On January 10, 2024, Titan Machinery Inc. (TITN) announced the acquisition of Scott Supply, Co., further solidifying its presence in the agricultural dealership sector. This strategic move encompasses the purchase of one full-line combined Case IH and New Holland Agriculture dealership located in Mitchell, South Dakota. With a rich history dating back to 1915, Scott Supply has served the Mitchell area with a strong commitment to customer service and a stellar team of employees.

TITN has refrained from disclosing the financial intricacies of the acquisition, but it was reported that Scott Supply generated approximately $40 million in revenues in the fiscal year ending December 31, 2023. Titan Machinery’s existing foothold in this highly productive region of eastern South Dakota is poised for augmentation.

While the company’s fiscal performance in the third quarter of 2024 showed a softening bottom line, with earnings per share at $1.32, the total revenues for the period reached a record $694 million, representing a 4% increase from the year-ago quarter.

Expanding Presence in South Dakota

Titan Machinery’s acquisition of Scott Supply presents an opportunity to bolster the company’s market position in South Dakota. With a vision to build upon the legacy of Scott Supply, the company anticipates significant growth in this burgeoning market.

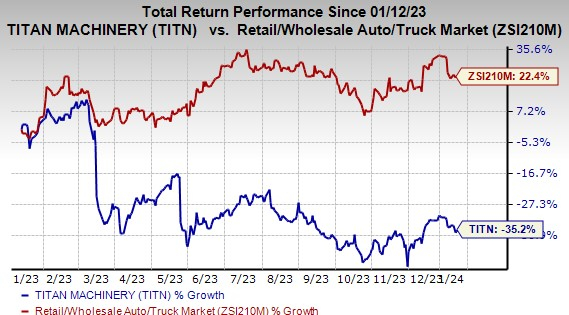

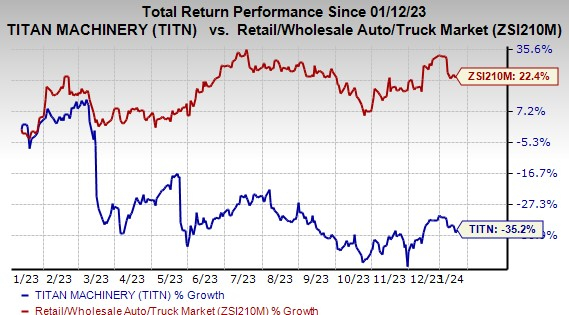

Historical Price Performance

Over the past year, Titan Machinery’s shares have experienced a 35.2% decline, signaling a stark contrast to the industry’s growth, which stood at 22.4% during the same period.

Image Source: Zacks Investment Research

Ranking and Stock Comparisons

Currently, Titan Machinery carries a Zacks Rank #5 (Strong Sell). In comparison, competitors such as Abercrombie & Fitch (ANF), Amazon.com, Inc. (AMZN), and American Eagle Outfitters (AEO) present more promising investment prospects, boasting higher Zacks Ranks in the Retail – Wholesale sector.

ANF, AMZN, and AEO have demonstrated strong average trailing four-quarter earnings surprises, adding to their appeal as viable investment options. In particular, Amazon.com has seen a 54.9% average earnings surprise over the trailing four quarters.

The robust potential and performance of these entities provide investors with multiple avenues for capitalizing on the current market dynamics.