Alphabet (GOOGL) made headlines in Friday’s trading session after crushing its first quarter earnings expectations yesterday evening and helping the broader indexes cap off a strong rebound.

Surging more than +10% today, Alphabet shares were boosted by news that the tech giant will be paying its first-ever dividend along with its board of directors approving $70 billion in stock buybacks.

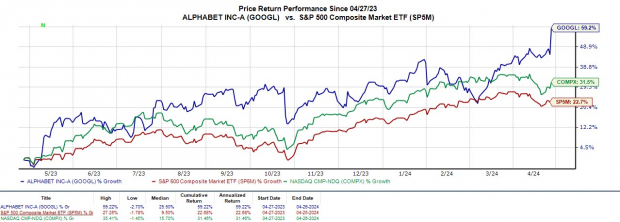

Let’s review Alphabet’s captivating Q1 report and see if now is a good time to buy into the strong post-earnings rally with GOOGL up more than +20% year to date.

Image Source: Zacks Investment Research

Alphabet’s Q1 Performance

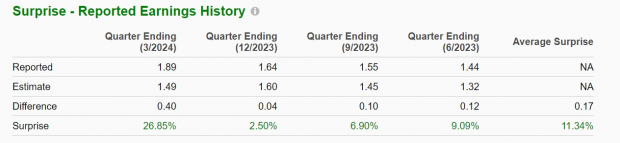

Alphabet’s Q1 earnings increased 61% to $1.89 per share compared to EPS of $1.17 in the comparative quarter. This topped the Zacks Consensus of $1.49 a share by 27%. On the top line, Q1 sales of $67.59 billion expanded 16% from $58.06 billion a year ago and came in 2% above estimates.

Image Source: Zacks Investment Research

The strong results were attributed to Google Search, Cloud, and stronger advertising growth on YouTube. Alphabet also emphasized that it is well-positioned for the next wave of artificial intelligence through its platform Gemini which is a generative AI multimodal with understanding across audio, video, and text code.

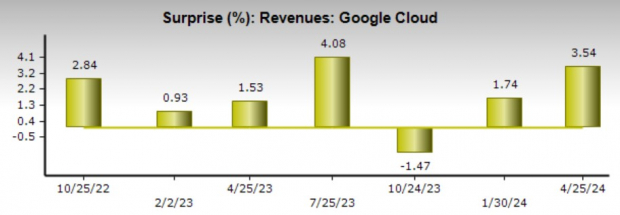

Notably, Google Cloud revenue beat estimates by 3% and grew 28% year over year to $9.57 billion with Alphabet still thought to hold the third spot in the domestic cloud computing market behind Amazon’s (AMZN) AWS and Microsoft’s (MSFT) Azure.

Image Source: Zacks Investment Research

Market Cap & Dividend

Alphabet’s quarterly dividend will be $0.20 per share with the first payout set for June 17 to shareholders on record as of June 10. With the dividend and stock buyback announcement fueling today’s rally, Alphabet’s stock briefly hit a $2 trillion market cap for the first time since 2021 with only Apple (AAPL) and Microsoft having a larger capitalization.

Image Source: Zacks Investment Research

Investor Outlook

Alphabet’s Q1 report helped reconfirm expectations of double-digit top and bottom line growth in fiscal 2024 and for now, GOOGL lands a Zacks Rank #3 (Hold). However, it wouldn’t be surprising if a buy rating is on the way as earnings estimate revisions could trend higher in the coming weeks.