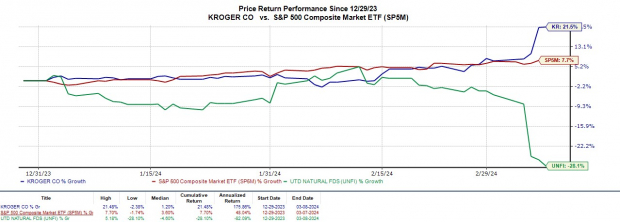

Value investors in particular may be eying Kroger KR and United Natural Foods UNFI stock with both beating their quarterly earnings expectations this week. The grocery chain giant and leading organic food distributor have been on two different spectrums in terms of their price performance but remain attractive regarding promising business operations and reasonable valuations.

To that point, Kroger’s stock is at 52-week highs at around $55 a share while United Natural Foods is sitting on lows of $11 a share. That said, let’s see if Kroger’s strong year-to-date rally can continue and if United Natural Foods stock is poised for a sharp rebound.

Image Source: Zacks Investment Research

Earnings Surprises

Kroger’s stock turned heads on Thursday spiking +10% after posting very favorable Q4 results driven by lower supply-chain costs. Fourth quarter earnings of $1.34 per share soared 35% YoY and crushed expectations of $1.13 a share by 18%. Kroger has now surpassed earnings expectations for 17 consecutive quarters dating back to March of 2020.

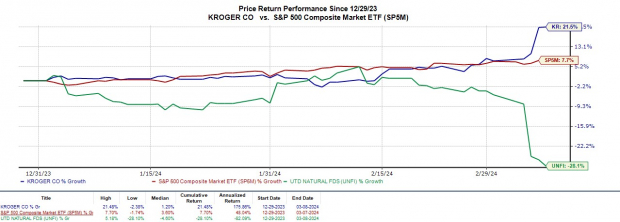

Image Source: Zacks Investment Research

Reporting its fiscal second-quarter results on Wednesday, United Natural Foods posted earnings of $0.07 a share which easily surpassed estimates of $0.01 a share. Although down from $0.78 per share a year ago due to supply chain disruptions and other factors, United Natural Foods has still exceeded earnings expectations in three of its last four quarterly reports.

Image Source: Zacks Investment Research

Assessing Value

Following its recent rally, Kroger’s stock trades at an attractive 12.7X forward earnings multiple, in line with the Zacks Retail-Supermarkets’ industry average and significantly lower than the S&P 500’s 21.6X.

Image Source: Zacks Investment Research

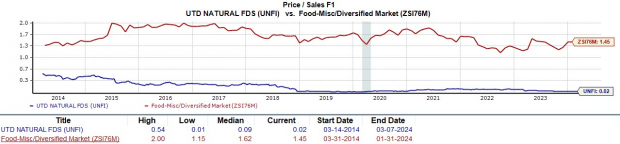

In comparison, United Natural Foods’ stock offers good value as UNFI shares trade at just 0.02X forward sales, a significant discount compared to its industry peers and the S&P 500. United Natural Foods’ total sales are forecasted to rise by 2% this year to $31 billion.

Image Source: Zacks Investment Research

Key Insights

With EPS estimates likely to trend higher after exceeding their earnings expectations, Kroger and United Natural Foods stock currently sport a Zacks Rank #2 (Buy). When considering their valuations, Kroger’s rally could very well continue, and United Natural Foods’ stock is beginning to show potential for a rebound.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.