Lululemon vs. Nike: Weathering Storms in Retail

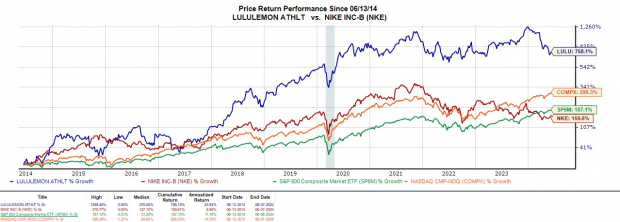

Amidst the tempest of consumer spending concerns, leading players like Lululemon and Nike have found themselves navigating turbulent waters, with both witnessing a downturn of approximately -8% in the past year. However, Lululemon’s recent triumph in outpacing Q1 revenue forecasts seems to have fortified its standing in the market. As Nike prepares to unveil its financial report later this month, all eyes are on whether it can match Lululemon’s stellar performance.

Image Source: Zacks Investment Research

A Glance at Q1 Success and Future Projections

Lululemon’s Q1 revenues surged by 10% to $2.2 billion, surpassing estimates marginally. Impressively, Q1 EPS stood at $2.54, marking a 7% beat from projections and an 11% leap from the previous year. Notably, Lululemon has now surpassed earnings expectations for 16 consecutive quarters dating back to September 2020.

Image Source: Zacks Investment Research

Lululemon anticipates a promising 9%-10% growth in revenue for the second quarter, slightly surpassing the current Zacks Consensus of 8.23% growth. The full-year revenue outlook remains upbeat, with an expected growth rate of 10%-11%.

Image Source: Zacks Investment Research

Charting the Growth Trajectory: EPS Predictions

Forecasted by Zacks, Lululemon’s annual earnings are poised to ascend by 11% in the current fiscal year to $14.14 per share, up from $12.77 in the prior year. Looking ahead, the FY26 EPS is estimated to spike by another 11% to $15.68.

Image Source: Zacks Investment Research

Evaluating the Landscape and Investment Potential

Despite lingering apprehensions around consumer spending trends, especially in premium retail segments, Lululemon’s stock maintains a Zacks Rank #3 (Hold). The robust Q1 results have reaffirmed a positive earnings outlook for the brand. Additionally, with LULU currently trading at an attractive P/E valuation of 22.9X, long-term investors could find value at its current price, although strategic investors may be eyeing more opportune moments for entry.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

lululemon athletica inc. (LULU) : Free Stock Analysis Report

NIKE, Inc. (NKE) : Free Stock Analysis Report