decades ago into an AI juggernaut showcases its adaptability and foresight. While gaming remains its stronghold, Nvidia’s foray into diverse computing realms has reaped rich dividends.

As the stock market braces for Nvidia’s next move, investors hold their breath in anticipation of another breathtaking ascent. Strap in, folks, because Nvidia is gearing up for liftoff towards the stratosphere!

The Unstoppable Rise of Nvidia Stocks

Nvidia: Leading the Charge in AI Chips

In the volatile world of stock investing, there are few certainties. However, the trajectory of Nvidia seems to be one of the exceptions. With shares predicted to rise to an impressive $1,400 each, the company’s dominance in AI chips is unquestionable.

Surging Profits and Financial Flexibility

Nvidia’s soaring profits not only showcase its current strength but also provide the company with unmatched financial flexibility. Like a hawk soaring effortlessly in the sky, Nvidia can now explore various avenues for future growth, backed by its solid financial foundation.

Benefiting from the AI Revolution

As the world delves deeper into the realms of artificial intelligence, Nvidia stands poised to benefit from the ongoing AI revolution. With secular tailwinds blowing strongly in its direction, the company is set to ride this wave for years to come, potentially reaping substantial rewards for its investors.

The Time to Invest in Nvidia

For investors with a long-term perspective, the current moment could be an opportune time to consider investing in Nvidia. Much like a seasoned sailor setting sail on a promising voyage, buying shares now could lead to significant wealth accumulation as the company continues its upward trajectory.