As Rivian graces the stock market, analysts are as confused as a chameleon in a bag of Skittles. Price targets swing widely from $14 to $19 per share, while the current price languishes around $13. Is this a dim flicker or a steady flame? In this enigmatic landscape, one Wall Street guru stands tall with a buoyant outlook: reaffirming an outperform rating, voicing unshakeable confidence in a $19 price target, promising a generous 42% upside – the most upbeat tune echoing on Wall Street.

Is there truly a 42% ascent awaiting Rivian’s stock in the next year’s embrace? Cynics may scoff, but there’s substantial rationale behind this analyst’s optimism.

The Upcoming Year: Rivian’s Trajectory

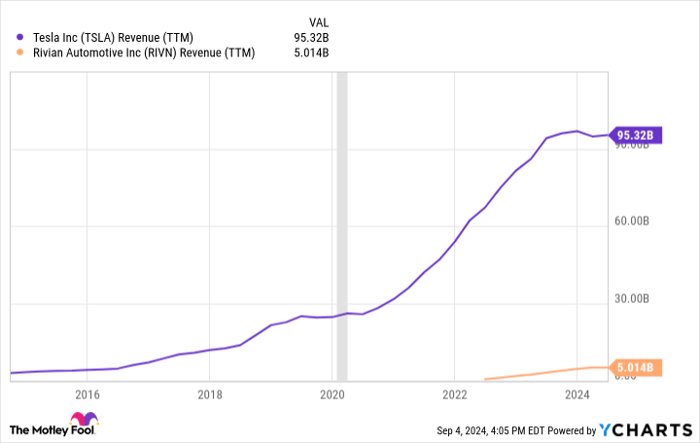

Forecasting short-term stock movements is akin to foreseeing a sudden rainstorm in the Sahara. Yet, anticipating Rivian’s operational path is as clear as a cheetah’s sprint. Rivian, a company that has swiftly soared from revenue infancy to a robust $5 billion, spun this magic with just two dazzling models: the R1T and R1S. Akin to Tesla’s early whirl, Rivian unfurled luxury vehicles targeting the elite echelons of the market, mirroring the genesis of the electric giant.

Rivian now stands at the precipice to emulate Tesla’s next act. After savoring the success of its elite models, Tesla plunged into the mainstream market with the Model 3 and Model Y, propelling its revenue from a Rivian-esque level to a staggering $100 billion. Rivian, gazing at the same trajectory, aims to replicate this climb with the eagerly anticipated R2, R3, and R3X models, priced under $50,000. These models, poised to widen Rivian’s horizon, hold the promise of a revenue surge.

Rivian’s transformative models are scheduled for a 2026 debut. Thus, the impending year forecast whispers of tranquility, dominated by manufacturing updates and production schedules. But a pivotal event looms in the horizon, fueling the optimism of the stock’s most bullish advocate.

The Ignition: A Catalyst Brewing for Rivian

A stark chasm between Tesla and Rivian lies in their bedrock – gross margins. While Tesla crafts profits per vehicle sold, Rivian, a petite contender, bleeds thousands per vehicle. Yet, this adversity might soon morph. Rivian’s executives pronounced the dawning of positive gross margins by Q4 of 2024, docking the per-vehicle gross loss to a mere $6,000 from a towering $33,000. Erasing this remnant deficit would validate Rivian’s fiscal acumen, a harbinger of seasoned financial stewardship, essential as it shoulders the weight of new mass-market models.

Canaccord analyst George Gianarikas, nudging the market’s belief, asserts that Rivian’s pivot to profitability marks its exodus from the realm of ‘EV walking dead,’ kindling momentum for the R2, R3, and R3X sales launch. This luminary stride, he contends, will propel Rivian through operational hurdles and breathe vitality into its mass-market lineup, painting a tableau of expansion.

Deciphering the Investment Quandary

Contemplating an investment in Rivian Automotive? Ponder this: the Motley Fool Stock Advisor squad showcased the 10 best stocks tailored for investors, with Rivian Automotive not securing a spot. The chosen decants promise a whirlwind yield in the imminent frontier.

Imagine the juncture when Nvidia joined this fraternity on April 15, 2005 – a $1,000 investment then would sprout into a staggering $630,099!* A vista where prudence meets bounty indeed!

Stock Advisor unveils a roadmap to success, offering a treasure map of stock selection, regular analyst updates, and a bimonthly stock pick snippet. The service’s feats have quadrupled the S&P 500 returns since 2002*.

*Stock Advisor returns as of September 3, 2024