Lamb Weston’s stock has been turning heads on Wall Street, and for good reason. Following the company’s impressive fiscal second quarter results, investors are contemplating whether it’s the right time to jump on the Lamb Weston bandwagon. With its commanding position as the leading supplier of frozen potato products in North America and a strong global presence, Lamb Weston’s trajectory has been nothing short of remarkable.

Q2 Review & Highlights

In the words of Lamb Weston CEO, Tom Werner, the company delivered a stellar performance in the recent quarter, driven by robust execution across customer channels in North America and key international markets. This remarkable feat was attributed to pricing actions spurred by inflation, improvements in customer and product mix, and productivity cost savings within the supply chain.

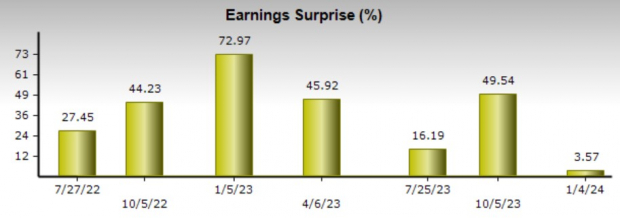

Lamb Weston’s net sales soared by 36% year over year to $1.73 billion, surpassing the Zacks consensus by 2%. Meanwhile, its adjusted net income spiked by 17% YoY to $212 million, with earnings per share up by 13% to $1.45, beating expectations by 3%. Additionally, the company repurchased $50 million of common stock and hiked its quarterly dividend by an impressive 29% to $0.36 per share.

Looking ahead, Lamb Weston raised its adjusted net income target for the full year 2024 and reaffirmed its net sales target and adjusted EBITDA target, signaling a bullish outlook for the company.

Growth & Outlook

According to Zacks estimates, Lamb Weston is set to witness a substantial 25% increase in annual earnings in fiscal 2024, with further growth projected for fiscal 2025. The company’s sales are also on an upward trajectory, with an estimated 28% surge expected this year and a further 5% increase penciled in for fiscal 2025.

Recent Performance

In a challenging year for the consumer food industry, Lamb Weston’s stock has emerged as a standout performer, surging by a notable +10% to outshine its peers. Over the last three years, its stock has soared by an impressive +40%, significantly outperforming the S&P 500 and its industry counterparts, General Mills and Hormel Foods.

Bottom Line

Despite currently holding a Zacks Rank #3 (Hold), Lamb Weston’s raised EPS guidance is anticipated to trigger upward revisions in annual earnings estimates, potentially paving the way for a buy rating. With a promising outlook following its Q2 report, the question isn’t whether to invest, but when.